Get the free INCOME ELIGIBILITY FORM FOR CHILD CARE CENTERS - health mo

Show details

This form is used to apply for free or reduced-price meal eligibility benefits for children enrolled in child care centers, requiring household and income information for eligibility determination.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign income eligibility form for

Edit your income eligibility form for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your income eligibility form for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing income eligibility form for online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit income eligibility form for. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

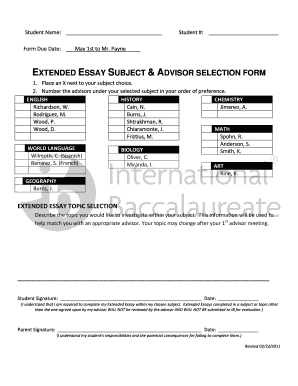

How to fill out income eligibility form for

How to fill out INCOME ELIGIBILITY FORM FOR CHILD CARE CENTERS

01

Obtain the Income Eligibility Form from the child care center or their website.

02

Gather required documentation, including proof of income, tax returns, and any other relevant financial information.

03

Fill out the form completely, ensuring all sections are filled accurately.

04

Enter the names and ages of the children who will be attending the center.

05

Provide details about your household composition and total income.

06

Sign and date the form to certify that the information provided is accurate.

07

Submit the completed form along with any required documentation to the child care center.

Who needs INCOME ELIGIBILITY FORM FOR CHILD CARE CENTERS?

01

Families seeking financial assistance for child care services.

02

Parents or guardians applying for child care programs that require proof of income.

03

Individuals who are low-income and need assistance to access affordable child care options.

Fill

form

: Try Risk Free

People Also Ask about

Which of the following groups are eligible under the CACFP?

Who is eligible for CACFP meals? Children age 12 and under. Migrant children age 15 and younger. Youths through age 18 in the Area Eligible Snack Program and in emergency shelters. Functionally impaired children through age 18 in child care centers or day care homes.

Do you get a tax form for child care?

If you qualify for the credit, you need to complete IRS Form 2441, Child and Dependent Care Expenses, and Form 1040 or Form 1040A, US Individual Income Tax Return.

How do I report child care income on my taxes?

If you provide daycare services with the intention of making a profit, you're considered self-employed and responsible for reporting child care income. So, report self-employment income and expenses on Schedule C. If your net income minus expenses is $400 or more, you'll also need to: File Schedule SE.

Are you supposed to get a tax form from daycare?

Daycare centers are required to provide parents with an annual daycare tax statement. This statement shows the total amount parents spent on child care costs during the past year. These annual receipts should cover January 1st through December 31st of the previous year.

How do I prove child care expenses on my taxes?

To complete Form 2441, you typically need the following information from your childcare provider: The name, address, and taxpayer identification number (TIN), social security number (SSN), or employer identification number (EIN) of the childcare provider. The total amount paid for childcare services during the tax year.

Does daycare affect your tax return?

You can claim from 20% to 35% of your care expenses up to a maximum of $3,000 for one person, or $6,000 for two or more people (tax year 2024).

Who is eligible for CACFP?

To be eligible for participation in CACFP, a sponsor must be a licensed or approved child care provider or a public or nonprofit private school which provides organized child care programs for school children during off-school hours.

What is the food program for daycare in Texas?

The CACFP is a nationwide program administered by the United States Department of Agriculture (USDA) and the Texas Department of Agriculture (TDA) that provides approved child care centers and home-based providers with financial resources for providing nutritious meals and snacks for the qualified children they serve.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is INCOME ELIGIBILITY FORM FOR CHILD CARE CENTERS?

The INCOME ELIGIBILITY FORM FOR CHILD CARE CENTERS is a document that collects income information to determine eligibility for child care assistance programs.

Who is required to file INCOME ELIGIBILITY FORM FOR CHILD CARE CENTERS?

Families seeking financial assistance for child care services are typically required to file the INCOME ELIGIBILITY FORM.

How to fill out INCOME ELIGIBILITY FORM FOR CHILD CARE CENTERS?

To fill out the form, applicants should provide accurate income information, family size, and any necessary documentation as specified by the child care center or program.

What is the purpose of INCOME ELIGIBILITY FORM FOR CHILD CARE CENTERS?

The purpose of the form is to assess financial need and determine eligibility for subsidized child care programs.

What information must be reported on INCOME ELIGIBILITY FORM FOR CHILD CARE CENTERS?

Required information typically includes household income, number of family members, employment status, and any additional assets or income sources.

Fill out your income eligibility form for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Income Eligibility Form For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.