Get the free APPLICATION FOR INCOME TAX WITHHOLDING AND SALES & USE TAX PERMIT - nd

Show details

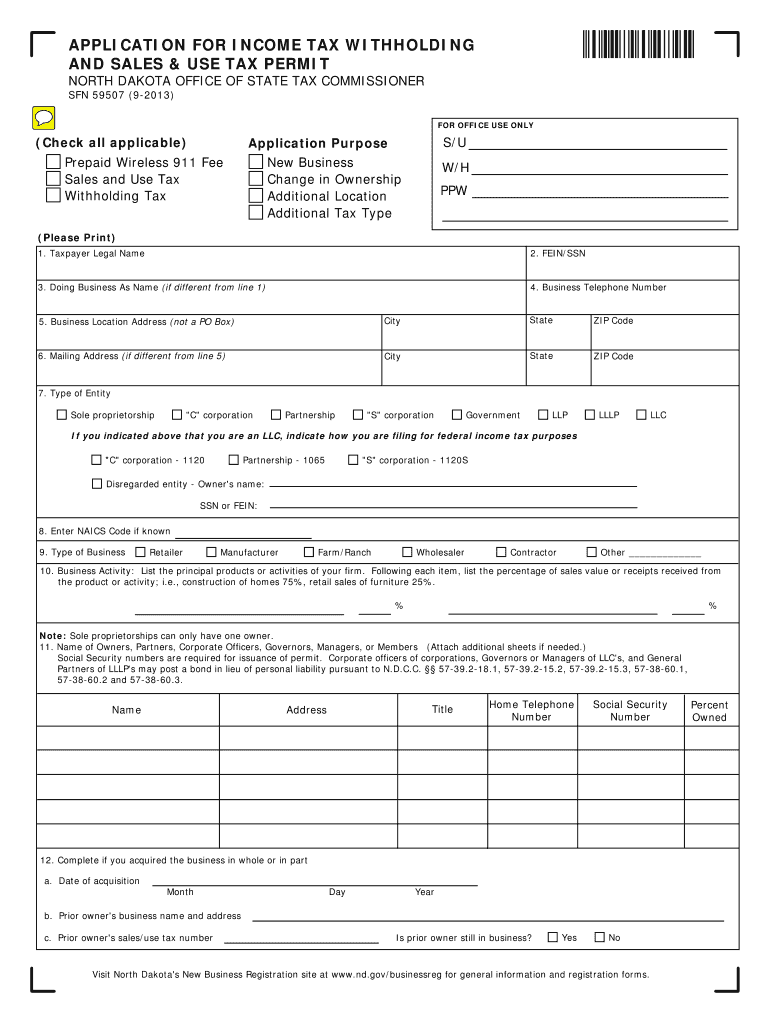

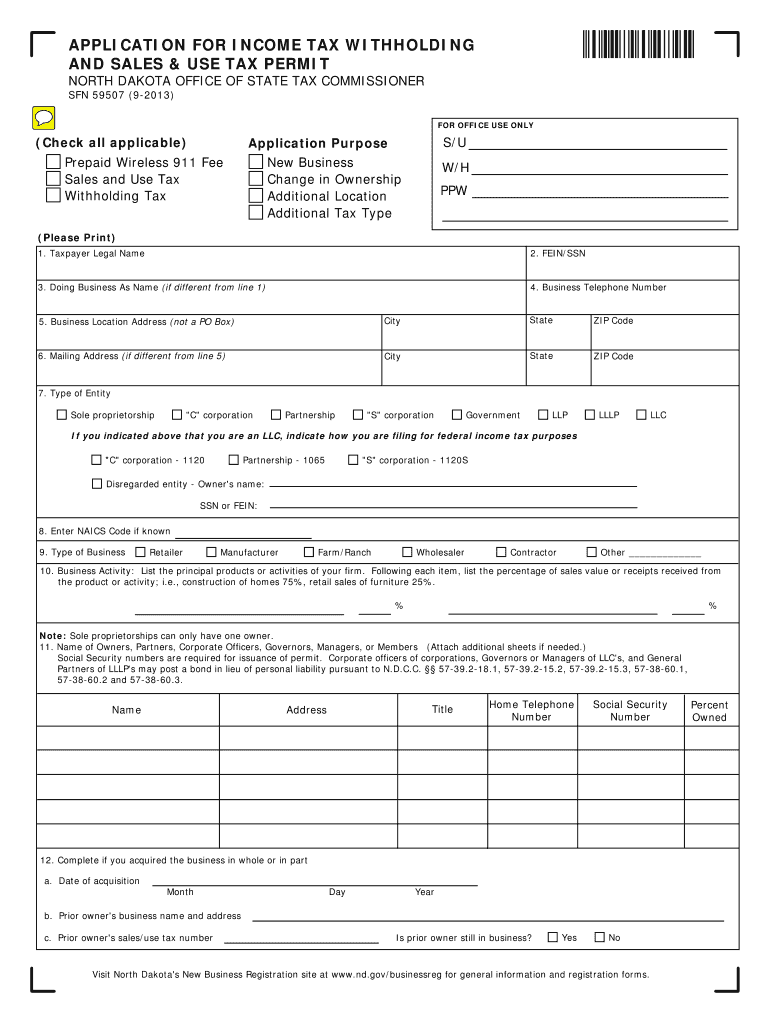

This application is intended for businesses in North Dakota to apply for income tax withholding and sales & use tax permits. It collects necessary information about the business, its owners, and specific

