Get the free 20 CSR 400-1—Department of Insurance, Financial Institutions and Professional Regist...

Show details

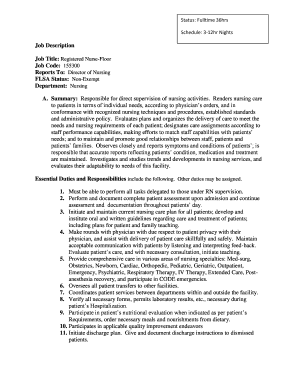

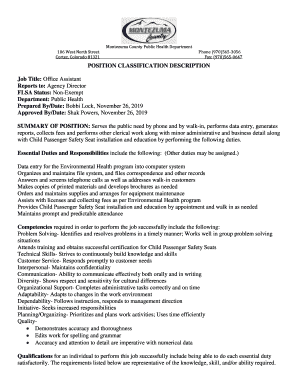

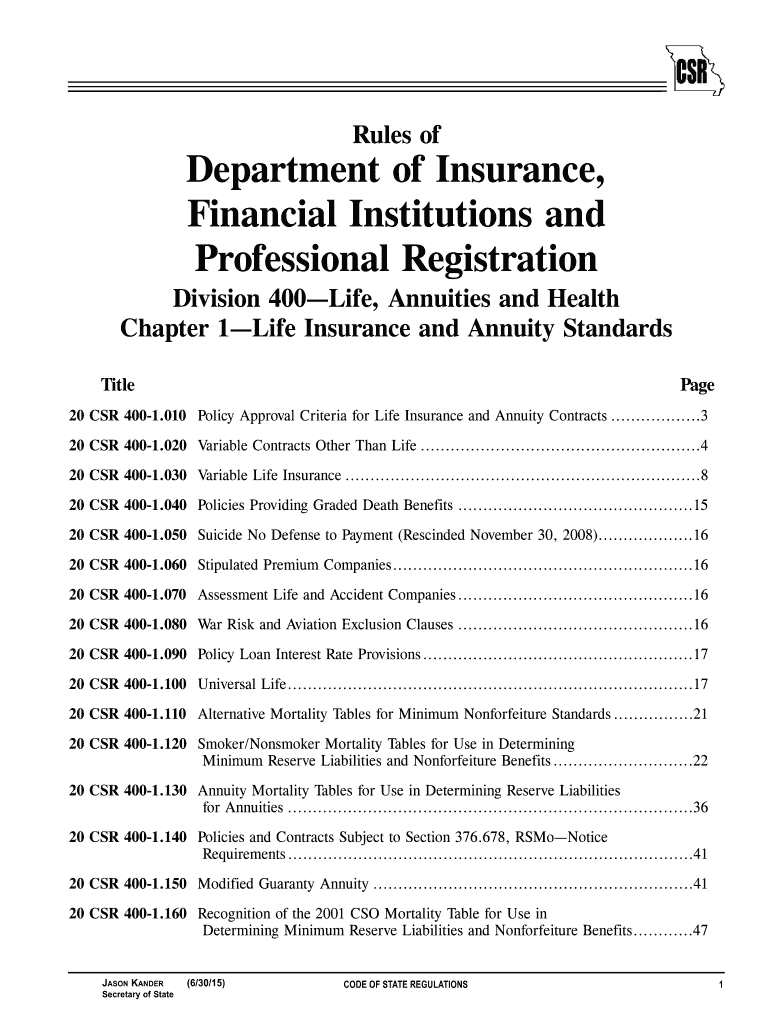

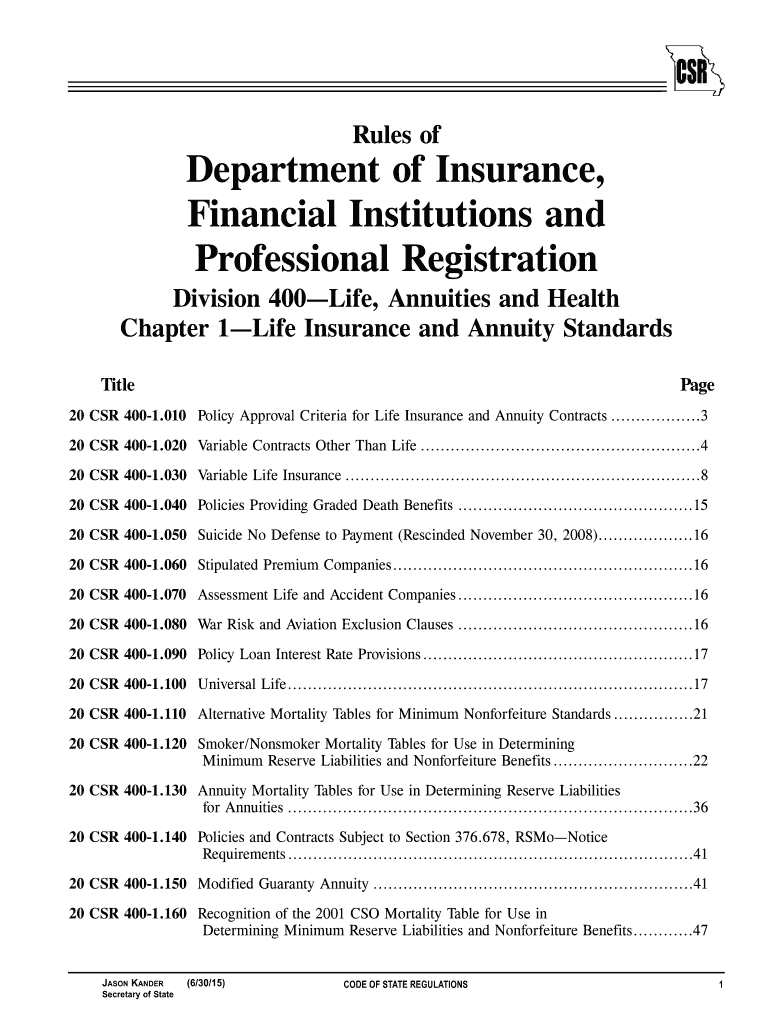

This document outlines the rules and regulations for life insurance and annuity contracts in Missouri, specifying approval criteria, variables in policy provisions, and requirements for insurance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 20 csr 400-1department of

Edit your 20 csr 400-1department of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 20 csr 400-1department of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit 20 csr 400-1department of online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 20 csr 400-1department of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 20 csr 400-1department of

How to fill out 20 CSR 400-1—Department of Insurance, Financial Institutions and Professional Registration

01

Obtain a copy of the 20 CSR 400-1 form from the Department of Insurance, Financial Institutions and Professional Registration website.

02

Review the instructions provided with the form to ensure you understand the requirements.

03

Begin filling out the form by entering your personal information, including your name, address, and contact details.

04

Provide details about your business or organization, including the legal name and any relevant identification numbers.

05

Complete the sections that pertain to the type of registration or licensing you are seeking.

06

If applicable, include any required documentation or attachments as specified in the instructions.

07

Double-check all entries for accuracy and completeness to avoid delays in processing.

08

Sign and date the form as required.

09

Submit the completed form via the appropriate method outlined in the instructions (e.g., mail, online submission).

10

Keep a copy of the submitted form and any correspondence for your records.

Who needs 20 CSR 400-1—Department of Insurance, Financial Institutions and Professional Registration?

01

Individuals or businesses seeking to operate in regulated financial sectors.

02

Insurance agents and brokers looking to obtain or renew their licenses.

03

Financial institutions that need to register with the Department.

04

Professional registrants in various occupations governed by the Department.

05

Entities seeking compliance with state regulations in the financial services industry.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between an insurance agent and a CSR?

The Claim Settlement Ratio (CSR) is the ratio of approved claims to the total claims received by an insurance company. It indicates the insurer's efficiency in settling claims and is a crucial factor in selecting an insurance policy.

What is CSR in life insurance?

