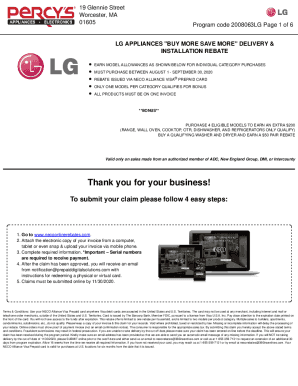

Get the free Application for Authority to Make Short-Term Borrowings - psc mt

Show details

This document is a default order issued by the Montana Public Service Commission, authorizing the Montana Power Company to make short-term borrowings up to $150,000,000 for operational purposes during

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for authority to

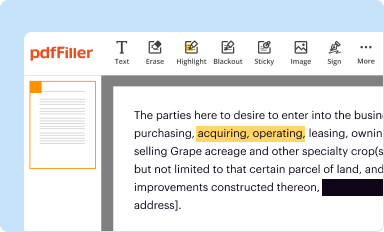

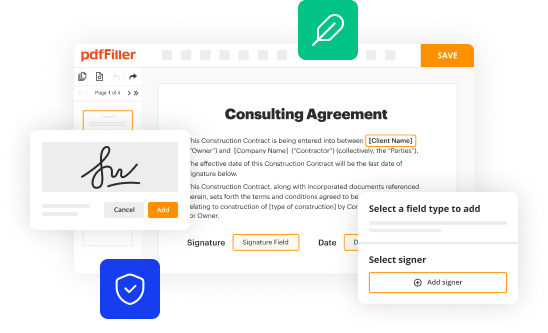

Edit your application for authority to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for authority to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit application for authority to online

To use the services of a skilled PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit application for authority to. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for authority to

How to fill out Application for Authority to Make Short-Term Borrowings

01

Obtain the Application for Authority to Make Short-Term Borrowings form from the relevant financial authority or agency.

02

Read the instructions carefully to understand the requirements and conditions for short-term borrowing.

03

Fill in your organization's details, including name, address, and contact information.

04

Provide the purpose of the short-term borrowing and how the funds will be used.

05

Specify the amount of money requested and the duration for which the borrowing is needed.

06

Include a detailed financial plan that demonstrates the ability to repay the borrowed amount.

07

Gather any required supporting documents, such as financial statements or proof of need.

08

Review the completed application for accuracy and completeness.

09

Sign and date the application to certify that all information is true and correct.

10

Submit the application to the appropriate authority by the specified deadline.

Who needs Application for Authority to Make Short-Term Borrowings?

01

Organizations or businesses needing temporary financial support to cover operating expenses.

02

Entities experiencing cash flow issues that require immediate funding.

03

Nonprofit organizations that need short-term funding to continue operations between grants.

04

Local governments requiring immediate funds for unforeseen expenses or projects.

Fill

form

: Try Risk Free

People Also Ask about

How do I write a letter to approve a loan?

Tips for Writing Effective Loan Approval Letters Keep it concise and professional: Get straight to the point and avoid unnecessary information. Personalize it if possible: A salutation with the borrower's name adds a touch of courtesy. Clearly state the loan details: Indicate the loan amount, purpose, and interest rate.

How to write a loan approval letter?

Salutation: Use a formal greeting (eg, ``Dear (Recipient's Name),''). Introduction: State your purpose for writing. Body: Provide details about your loan request (amount, purpose, repayment terms, etc.). Conclusion: Thank the recipient and express your hope for a positive response.

How to write a loan acceptance letter?

It should clearly state the purpose of the loan, the requested amount, and the terms of repayment. Additionally, the letter should highlight the borrower's creditworthiness and ability to repay the loan.

What are short-term borrowings?

Short-term loans are generally repaid within a few months or often up to a year. You can take them to meet urgent financial needs, such as unexpected expenses or cash flow shortages. With quick approval processes and flexible terms, Short-term Loans provide quick access to funds when needed most.

How to write loan application in English?

A Step-By-Step Guide To Writing A Personal Loan Application Add Basic Information About Yourself and the Lender. Write a Clear Subject Line. Clearly State the Purpose of the Loan. Highlight Your Creditworthiness. Include Any Collateral (If Applicable) Maintain a Professional and Courteous Tone.

How do I write a letter of approval?

Follow these steps to request an approval letter when starting or during a project: Choose a contact method. Include your address. Add the recipient's address. State your request. Discuss why you need it. Inform them why their consideration is important. Display your enthusiasm for a response. Conclude the letter.

How to apply for a short-term loan?

Short-term personal loans are available through banks, credit unions and online lenders. The application process is straightforward, and borrowers can usually apply online. However, the exact requirements may differ from lender to lender, so research the specific requirements with your preferred lender before applying.

What do I write to get approved for a loan?

Here are some tips to help you write a letter for loan approval: Review the loan guidelines and understand how they apply. Describe the reason for the loan in detail. Attach the necessary supporting documentation. Identify the amount of money you need. Be polite and professional when addressing the reader.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Application for Authority to Make Short-Term Borrowings?

The Application for Authority to Make Short-Term Borrowings is a formal request submitted by an organization to obtain permission from regulatory authorities to engage in short-term borrowing activities, often to manage cash flow or meet immediate financial obligations.

Who is required to file Application for Authority to Make Short-Term Borrowings?

Typically, organizations such as corporations, municipalities, or non-profit entities that intend to undertake short-term borrowing need to file the Application for Authority to Make Short-Term Borrowings, particularly if required by state or federal regulations.

How to fill out Application for Authority to Make Short-Term Borrowings?

To fill out the Application for Authority to Make Short-Term Borrowings, the applicant must provide details such as the purpose of the borrowing, the amount requested, the term of the borrowing, financial statements, and any relevant collateral agreements as required by the regulatory body.

What is the purpose of Application for Authority to Make Short-Term Borrowings?

The purpose of the Application for Authority to Make Short-Term Borrowings is to allow organizations to secure permission for borrowing funds for short durations to address immediate financial needs without compromising long-term financial stability.

What information must be reported on Application for Authority to Make Short-Term Borrowings?

The Application for Authority to Make Short-Term Borrowings must report information such as the applicant's entity details, specifics of the proposed borrowing (amount, duration, purpose), financial condition, intended use of funds, and any existing debts or obligations.

Fill out your application for authority to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Authority To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.