Get the free Missouri Qualified Biodiesel Producer Incentive Program - sos mo

Show details

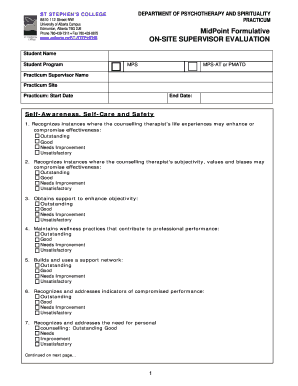

This document outlines the rules and requirements for the Missouri Qualified Biodiesel Producer Incentive Program, detailing eligibility, licensing, grant application procedures, and record-keeping

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign missouri qualified biodiesel producer

Edit your missouri qualified biodiesel producer form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your missouri qualified biodiesel producer form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit missouri qualified biodiesel producer online

To use our professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit missouri qualified biodiesel producer. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out missouri qualified biodiesel producer

How to fill out Missouri Qualified Biodiesel Producer Incentive Program

01

Ensure eligibility by confirming that you are a registered biodiesel producer in Missouri.

02

Gather all necessary documentation including proof of biodiesel production and quality certifications.

03

Complete the application form for the Missouri Qualified Biodiesel Producer Incentive Program, providing accurate information.

04

Submit required evidence of biodiesel production metrics, including gallons produced and sales records.

05

Attach any additional documents as specified in the application guidelines.

06

Review your application for completeness and accuracy before submission.

07

Submit your application by the designated deadline to the appropriate state department.

Who needs Missouri Qualified Biodiesel Producer Incentive Program?

01

Biodiesel producers in Missouri looking for financial incentives to support their operations.

02

Individuals or companies producing biodiesel who want to enhance their market competitiveness.

03

Farmers or renewable energy producers who diversify their operations and income through biodiesel production.

Fill

form

: Try Risk Free

People Also Ask about

What is the 45Z tax credit 2025?

117-169, commonly known as the Inflation Reduction Act (IRA), added the clean fuel production credit (CFPC) to Section 45Z of the Internal Revenue Code (IRC). The credit may be claimed by taxpayers producing and selling qualifying transportation fuel between 2025 and 2027.

Who qualifies for the biodiesel tax credit?

Biodiesel (Renewable Diesel) Credit The biodiesel or renewable diesel reported must not be a mixture. If the biodiesel was sold at retail, only the person that sold the fuel and placed it into the tank of the vehicle is eligible for the tax credit.

What is the biodiesel tax credit for 2025?

The "Biodiesel Tax Credit Extension Act of 2025" would extend the biodiesel tax credit for two years at the blender level. Taxpayers would be able to choose between claiming the Biodiesel Tax Credit or the '45Z' Clean Fuel Production Credit.

What is the 45Z biodiesel tax credit?

The 45Z credit can be claimed by producers of more types of biofuels than the 40A and 40B credits. Not only are BBD and SAF eligible, but so are ethanol and renewable natural gas, among others. Unlike the 40A/BTC, the 45Z credit is available to producers of biofuels instead of blenders.

What is the biodiesel producer tax credit for 2025?

January 19, 2025 Effective since January 1, 2025, the 45Z regime provides a credit of up to: $1.00 per gallon for the production of over-the-road biofuels (e.g., biodiesel, renewable diesel) $1.75 for the production of sustainable aviation fuel.

What is the producers tax credit for biodiesel?

The biodiesel mixture credit is a $1.00 credit for each gallon of biodiesel used to produce a qualified mixture. A qualified mixture is a mixture of biodiesel and diesel fuel sold for use as fuel or used as a fuel by the taxpayer producing the mixture.

What is the BTC biodiesel tax credit?

This credit provided $1.00 per gallon to blenders of biodiesel, renewable diesel and certain types of sustainable aviation fuel (collectively known as biomass-based diesel) with petroleum fuels. The BTC was first established in 2004 and maintained through a series of short-term extensions, some retroactive.

Is making biodiesel legal?

Biodiesel made solely for personal use is not required to be registered with EPA. For any biodiesel made for commerce, registration is required even for very low volumes. Organizations making biodiesel for their own use should contact EPA's Office of Transportation and Air Quality to see if they need to register.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Missouri Qualified Biodiesel Producer Incentive Program?

The Missouri Qualified Biodiesel Producer Incentive Program is a state initiative designed to promote the production of biodiesel in Missouri by providing financial incentives to qualified biodiesel producers.

Who is required to file Missouri Qualified Biodiesel Producer Incentive Program?

Biodiesel producers who wish to receive financial incentives under the program must file for the Missouri Qualified Biodiesel Producer Incentive Program.

How to fill out Missouri Qualified Biodiesel Producer Incentive Program?

To fill out the Missouri Qualified Biodiesel Producer Incentive Program application, producers must provide required documentation and information about their biodiesel production process and meet eligibility criteria as outlined by the program.

What is the purpose of Missouri Qualified Biodiesel Producer Incentive Program?

The purpose of the Missouri Qualified Biodiesel Producer Incentive Program is to encourage the production and use of biodiesel, thereby supporting renewable energy sources and reducing reliance on fossil fuels.

What information must be reported on Missouri Qualified Biodiesel Producer Incentive Program?

Producers must report information such as production volumes, feedstock used, financial records, and any other data required by the state to verify eligibility for the incentive.

Fill out your missouri qualified biodiesel producer online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Missouri Qualified Biodiesel Producer is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.