Get the free Quarterly Fuel Rate Rider Order - psc mt

Show details

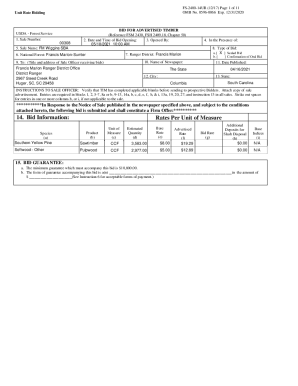

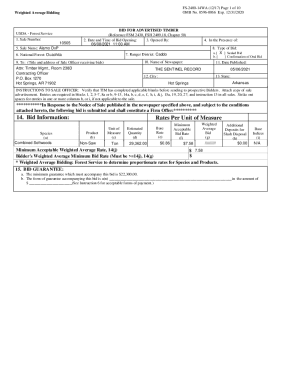

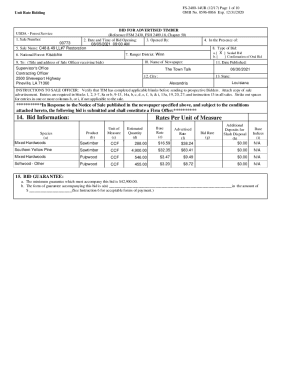

This document is an order from the Montana Public Service Commission authorizing an increase in the fuel rate charged by Black Hills Corporation for electricity generation, based on increased fuel

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quarterly fuel rate rider

Edit your quarterly fuel rate rider form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quarterly fuel rate rider form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit quarterly fuel rate rider online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit quarterly fuel rate rider. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quarterly fuel rate rider

How to fill out Quarterly Fuel Rate Rider Order

01

Gather all necessary documentation related to fuel costs and usage for the quarter.

02

Access the Quarterly Fuel Rate Rider Order form from the appropriate authority or website.

03

Fill in your company's details, including the name, address, and contact information.

04

Provide the quarter's specific dates for which the fuel rate is being calculated.

05

List the total amount of fuel used during the quarter, including gallonage and types of fuel.

06

Calculate the total fuel costs incurred during the quarter based on documented usage.

07

Review and adjust the requested fuel rate as per the calculated costs and regulatory guidelines.

08

Attach any required supporting documents or calculations to the completed order form.

09

Sign and date the order form, confirming the accuracy of the information provided.

10

Submit the completed Quarterly Fuel Rate Rider Order to the relevant regulatory authority by the deadline.

Who needs Quarterly Fuel Rate Rider Order?

01

Public utilities and energy suppliers responsible for delivering fuel services.

02

Businesses and organizations that must report and adjust fuel rates quarterly.

03

Regulatory agencies that oversee fuel pricing and ensure compliance with standards.

04

Consumers and clients who are impacted by fuel rates and rely on transparent reporting.

Fill

form

: Try Risk Free

People Also Ask about

What is the best way to track IFTA miles?

The best way to track IFTA miles is by using a GPS tracking system. GPS-enabled devices automatically record the distance your vehicles travel in each state or province. These systems are highly accurate, saving time and reducing errors compared to manual methods.

How does IFTA work for dummies?

IFTA is a framework that allows trucking companies to report and pay fuel taxes based on the distance traveled in each participating jurisdiction. Under this agreement, carriers are required to maintain detailed records of the fuel consumed and miles driven within and across member jurisdictions.

How to calculate fuel tax for IFTA?

You can calculate your IFTA fuel tax returns by analyzing how much gas you burn in each state. The IFTA tax calculation process involves five key steps, which include tracking mileage and fuel purchases to calculate taxes. You'll then analyze tax rates for each jurisdiction to calculate your IFTA tax returns.

How is IFTA calculated?

How to calculate IFTA tax Track Total Miles Driven in Each Jurisdiction. Record the miles driven in each state or province using trip logs, odometer readings, or GPS tracking. Calculate Overall Fuel Mileage. Determine Fuel Consumed per Jurisdiction. Apply the Jurisdiction's Tax Rate. Reconcile Tax Paid and Tax Owed.

How much is the IFTA tax per mile?

State / ProvinceRateM-85 CALIFORNIA (CA) #1 U.S. Can. 0.0900 0.0340 COLORADO (CO) U.S. Can. 0.2600 0.0982 CONNECTICUT (CT) #15 U.S. Can. 0.2500 0.0945 DELAWARE (DE) U.S. Can. 0.2200 0.083113 more rows

What state has the highest diesel tax?

The three states with the highest gasoline taxes were California ($0.6982/gal), Illinois ($0.6710/gal), and Pennsylvania ($0.5870/gal). Those same three states also had the highest diesel taxes: California ($0.9212/gal), Illinois ($0.7460/gal), and Pennsylvania ($0.7410/gal).

How much is the fuel tax in Missouri?

Missouri Fuel Tax (as of July 1, 2024) 27 cents per gallon – gasoline and diesel. Each cent of additional fuel tax results in approximately $29.0 million for MoDOT and $12.6 million for cities and counties. Missouri ranks 47th nationally in revenue per mile.

How much is the ifta tax per mile?

State / ProvinceRateM-85 CALIFORNIA (CA) #1 U.S. Can. 0.0900 0.0340 COLORADO (CO) U.S. Can. 0.2600 0.0982 CONNECTICUT (CT) #15 U.S. Can. 0.2500 0.0945 DELAWARE (DE) U.S. Can. 0.2200 0.083113 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Quarterly Fuel Rate Rider Order?

The Quarterly Fuel Rate Rider Order is a regulatory mechanism used by utility companies to adjust the fuel rates charged to customers on a quarterly basis, based on changes in fuel costs.

Who is required to file Quarterly Fuel Rate Rider Order?

Utility companies that provide services and are subject to regulatory oversight are typically required to file the Quarterly Fuel Rate Rider Order with the relevant regulatory agency.

How to fill out Quarterly Fuel Rate Rider Order?

To fill out the Quarterly Fuel Rate Rider Order, companies must complete a standardized form provided by the regulatory agency, detailing current fuel costs, projected changes, and the proposed rates to be charged.

What is the purpose of Quarterly Fuel Rate Rider Order?

The purpose of the Quarterly Fuel Rate Rider Order is to ensure that utility companies can recover the costs of fuel used in energy production while providing transparency and fairness in pricing for consumers.

What information must be reported on Quarterly Fuel Rate Rider Order?

The information that must be reported includes actual fuel costs, projected fuel costs, any adjustments related to previous orders, and the proposed rate changes for the upcoming quarter.

Fill out your quarterly fuel rate rider online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quarterly Fuel Rate Rider is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.