Get the free APPLICATION FOR REVERSE ANNUITY MORTGAGE LOAN - housing mt

Show details

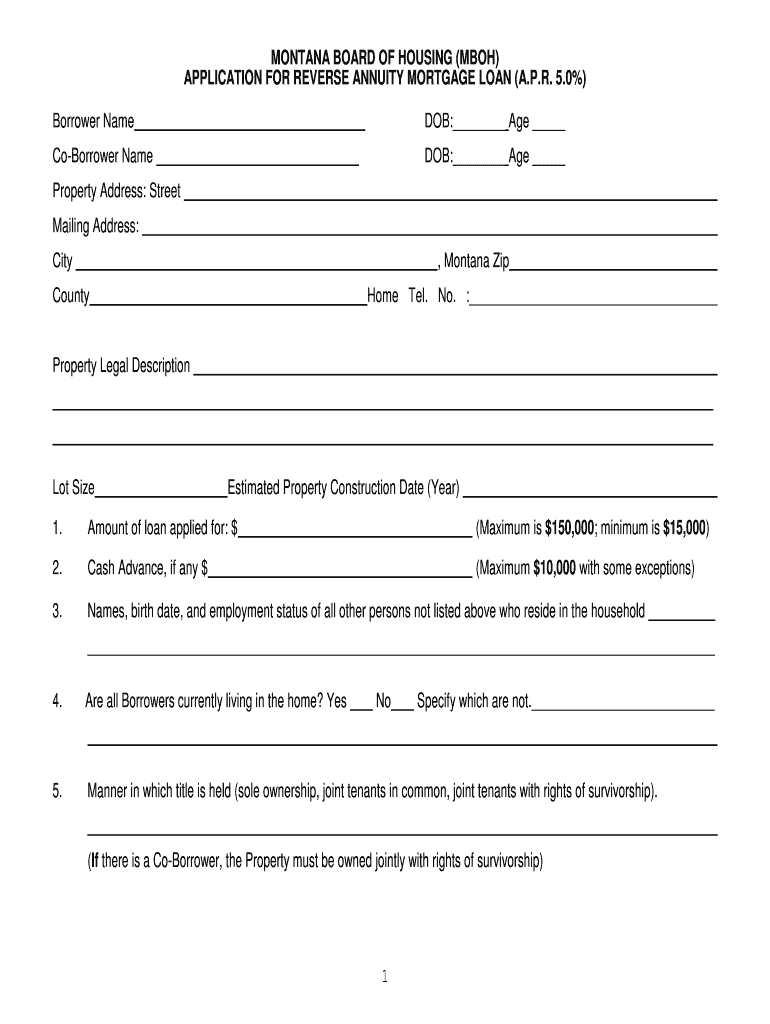

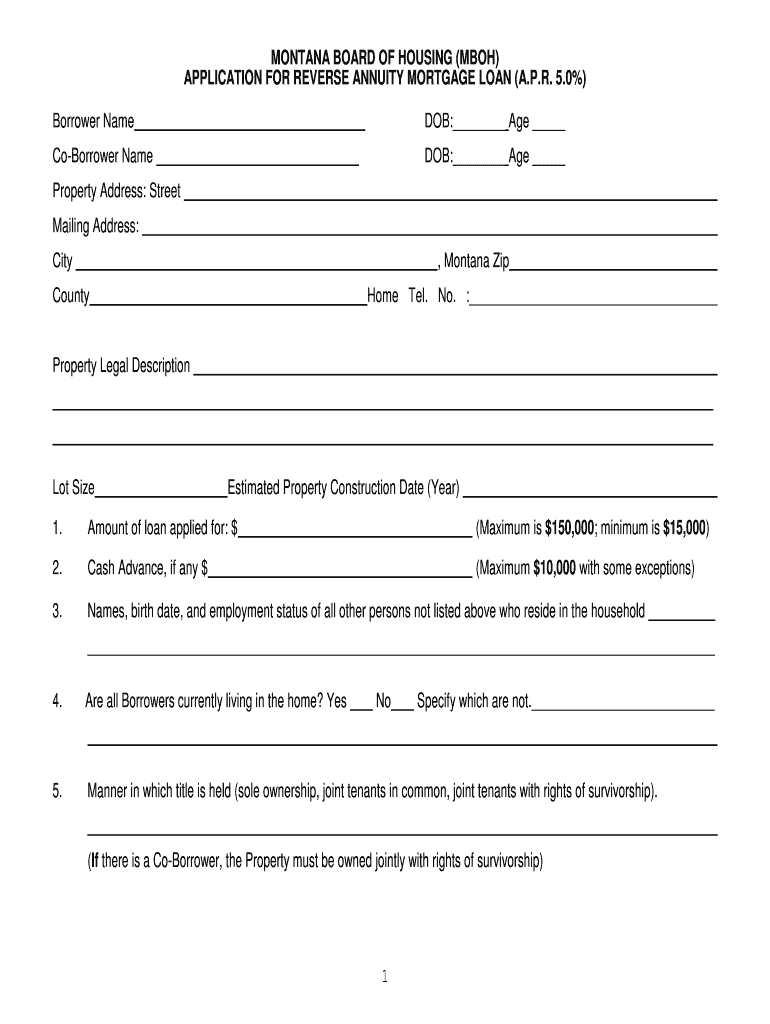

This document provides instructions for completing the application for a Reverse Annuity Mortgage Loan offered by the Montana Board of Housing, detailing eligibility requirements and necessary documentation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for reverse annuity

