Get the free Insurance Annuity Contract Checklist - insurance mo

Show details

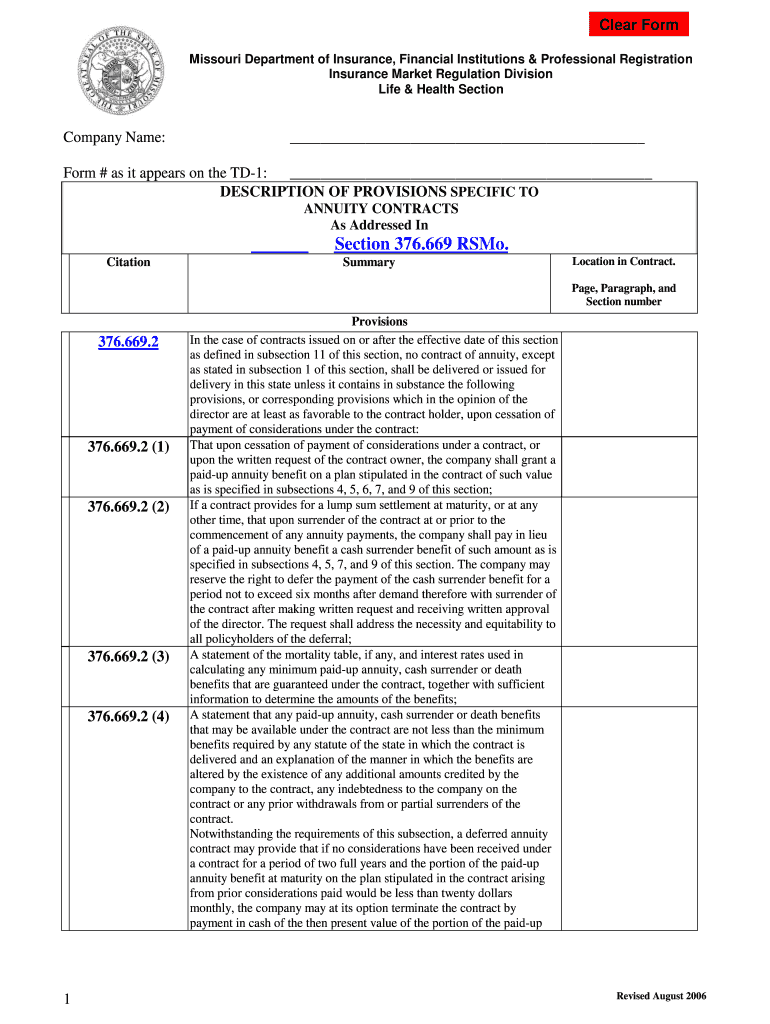

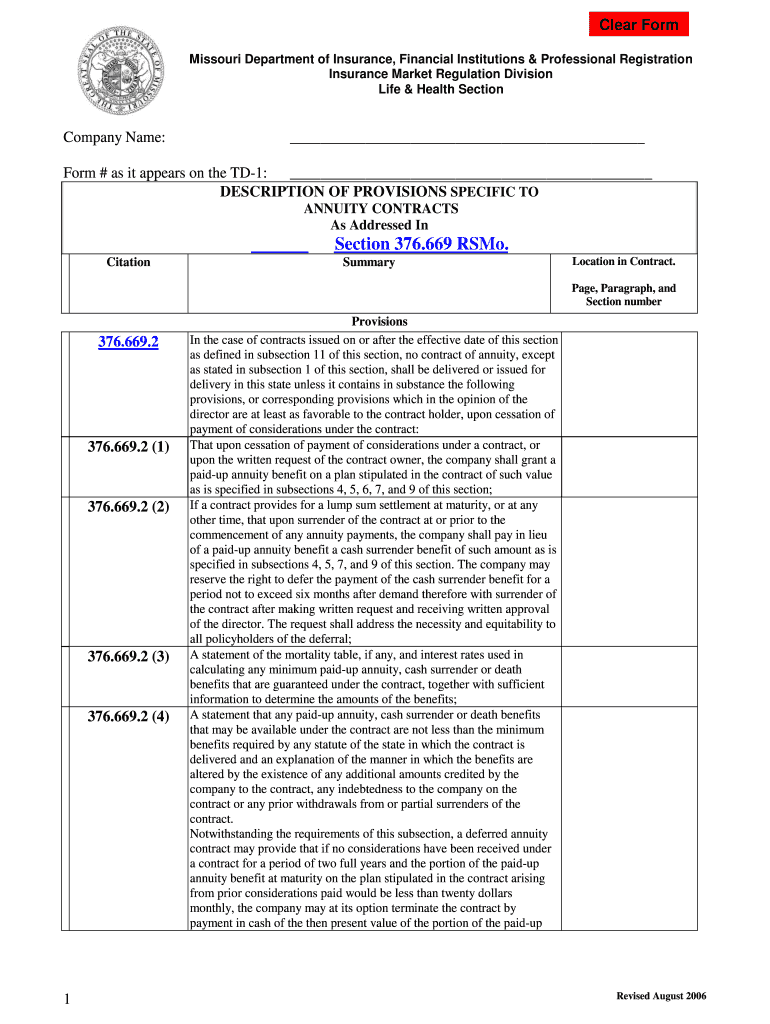

This document serves as a checklist to ensure compliance with specific provisions related to annuity contracts as outlined in Missouri statutes, particularly Section 376.669. It guides insurers on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign insurance annuity contract checklist

Edit your insurance annuity contract checklist form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your insurance annuity contract checklist form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit insurance annuity contract checklist online

To use our professional PDF editor, follow these steps:

1

Log in to your account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit insurance annuity contract checklist. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out insurance annuity contract checklist

How to fill out Insurance Annuity Contract Checklist

01

Review the checklist requirements carefully.

02

Gather personal information such as name, address, and social security number.

03

Collect financial information including your income, expenses, and existing insurance policies.

04

Check any specific state regulations or guidelines related to annuities.

05

Fill out all sections of the checklist accurately, ensuring no information is left blank.

06

Double-check for any required signatures or date fields.

07

Submit the completed checklist to your insurance provider.

Who needs Insurance Annuity Contract Checklist?

01

Individuals looking to invest in an annuity.

02

Financial advisors assisting clients with annuity purchases.

03

Insurance agents who need to guide clients through the annuity process.

04

Anyone reviewing their financial planning strategies.

Fill

form

: Try Risk Free

People Also Ask about

What is not included in an annuity contract?

Such a document will include the specific details of the contract, such as the structure of the annuity (e.g. variable or fixed); any penalties for early withdrawal; spousal and beneficiary provisions (such as a survivor clause and rate of spousal coverage); and more.

What is included in an annuity contract?

One of the most important benefits of the annuity is the ability to use the value built up during the accumulation period to provide a lump sum payment or to make income payments during the payout period. Income payments are usually made monthly, but you may choose to receive them less often.

