FL DoR DR-601G 2012 free printable template

Show details

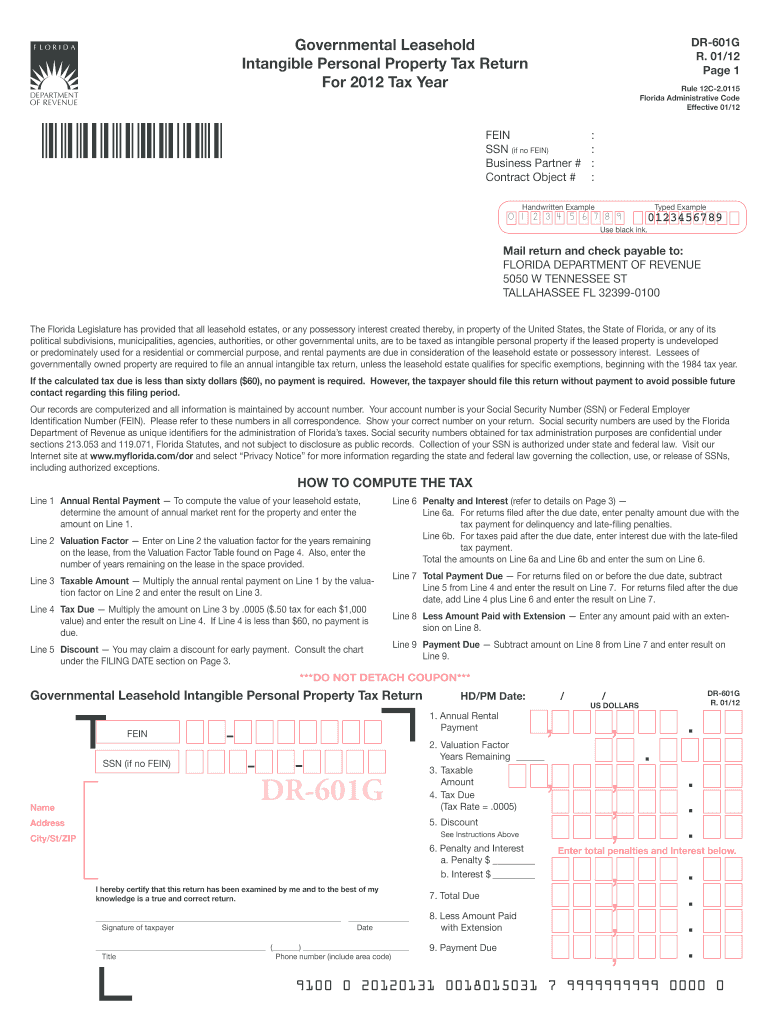

DR-601G R. 01/12 Page 1 Governmental Leasehold Intangible Personal Property Tax Return For 2012 Tax Year Rule 12C-2. If the 1/2 mill. 50 per 1000 value annual tax levy on the value of the is required to file this return Form DR-601G and pay the tax. If the tax due is less than sixty dollars 60 the taxpayer should file this return without payment of the tax to avoid unnecessary contact by the Taxpayers are not entitled to the exemption for the FILING DATE The Governmental Leasehold Intangible...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign dr 601g 2012 form

Edit your dr 601g 2012 form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dr 601g 2012 form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dr 601g 2012 form online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit dr 601g 2012 form. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

FL DoR DR-601G Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out dr 601g 2012 form

How to fill out FL DoR DR-601G

01

Download the FL DoR DR-601G form from the Florida Department of Revenue website.

02

Complete the taxpayer information section, including the name, address, and identification number.

03

Indicate the reason for the request, specifying the applicable tax periods.

04

Provide any necessary documentation to support the claim.

05

Review the completed form for accuracy and completeness.

06

Sign and date the form at the designated area.

07

Submit the form by mail or online as instructed on the website.

Who needs FL DoR DR-601G?

01

Individuals or businesses seeking a refund or adjustment to previously paid sales tax in Florida.

02

Taxpayers who have overpaid sales tax related to specific transactions.

Fill

form

: Try Risk Free

People Also Ask about

What is the intangible tax on a leasehold mortgage in Florida?

Florida Intangible Tax is calculated at 2 mills per each dollar of the just value of the note ($. 002) secured by the mortgage. (§199.133, Fla. Stat.)

Who pays intangible tax in Florida buyer or seller?

The lender is the taxpayer for the nonrecurring intangible tax. The nonrecurring intangible tax is paid at the time the mortgage is filed or recorded in Florida.

What is the Florida governmental leasehold intangible tax?

The tax rate is 50 cents per $1,000 (1/2 mill) of value of the leasehold estate. If the tax due amount is $60 or more, the lessee must file a return and pay the tax.

What is the statute intangible tax in Florida?

§199.133, Fla. Stat. Intangible tax is calculated at the rate of 2 mills on each dollar of the just valuation of the note or other obligation for the payment of money which are secured by a mortgage upon real property situated in the state of Florida.

Who is exempt from intangible tax in Florida?

FLORIDA INTANGIBLES TAX For single filers, businesses, and trusts, the first $250,000 of property value was exempt; for joint filers, the exemption was $500,000.

Who pays tangible property tax in Florida?

Who must file a TPP tax return? Anyone owning tangible personal property on January 1 must file a tax return by April 1 each year unless you were notified by our office that the filing requirement has been waived. Every new business owning tangible personal property on January 1 must file an initial tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit dr 601g 2012 form straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing dr 601g 2012 form.

How do I fill out the dr 601g 2012 form form on my smartphone?

Use the pdfFiller mobile app to complete and sign dr 601g 2012 form on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

How do I complete dr 601g 2012 form on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your dr 601g 2012 form. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is FL DoR DR-601G?

FL DoR DR-601G is a tax form used in Florida for reporting and paying the state's sales and use tax. It is specifically designed for businesses to accurately report their tax obligations.

Who is required to file FL DoR DR-601G?

Businesses that collect sales and use tax in Florida are required to file FL DoR DR-601G. This includes retailers, wholesalers, and any other entities engaged in taxable activities.

How to fill out FL DoR DR-601G?

To fill out FL DoR DR-601G, businesses must enter their sales data, calculate the tax due based on the applicable rates, and provide information about their business, including their tax identification number and relevant financial figures.

What is the purpose of FL DoR DR-601G?

The purpose of FL DoR DR-601G is to enable businesses to report their sales and use tax liability to the Florida Department of Revenue and to ensure compliance with state tax laws.

What information must be reported on FL DoR DR-601G?

FL DoR DR-601G requires the reporting of total sales, exempt sales, taxable sales, the amount of tax collected, and the business's identification details, including name and address.

Fill out your dr 601g 2012 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Dr 601g 2012 Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.