Get the free APPLICATION FOR LOAN REHABILITATION - starthere4loans nd

Show details

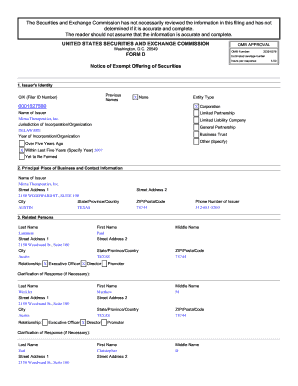

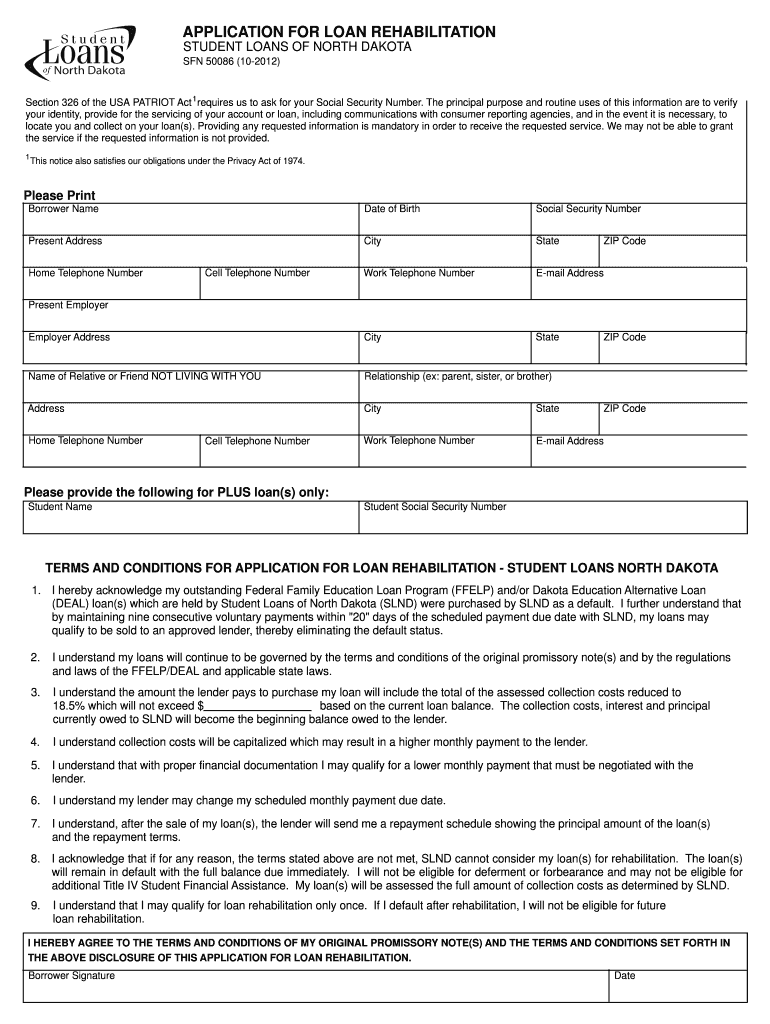

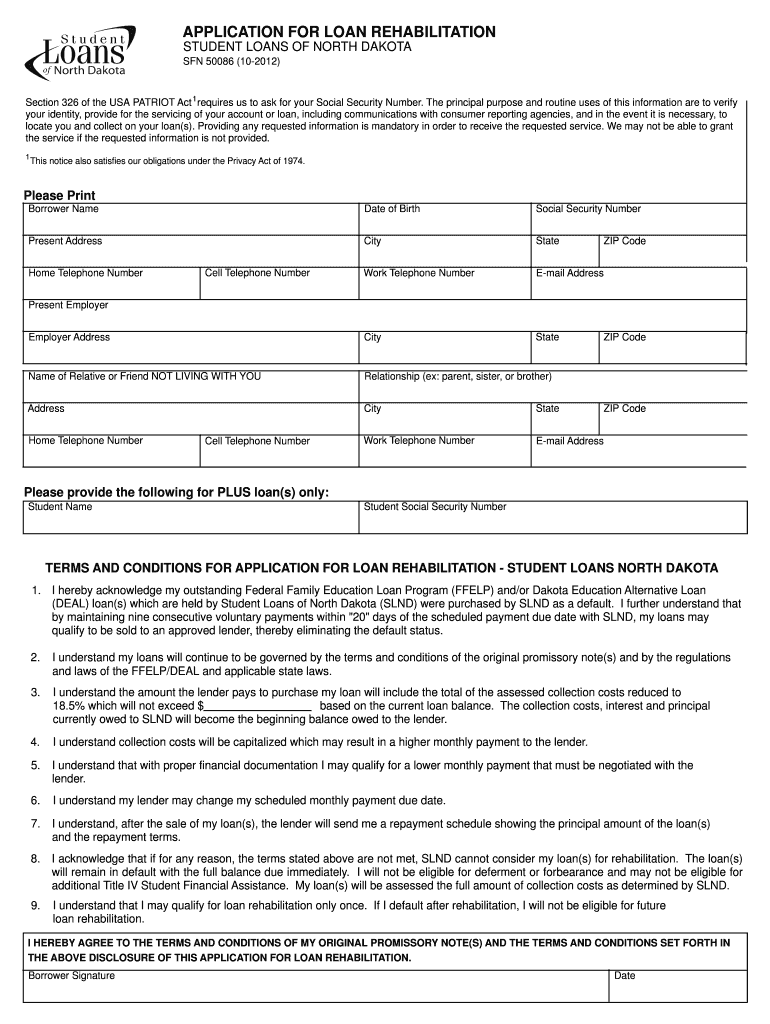

This document serves as an application for loan rehabilitation specifically for federal education loans. It outlines the necessary information needed from the borrower and the terms and conditions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for loan rehabilitation

Edit your application for loan rehabilitation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for loan rehabilitation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for loan rehabilitation online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit application for loan rehabilitation. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for loan rehabilitation

How to fill out APPLICATION FOR LOAN REHABILITATION

01

Obtain the APPLICATION FOR LOAN REHABILITATION form from your loan servicer's website or office.

02

Fill out your personal information, including your name, address, and contact details.

03

Provide details about your loan, such as the loan account number and the amount currently owed.

04

Indicate your current financial situation, including income, expenses, and any other relevant financial obligations.

05

Explain any circumstances that have affected your ability to repay the loan on time.

06

Specify the proposed rehabilitation plan, including the new monthly payment amount you can afford.

07

Review the application for any errors or missing information.

08

Submit the completed application to your loan servicer along with any required documentation.

Who needs APPLICATION FOR LOAN REHABILITATION?

01

Individuals who have defaulted on their federal student loans and want to restore their loan to good standing.

02

Borrowers seeking to reduce their monthly payment amounts and rehabilitate their loan status.

03

Someone who wants to improve their credit score after experiencing financial difficulties.

Fill

form

: Try Risk Free

People Also Ask about

What is the difference between consolidation and loan rehabilitation?

The difference is in how each handles the default status. Loan rehabilitation removes the default from your credit history, while consolidation pays off the defaulted student loan but leaves the default mark intact.

What is required for a plan of rehabilitation by repayment?

To rehabilitate, you must make 9 on-time payments of that amount over a period of 10 consecutive months. Provide the monthly income and expense information listed below. Include documentation of these sources of income or expenses if your loan holder asks you to.

How many times can you get student loan forgiveness?

Under all four plans, any remaining loan balance is forgiven if your federal student loans aren't fully repaid at the end of the repayment period. There is no limit on how much forgiveness you receive as long as you meet the requirements.