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for income tax

Edit your application for income tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for income tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for income tax online

Follow the guidelines below to use a professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit application for income tax. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for income tax

How to fill out APPLICATION FOR INCOME TAX WITHHOLDING AND SALES & USE TAX PERMIT

01

Obtain the APPLICATION FOR INCOME TAX WITHHOLDING AND SALES & USE TAX PERMIT form from the state's tax department website or office.

02

Fill out the business information section, including the legal name, address, and contact details of your business.

03

Provide information about the type of business entity (e.g., sole proprietorship, partnership, corporation) and the owner's information.

04

Indicate if your business will be withholding income tax from employees by checking the appropriate box.

05

Complete the sales tax section by indicating the nature of your business sales and the expected volume of sales.

06

Provide your Social Security Number or Federal Employer Identification Number (EIN).

07

Review all the information you have provided for accuracy.

08

Sign and date the form.

09

Submit the completed application to the appropriate tax authority as instructed on the form.

Who needs APPLICATION FOR INCOME TAX WITHHOLDING AND SALES & USE TAX PERMIT?

01

Any business that plans to hire employees and withhold income taxes.

02

Businesses that sell goods or services and need to collect sales and use tax.

03

Newly established businesses that require permits to operate legally within their state.

Fill

form

: Try Risk Free

People Also Ask about

What is an example of a tax exemption?

Tax exemptions reduce the amount of income on which you owe tax. For example, if your gross income is $100,000 and you have a $5,000 exemption, you will be taxed on $95,000.

Is a sales tax permit the same as an EIN?

Is a sales tax permit the same as an EIN? No. However, you typically need to provide your Federal Employer Identification Number (EIN) to the state department of revenue when registering for a sales tax permit. Do I need a sales tax permit in every state?

How to apply for a NJ sales tax certificate?

To register, file a Business Registration Application (Form NJ-REG) online with the Division of Revenue and Enterprise Services. Once registered, you will receive a New Jersey Business Registration Certificate and, if applicable, a New Jersey Certificate of Authority (to be able to collect Sales Tax).

Do I need a sales tax permit in every state?

In the US, you are required to register for sales tax in each state in which you have met the physical or economic nexus standards or any other requirement of the state. For out-of-state sellers, economic nexus is generally the applicable standard for determining when to register to collect sales tax.

How do I report tax-exempt sales?

How Should You Document Your Tax Exempt Sales? Anytime a tax-exempt organization asks you to remove sales tax from their order, require them to give you a copy of their tax-exempt certificate. Print a copy of the sales receipt showing that the sales tax has been removed and attach it to the certificate.

How to fill out a CT sales and use tax resale certificate?

How to fill out the Connecticut Sales and Use Tax Resale Certificate? Provide seller's name and address. Fill in your business details and registration information. Specify the nature of your business. List the general description of products to be purchased. Sign and date the certificate.

How to fill out sales and use tax certificate of exemption?

The exemption certificate is properly completed and legible: Name and address of the purchaser. Description of the item to be purchased. The reason the purchase is exempt. Signature of purchaser and date; and. Name and address of the seller.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR INCOME TAX WITHHOLDING AND SALES & USE TAX PERMIT?

The APPLICATION FOR INCOME TAX WITHHOLDING AND SALES & USE TAX PERMIT is a form that businesses must complete to obtain the necessary permits for withholding income tax from employees' wages and for collecting and remitting sales and use taxes on goods and services they sell.

Who is required to file APPLICATION FOR INCOME TAX WITHHOLDING AND SALES & USE TAX PERMIT?

Businesses that have employees subject to income tax withholding and those that sell goods or services subject to sales and use tax are required to file this application.

How to fill out APPLICATION FOR INCOME TAX WITHHOLDING AND SALES & USE TAX PERMIT?

To fill out the application, a business must provide information including business name, address, federal employer identification number (FEIN), type of business entity, and details regarding expected income tax withholding and sales tax collection.

What is the purpose of APPLICATION FOR INCOME TAX WITHHOLDING AND SALES & USE TAX PERMIT?

The purpose of this application is to ensure that businesses comply with state tax laws regarding income tax withholding and sales and use tax collection, thereby facilitating proper tax administration and revenue collection.

What information must be reported on APPLICATION FOR INCOME TAX WITHHOLDING AND SALES & USE TAX PERMIT?

The application requires reporting of business identification details, such as name and address, contact information, federal employer identification number, type of business, and projected amounts for income tax withholding and sales and use tax.

Fill out your application for income tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Income Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.