CSR, or Claim Settlement Ratio, in insurance, represents the ratio of claims settled by an insurance company to the total claims received within a specific timeframe, usually a financial year.

What does CSR mean in insurance?

Insurance Customer Service Representative job summary You'll be responsible for creating insurance policies, advising potential clients on coverage, and converting quotes into new policies. You'll also help resolve billing issues, change policies, and make policy recommendations.

What is CSR with insurance?

A cost-sharing reduction (CSR) is a provision of the Affordable Care Act that reduces out-of-pocket costs for eligible enrollees who select Silver health insurance plans in the marketplace.

What is a CSR role in insurance?

Insurance agents can help them determine if their current coverage still meets their needs or if they should make changes. In contrast, CSRs typically only have access to the policy information. In addition, they are unable to make updates without the guidance and authorization of an insurance agent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 20 CSR 400-1—Department of Insurance, Financial Institutions and Professional Registration?

20 CSR 400-1 is a set of regulations established by the Department of Insurance, Financial Institutions and Professional Registration that governs the operations, compliance, and reporting requirements for entities within the insurance and financial sectors in Missouri.

Who is required to file 20 CSR 400-1—Department of Insurance, Financial Institutions and Professional Registration?

Entities such as insurance companies, financial institutions, and other related organizations operating in Missouri are required to file documents and reports as mandated by 20 CSR 400-1.

How to fill out 20 CSR 400-1—Department of Insurance, Financial Institutions and Professional Registration?

To fill out 20 CSR 400-1, entities must follow the guidelines and instructions provided within the regulation, which typically involve providing pertinent financial information, disclosures, and operational details in the prescribed format.

What is the purpose of 20 CSR 400-1—Department of Insurance, Financial Institutions and Professional Registration?

The purpose of 20 CSR 400-1 is to ensure that regulated entities comply with state laws, maintain financial stability, protect consumer interests, and uphold the integrity of the financial and insurance markets.

What information must be reported on 20 CSR 400-1—Department of Insurance, Financial Institutions and Professional Registration?

Information that must be reported includes financial statements, operational metrics, compliance data, risk management details, and any other disclosures as required by the regulation to ensure transparency and regulatory compliance.

Fill out your 20 csr 400-1department of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

20 Csr 400-1department Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.