How many times can you rehabilitate student loans?

NOTE: You can rehabilitate a defaulted loan only once. Exceptions are if you completed the rehabilitation process before Aug. 14, 2008, or during the COVID-19 payment pause (March 13, 2020, to Dec. 1, 2022).

What is the 7 year rule for student loans?

Lenders are not all equal, so the number of deferments you'll be allowed on a car loan will vary. Keep in mind that many lenders will only approve one deferment, where others may approve two or more. Those stipulations could also apply yearly, or to the life of your entire loan.

Do I have to submit an application for loan forgiveness?

After you Make 120 Qualifying Monthly Payments for PSLF After you make your 120th qualifying monthly payment for PSLF, you'll need to submit the PSLF form to receive loan forgiveness. You must be working for a qualifying employer at the time you submit the PSLF form.

How many times can you get a payment deferred?

There's no limit to how often you can refinance, but you will need a good credit score or a co-signer with good credit to qualify for a loan. Refinancing federal student loans with a private loan will result in the loss of federal benefits like income-driven repayment and loan forgiveness.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR LOAN REHABILITATION?

APPLICATION FOR LOAN REHABILITATION is a formal process that allows borrowers, typically in default on their loans, to request the rehabilitation of their loan status by agreeing to a new repayment plan.

Who is required to file APPLICATION FOR LOAN REHABILITATION?

Borrowers who are currently in default on their federal student loans or other specified types of loans are required to file APPLICATION FOR LOAN REHABILITATION to restore their standing.

How to fill out APPLICATION FOR LOAN REHABILITATION?

To fill out APPLICATION FOR LOAN REHABILITATION, borrowers should provide personal information, loan details, and document their financial situation, including income and expenses, to demonstrate their ability to repay.

What is the purpose of APPLICATION FOR LOAN REHABILITATION?

The purpose of APPLICATION FOR LOAN REHABILITATION is to help borrowers regain good standing on their loans, avoid wage garnishment or tax refund offsets, and make their loans manageable through a new payment plan.

What information must be reported on APPLICATION FOR LOAN REHABILITATION?

The information that must be reported on APPLICATION FOR LOAN REHABILITATION includes personal identification details, loan specifics, monthly income, living expenses, and other financial obligations.

Fill out your application for loan rehabilitation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Loan Rehabilitation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.