Get the free Tax Credit Analysis - ded mo

Show details

This document outlines the details of the 'Rebuilding Communities' tax credit program, including eligibility requirements, tax credit computation, program caps, and historical financial impacts.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax credit analysis

Edit your tax credit analysis form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax credit analysis form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax credit analysis online

Follow the steps below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit tax credit analysis. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax credit analysis

How to fill out Tax Credit Analysis

01

Gather all necessary financial documents, including income statements, tax forms, and any relevant receipts.

02

Determine the specific tax credits you may qualify for by researching available options based on your location and financial situation.

03

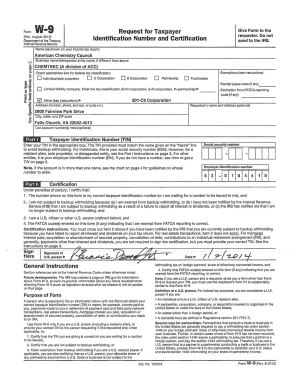

Fill out the Tax Credit Analysis form with your personal information, including name, address, and tax identification number.

04

Input your financial information into the appropriate sections, detailing your income, expenses, and any tax deductions.

05

Calculate your eligibility for various tax credits by following the instructions provided with the form.

06

Review your completed analysis for accuracy, ensuring all figures are correct and all required fields are filled.

07

Submit the Tax Credit Analysis form according to the guidelines provided, either electronically or via mail.

Who needs Tax Credit Analysis?

01

Individuals or families seeking to maximize their tax benefits.

02

Low-income households that may qualify for specific tax credits.

03

Tax professionals assisting clients in navigating credit options.

04

Organizations involved in financial planning or tax preparation services.

Fill

form

: Try Risk Free

People Also Ask about

What is a tax credit assessment?

Tax credit screenings are used to determine if job applicants are eligible for state and federal tax incentives. Candidates may be eligible for various tax credits for which employers would receive up to $9,600 for each qualifying hire.

Is an example of a tax credit?

A tax credit is a dollar-for-dollar reduction in your income. For example, if your total tax on your return is $1,000 but you are eligible for a $1,000 tax credit, your net liability drops to zero.

What are 3 examples of tax credits?

Personal Credits California Earned Income Tax Credit. Child Adoption Costs Credit. Child and Dependent Care Expenses Credit. College Access Tax Credit. Dependent Parent Credit. Foster Youth Tax Credit. Joint Custody Head Of Household. Nonrefundable Renter's Credit.

What are the most common tax credits?

Some of the most common include: the Child Tax Credit (CTC), the Earned Income Tax Credit (EITC), and deductions for student loan interest and retirement plan contributions. Tax deductions and credits come into play at different points in the filing process.

How do tax credits work for dummies?

A credit is an amount you subtract from the tax you owe. This can lower your tax payment or increase your refund. Some credits are refundable — they can give you money back even if you don't owe any tax. To claim credits, answer questions in your tax filing software.

What is the maximum income to qualify for tax credits?

You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000 if filing a joint return).

What is an example of a foreign tax credit?

The Foreign Tax Credit (FTC) is one method U.S. expats can use to offset foreign taxes paid abroad dollar-for-dollar. Tax credits in general work like this: If you owe the U.S. government $1,500 in taxes and you have a $500 tax credit, you'll end up only owing $1,000 — and the Foreign Tax Credit is no different.

How to get the most money back on taxes?

Your Money 1 – Choose the right filing status. Your filing status has a major impact on how much tax you owe. 2 – Make the most of tax deductions. 3 – Take advantage of tax credits. 4 – There's still time to contribute to an IRA.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Tax Credit Analysis?

Tax Credit Analysis is the process of evaluating and determining the eligibility and amount of tax credits for which an individual or business may qualify. It involves analyzing financial statements, tax returns, and other relevant documentation to assess the potential tax benefits.

Who is required to file Tax Credit Analysis?

Individuals and businesses that are seeking to claim tax credits on their tax returns are often required to file a Tax Credit Analysis. This may include taxpayers who are eligible for specific credits, such as education credits, earned income credits, or business tax credits.

How to fill out Tax Credit Analysis?

To fill out a Tax Credit Analysis, one should gather required financial documents, complete the necessary forms by providing accurate information regarding income, expenses, and applicable credit details, and review the document for completeness before submission.

What is the purpose of Tax Credit Analysis?

The purpose of Tax Credit Analysis is to identify available tax credits, ensure compliance with tax regulations, maximize potential tax savings for individuals and businesses, and provide a clear understanding of the tax benefits applicable to each taxpayer's situation.

What information must be reported on Tax Credit Analysis?

The information that must be reported on Tax Credit Analysis includes taxpayer identification details, income levels, types of expenses qualifying for credits, relevant financial documentation, and any other specifics required by the tax authority to assess eligibility for credits.

Fill out your tax credit analysis online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Credit Analysis is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.