Get the free DE 3BHW - edd ca

Show details

Este formulario es utilizado para reportar los salarios y las retenciones de los empleados del hogar trimestralmente. Es un requisito para los empleadores que han optado por pagar impuestos anualmente

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign de 3bhw - edd

Edit your de 3bhw - edd form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your de 3bhw - edd form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit de 3bhw - edd online

In order to make advantage of the professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit de 3bhw - edd. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out de 3bhw - edd

How to fill out DE 3BHW

01

Obtain the DE 3BHW form online or from a local office.

02

Fill in your name and contact information at the top of the form.

03

Provide details about your employment history, including dates and employers.

04

Indicate the reason for your claim or application in the specified section.

05

Include any relevant documentation or proof required.

06

Review the completed form for accuracy.

07

Submit the form as per the instructions provided.

Who needs DE 3BHW?

01

Individuals applying for job training benefits.

02

Workers seeking assistance in finding new employment.

03

Those needing to document their work history for unemployment purposes.

Fill

form

: Try Risk Free

People Also Ask about

What is de 3BHW?

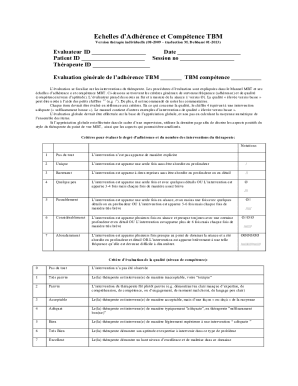

Employer of Household Worker(s) Quarterly Report of Wages and Withholdings (DE 3BHW)

What is the de4 tax withholding in California?

Employees must understand this form, as it determines the amount of state income tax their employer withholds from their wages. The DE 4 form, or Employee's Withholding Allowance Certificate, is used by California employees to determine the number of withholding allowances they claim for state tax purposes.

How to fill out a DE4?

Complete California State DE-4 Form Select Form DE-4 tab. Review your Full Name and Home Address. Select your Filing Status. Enter the Number of allowances you wish to claim in Section 1. Enter any Additional amount you want withheld from each paycheck in Section 2.

What should my California withholding allowance be?

Effective January 1, 2024, the annual standard deduction will increase to $5,363 or $10,726 based on the employee's filing status and the number of allowances claimed. The value of a state allowance increases to $158.40 annually. Review Method B exact calculation methodopens in a new tab for more detailed information.

What is a commercial owner EDD?

A commercial employer is a business connected with commerce or trade, operating primarily for profit and employs workers subject to California employment taxes.

What is the de 4 withholding in California?

Form DE 4: This California form is vital for employees to indicate their state withholding allowances and ensure accurate personal income tax deductions. DE-4 vs. Federal W-4: The state DE 4 form is distinct from the federal Form W-4, specifically tailored for California's personal income tax requirements.

Is it better to claim 1 or 0 in California?

If you'd rather get more money with each paycheck instead of having to wait for your refund, claiming 1 on your taxes is typically a better option. Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund.

What is employer payroll tax?

Employers must pay payroll taxes every pay period. These include: Social Security, taxed at 6.2% for employees and 6.2% for the employer up to the taxable earnings cap. Medicare, taxed at 1.45% for employees and 1.45% for the employer. State unemployment taxes (varies by state)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is DE 3BHW?

DE 3BHW is a California form used to report the wages paid and withholding amounts for household employees.

Who is required to file DE 3BHW?

Employers who pay household employees $1,000 or more in a calendar quarter are required to file DE 3BHW.

How to fill out DE 3BHW?

To fill out DE 3BHW, provide the employer's information, employee's information, total wages paid, and withholding amounts for each household employee.

What is the purpose of DE 3BHW?

The purpose of DE 3BHW is to report payroll taxes and ensure compliance with state employment tax requirements for household workers.

What information must be reported on DE 3BHW?

The information that must be reported on DE 3BHW includes the employer's name and address, employee's name and Social Security number, total wages paid, and any taxes withheld.

Fill out your de 3bhw - edd online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

De 3bhw - Edd is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.