Edit your application for reverse annuity form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for reverse annuity form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for reverse annuity online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for reverse annuity. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for reverse annuity

How to fill out APPLICATION FOR REVERSE ANNUITY MORTGAGE LOAN

01

Gather necessary documents, including proof of income, property deed, and identification.

02

Visit the lender's website or office to obtain the APPLICATION FOR REVERSE ANNUITY MORTGAGE LOAN form.

03

Fill out personal information, such as name, address, and contact details.

04

Provide information about the property, including its value and current mortgage status.

05

Indicate your income sources and amounts as requested on the application.

06

Review the loan terms and provide consent by signing where indicated.

07

Submit the completed application along with any required documentation.

Who needs APPLICATION FOR REVERSE ANNUITY MORTGAGE LOAN?

01

Individuals aged 62 or older who own a home and want to access their home equity without monthly mortgage payments.

02

Retirees looking for supplemental income to cover living expenses.

03

Homeowners who wish to downsize or relocate while tapping into the value of their existing home.

Fill

form

: Try Risk Free

People Also Ask about

What would disqualify me from a reverse mortgage?

Factors that can disqualify you from getting a reverse mortgage are that you don't meet the age requirement, you don't have sufficient equity, the home is not your primary residence, or you don't have enough income to cover ongoing home maintenance and homeowners insurance costs or property taxes.

What is the downside of an HECM loan?

You might lose government aid: While an HECM isn't counted as income for tax reasons, the money you receive from your HECM can affect your ability to qualify for Supplemental Security Income or Medicaid. Carefully consider the effects of losing your benefits if you were to take out an HECM.

Are there income requirements for a reverse mortgage?

Your income or credit score is not a consideration in obtaining a reverse mortgage, since no payments are required until the loan ends.

What credit score do you need to get a reverse mortgage?

1 There are no credit score or income requirements for reverse mortgages. U.S. Department of Housing and Urban Development.

Who is not a good candidate for a reverse mortgage?

Who is not a good candidate for a reverse mortgage? A reverse mortgage is a questionable proposition if you have sufficient income to pay your bills or are willing to sell your home to tap into the equity. If that's the case, it may make more sense to just sell it and downsize your home.

Why would someone not qualify for a reverse mortgage?

You have insufficient equity A reverse mortgage needs to be in first lien position, which means you need to either already have paid off your first mortgage, or you need to be able to pay off your mortgage in its entirety with your reverse mortgage proceeds.

Who is the most reputable reverse mortgage company?

Our Top Picks for Reverse Mortgage Lenders Finance of America: Best Overall. Northwest Reverse Mortgage: Best for Comparison Shopping. Longbridge Financial: Best for Coverage Options. South River Mortgage: Best for Refinancers. Guild Mortgage: Best for Low Rates. Fairway: Best for Homebuyers.

How to apply for a reverse mortgage loan?

Step 1: Research lenders and loan availability. Step 2: Attend reverse mortgage counseling. Step 3: Review application, fees, and disclosures. Step 4: Submit for loan processing. Step 5: Close on the loan. Step 6: Receive fund distribution. Step 7: Work with loan servicing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR REVERSE ANNUITY MORTGAGE LOAN?

The Application for Reverse Annuity Mortgage Loan is a formal request to obtain a reverse mortgage, allowing homeowners, typically seniors, to convert part of their home equity into cash without having to sell their home.

Who is required to file APPLICATION FOR REVERSE ANNUITY MORTGAGE LOAN?

Homeowners aged 62 or older who wish to access the equity in their homes through a reverse mortgage must file this application.

How to fill out APPLICATION FOR REVERSE ANNUITY MORTGAGE LOAN?

To fill out the application, homeowners need to provide personal information, details about the property, financial information, and sign necessary disclosures. It is often advised to seek assistance from a certified counselor.

What is the purpose of APPLICATION FOR REVERSE ANNUITY MORTGAGE LOAN?

The purpose of the application is to initiate the process of obtaining a reverse mortgage, which allows homeowners to receive funds while retaining ownership of their home.

What information must be reported on APPLICATION FOR REVERSE ANNUITY MORTGAGE LOAN?

The application must report the applicant's personal information, property details, outstanding mortgage balances, income, debts, and any other relevant financial information.

Fill out your application for reverse annuity online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Reverse Annuity is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.