Get the free Actuarial Opinion and Memorandum Regulation - legis nd

Show details

This document outlines the regulations and requirements for actuarial opinions and memoranda for life insurance companies and fraternal benefit societies, detailing the necessary qualifications, submission

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign actuarial opinion and memorandum

Edit your actuarial opinion and memorandum form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your actuarial opinion and memorandum form via URL. You can also download, print, or export forms to your preferred cloud storage service.

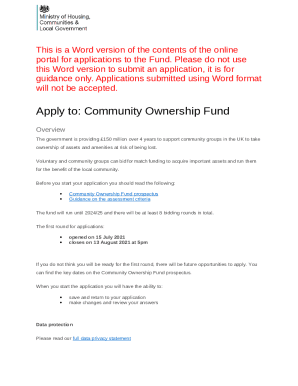

Editing actuarial opinion and memorandum online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit actuarial opinion and memorandum. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out actuarial opinion and memorandum

How to fill out Actuarial Opinion and Memorandum Regulation

01

Begin by gathering relevant data on the insurance company's financial position.

02

Analyze the company’s reserves and surplus to ensure they are adequate.

03

Prepare a clear and concise memorandum outlining the methods and assumptions used in the opinion.

04

Document all findings and conclusions in the memorandum.

05

Ensure that the opinion is signed by a qualified actuary.

06

Submit the original signed opinion and memorandum to the appropriate regulatory authority.

Who needs Actuarial Opinion and Memorandum Regulation?

01

Insurance companies that are required by state regulations to maintain solvency and meet reserve requirements.

02

Actuaries providing opinions are usually employed by the insurance company or contracted for their expertise.

Fill

form

: Try Risk Free

People Also Ask about

Is a Statement of Actuarial Opinion an sao?

An SAO is usually a written actuarial opinion, but it may also be conveyed by oral communication. The fact that an actuary's opinion is conveyed orally is not, in and of itself, evidence that the opinion is not an SAO.

What is a sao in insurance?

Because the financial statements of insurance companies are highly complex, and key issues and risk factors affecting their financial condition are not always readily apparent, insurance laws require that along with the financial state- ment, the insurance company must provide a “Statement of Actuarial Opinion” (SAO)

What is an actuary SOA?

An actuary is a professional expert on analyzing risk. Beyond crunching numbers, actuaries think three-dimensionally, using their knowledge of math, human behavior, and business realities to identify the likely real-world outcomes.

Can actuaries make $500,000 a year?

Very few actuaries earn mega bucks - eg 500k plus. Only via longevity and skill (and possibly sector- eg investment capital management, investment management ) would you get to that level.

What are actuarial guidelines?

ASOPs provide guidance on the techniques, applications, procedures, and methods that reflect appropriate actuarial practices in the United States.

What is a Statement of Actuarial Opinion?

The Statement of Actuarial Opinion must consist of an IDENTIFICATION paragraph identifying the Appointed Actuary; a SCOPE paragraph identifying the subjects on which an opinion is to be expressed and describing the scope of the actuary's work; an OPINION paragraph expressing his or her opinion with respect to such

What are the requirements for Statement of Actuarial Opinion?

The Statement of Actuarial Opinion must consist of an IDENTIFICATION paragraph identifying the Appointed Actuary; a SCOPE paragraph identifying the subjects on which an opinion is to be expressed and describing the scope of the actuary's work; an OPINION paragraph expressing his or her opinion with respect to such

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Actuarial Opinion and Memorandum Regulation?

Actuarial Opinion and Memorandum Regulation refers to a set of rules established by state insurance departments requiring actuaries to provide an opinion on the adequacy of reserves and surplus of an insurance company, as well as a detailed memorandum explaining the actuarial methodologies used.

Who is required to file Actuarial Opinion and Memorandum Regulation?

Insurance companies, particularly those licensed to write property and casualty insurance, are required to file an Actuarial Opinion and Memorandum. This obligation typically falls on the appointed actuary of the company.

How to fill out Actuarial Opinion and Memorandum Regulation?

To fill out the Actuarial Opinion and Memorandum Regulation, the actuary must use prescribed formats to document their opinion on the adequacy of reserves, detail the methodology and assumptions utilized, and ensure compliance with any applicable regulatory standards and guidelines.

What is the purpose of Actuarial Opinion and Memorandum Regulation?

The purpose of the Actuarial Opinion and Memorandum Regulation is to ensure that insurers maintain sufficient reserves to meet future policyholder obligations and to enhance the reliability and transparency of financial reporting in the insurance industry.

What information must be reported on Actuarial Opinion and Memorandum Regulation?

The Actuarial Opinion and Memorandum must include the actuary's opinion on the adequacy of reserves, a description of the actuarial methods employed, the data used in the analysis, assumptions made during calculations, and any qualifications or limitations regarding the opinion.

Fill out your actuarial opinion and memorandum online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Actuarial Opinion And Memorandum is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.