Get the free Notice of Withdrawal for a Limited Liability Partnership - sos mo

Show details

This document serves as a formal notice for withdrawing a limited liability partnership, requiring partners' signatures and submission to the state.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign notice of withdrawal for

Edit your notice of withdrawal for form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your notice of withdrawal for form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing notice of withdrawal for online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit notice of withdrawal for. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

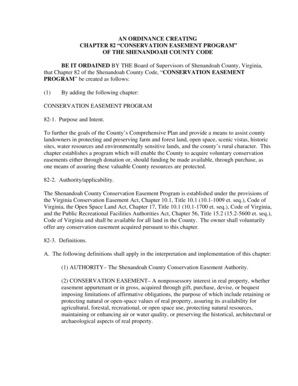

How to fill out notice of withdrawal for

How to fill out Notice of Withdrawal for a Limited Liability Partnership

01

Obtain the official Notice of Withdrawal form from your state’s Secretary of State website or office.

02

Fill in the name of the Limited Liability Partnership (LLP) as it appears on the original formation documents.

03

Provide the LLP’s official business address and any other contact information required.

04

State the effective date of withdrawal from the partnership.

05

Include the names and signatures of all partners, affirming their agreement to the withdrawal.

06

Double-check the form for accuracy and completeness to avoid any delays.

07

Submit the completed Notice of Withdrawal form to the appropriate state office, along with any required filing fees.

08

Keep a copy of the filed documentation for your records.

Who needs Notice of Withdrawal for a Limited Liability Partnership?

01

Any Limited Liability Partnership (LLP) that has decided to dissolve or withdraw from the partnership.

02

Partners who are exiting the business need to file this notice to formally document their withdrawal.

03

Businesses that are ceasing operations or restructuring their partnerships will also need this notice.

Fill

form

: Try Risk Free

People Also Ask about

How do I withdraw from a limited partnership?

Unless the partnership agreement provides otherwise (it usually does), the admission of additional limited partners requires the written consent of all. A general partner may withdraw at any time with written notice; if withdrawal is a violation of the agreement, the limited partnership has a right to claim of damages.

How much notice must a limited partner give before withdrawing from an LP?

A limited partner can withdraw any time after six months' notice to each general partner, and the withdrawing partner is entitled to any distribution as per the agreement or, if none, to the fair value of the interest based on the right to share in distributions.

How do you remove someone from a limited partnership?

Advice on removing a Partner We recommend that partnership agreements should be in place to regulate the conduct of the partners or members. Under the Limited Liability Partnership Act 2000 it is impossible to expel members without an express agreement. In this case it would be necessary to go to court to get an order.

How do you terminate a limited partnership?

Examine Your Limited Partnership Agreement. Vote to Dissolve Your Limited Partnership. File Dissolution Papers. Publish Notice of Your Dissolution. Review Your Third-Party Contracts. Liquidate Your Assets and Settle Your Debts. Distribute Remaining Assets to Partners. Cancel Business Accounts, Licenses, and Permits.

How do I withdraw from a limited partnership?

Unless the partnership agreement provides otherwise (it usually does), the admission of additional limited partners requires the written consent of all. A general partner may withdraw at any time with written notice; if withdrawal is a violation of the agreement, the limited partnership has a right to claim of damages.

What happens when a partner leaves a limited partnership?

If a partner's departure triggers an end to the partnership, the partners will need to follow a dissolution procedure. In this case, the partnership will settle its debts and distribute any remaining assets to the partners—including the withdrawing partner—ing to their capital accounts.

How do I write a letter of withdrawal from an LLC?

Draft a formal, written notice that states your intention to withdraw and be sure to cite the provisions of the Operating Agreement that pertain to withdrawal. State any desires or demands regarding full payment for any investments you made in the company. Deliver your written notice to every member of the company.

How do I remove someone from a limited partnership?

Advice on removing a Partner We recommend that partnership agreements should be in place to regulate the conduct of the partners or members. Under the Limited Liability Partnership Act 2000 it is impossible to expel members without an express agreement. In this case it would be necessary to go to court to get an order.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Notice of Withdrawal for a Limited Liability Partnership?

A Notice of Withdrawal for a Limited Liability Partnership is a formal document filed with the state to indicate that a partner or partners are withdrawing from the partnership, effectively updating the partnership's status.

Who is required to file Notice of Withdrawal for a Limited Liability Partnership?

The partners who are withdrawing from the Limited Liability Partnership are required to file the Notice of Withdrawal.

How to fill out Notice of Withdrawal for a Limited Liability Partnership?

To fill out the Notice of Withdrawal, partners should provide details such as the name of the partnership, the names of withdrawing partners, the effective date of withdrawal, and any other required information as stipulated by state law.

What is the purpose of Notice of Withdrawal for a Limited Liability Partnership?

The purpose of the Notice of Withdrawal is to officially document the departure of a partner, ensuring that the public records reflect the current status of the partnership and helping protect the remaining partners from liability.

What information must be reported on Notice of Withdrawal for a Limited Liability Partnership?

The Notice of Withdrawal must typically include the partnership's name, address, names of the partners withdrawing, the effective date of withdrawal, and possibly signature verification or additional information as required by state regulations.

Fill out your notice of withdrawal for online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Notice Of Withdrawal For is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.