Get the free Form MO-1040B - dor mo

Show details

This document serves as the Missouri income tax return form for individuals, allowing them to report their income, calculate their tax liabilities, and claim deductions or credits for the state of

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign form mo-1040b - dor

Edit your form mo-1040b - dor form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your form mo-1040b - dor form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit form mo-1040b - dor online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit form mo-1040b - dor. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out form mo-1040b - dor

How to fill out Form MO-1040B

01

Gather your personal information including your Social Security number and filing status.

02

Obtain Form MO-1040B from the Missouri Department of Revenue website or office.

03

Fill out your name, address, and other required identification details at the top of the form.

04

Enter your income details in the appropriate sections, including wages, interest, and other sources of income.

05

Calculate your adjustments to income if applicable and enter the amount on the form.

06

Determine your Missouri tax liability using the provided tax tables or formula.

07

If you have any credits or prepayments, calculate and include these amounts.

08

Review the form for accuracy, ensuring all information is correctly entered.

09

Sign and date the form at the bottom.

10

Submit the completed form by the due date via mail or electronically if available.

Who needs Form MO-1040B?

01

Individuals who are residents of Missouri and earn income that is subject to state income tax.

02

Part-year residents of Missouri who need to report income earned while living in the state.

03

People who are required to file a tax return due to their income level or circumstances, as specified by Missouri tax laws.

Fill

form

: Try Risk Free

People Also Ask about

Does the state have access to my federal tax return?

IRS and state/local agencies share data with each other through a variety of ongoing initiatives. The information includes: Audit results. Federal individual and business return information.

What is the difference between MO-1040 and MO-1040A?

In Missouri, both U.S. residents and nonresidents use the same forms. If you are single or married with one income, you can probably use the MO-1040A. There is a longer MO-1040 form that married couples with two incomes must use.

Do I need to send a copy of my state return with my federal return?

The state return is not submitted until after the federal return is accepted. If your federal return is rejected the state return is not sent.

Do I need to send a copy of my federal return with my Missouri state return?

You must allocate your Missouri source income on Form MO-NRI and complete Form MO-1040. You must include a copy of your federal return with your state return.

Do I need to attach a copy of my federal return to my state return in California?

The California Franchise Tax Board (FTB) needs you to attach the federal return to the California return as follows: Form 540: Federal return is needed if the federal return includes supporting forms or schedules other than Schedule A or Schedule B. Form 540NR: Federal return is needed for all Form 540NR returns.

Can I download and print tax forms?

Instead of waiting for tax forms to arrive in the mail, taxpayers can simply access them online and print them out at home or at a local library or print shop. Another advantage of using the IRS website to download and print tax forms is that it can help prevent errors on tax returns.

What documents do I mail with my federal tax return?

These include: A W-2 form from each employer. Other earning and interest statements (1099 and 1099-INT forms) Receipts for charitable donations; mortgage interest; state and local taxes; medical and business costs; and other tax-deductible expenses if you are itemizing your return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

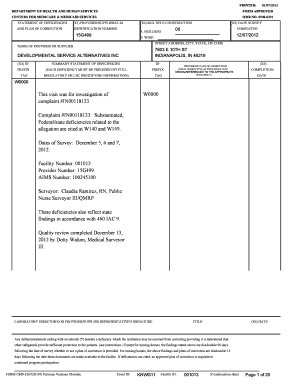

What is Form MO-1040B?

Form MO-1040B is a Missouri state income tax form used by certain taxpayers to report their Missouri income tax liability and claim tax credits.

Who is required to file Form MO-1040B?

Individuals who have income in Missouri and are not required to file a federal income tax return but wish to claim a refund of Missouri withholding tax may need to file Form MO-1040B.

How to fill out Form MO-1040B?

To fill out Form MO-1040B, you need to provide personal information such as your name and address, report your income, calculate your Missouri tax, and complete any applicable credits or deductions.

What is the purpose of Form MO-1040B?

The purpose of Form MO-1040B is to allow eligible taxpayers to file a simplified return for claiming refunds for Missouri income tax withheld or to report income that is not required on a more complex return.

What information must be reported on Form MO-1040B?

Form MO-1040B requires reporting information such as total income, withholdings, any applicable deductions or credits, and basic personal information.

Fill out your form mo-1040b - dor online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Form Mo-1040b - Dor is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.