What is included in the annuity contract?

The most appropriate use for income payments from an annuity contract is to fund your retirement. Only an annuity can pay an income that can be guaranteed to last as long as you live. There are three participants in an annuity contract: the owner, the annuitant, and the beneficiary.

What is the biggest disadvantage of an annuity?

What Is An Annuity? An is a financial product issued by an insurance company that allows you to grow your money tax-deferred and receive income in the future. You purchase an annuity with an initial premium; in return, the insurance company provides interest credits to grow your value.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Insurance Annuity Contract Checklist?

The Insurance Annuity Contract Checklist is a document that outlines the necessary elements and terms that must be included in an annuity contract to ensure compliance and proper understanding between the parties involved.

Who is required to file Insurance Annuity Contract Checklist?

Insurance providers and agents who are offering annuity contracts to consumers are required to file the Insurance Annuity Contract Checklist to ensure all regulatory and disclosure requirements are met.

How to fill out Insurance Annuity Contract Checklist?

To fill out the Insurance Annuity Contract Checklist, follow the provided guidelines to input required information such as contract details, clauses, beneficiary designations, and any additional disclosures relevant to the annuity being offered.

What is the purpose of Insurance Annuity Contract Checklist?

The purpose of the Insurance Annuity Contract Checklist is to provide a standardized method for ensuring that all critical aspects of the annuity contract are addressed, helping to protect the interests of the policyholder and the insurer.

What information must be reported on Insurance Annuity Contract Checklist?

The information that must be reported includes the contract owner's details, contract type, premium amounts, interest rate, surrender charges, payout options, and any applicable fees or penalties associated with the annuity.

Fill out your insurance annuity contract checklist online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Insurance Annuity Contract Checklist is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.