Get the free APPLICATION FOR CERTIFICATION OF EXEMPTION TO ISSUE GIFT ANNUITIES - nd

Show details

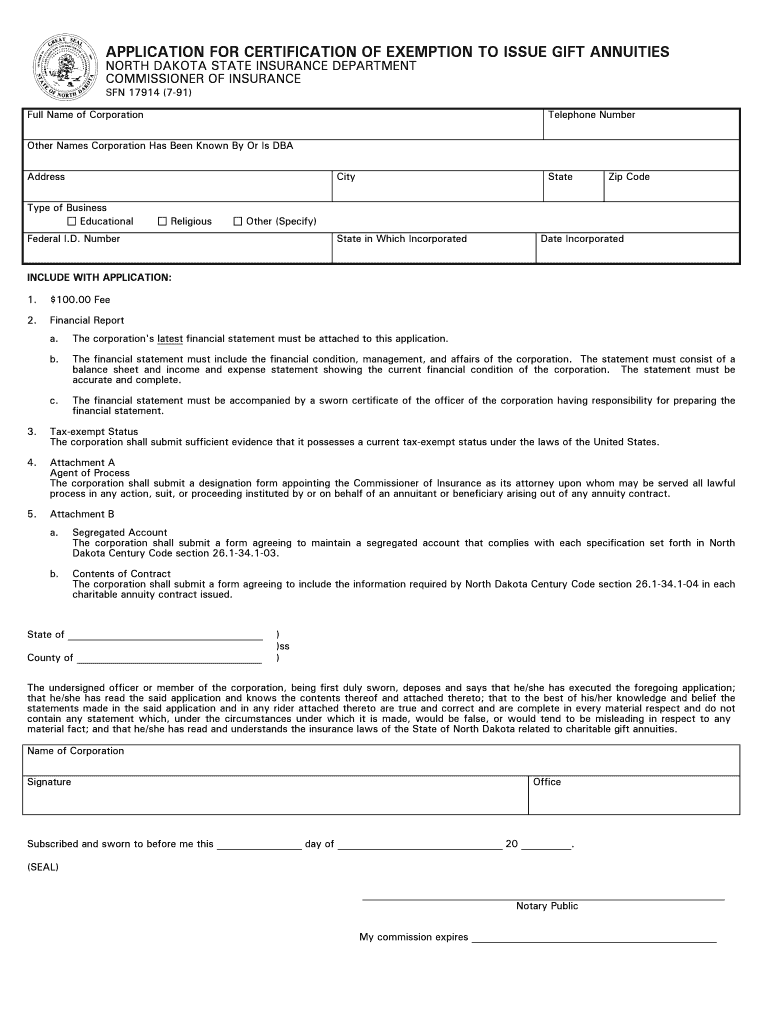

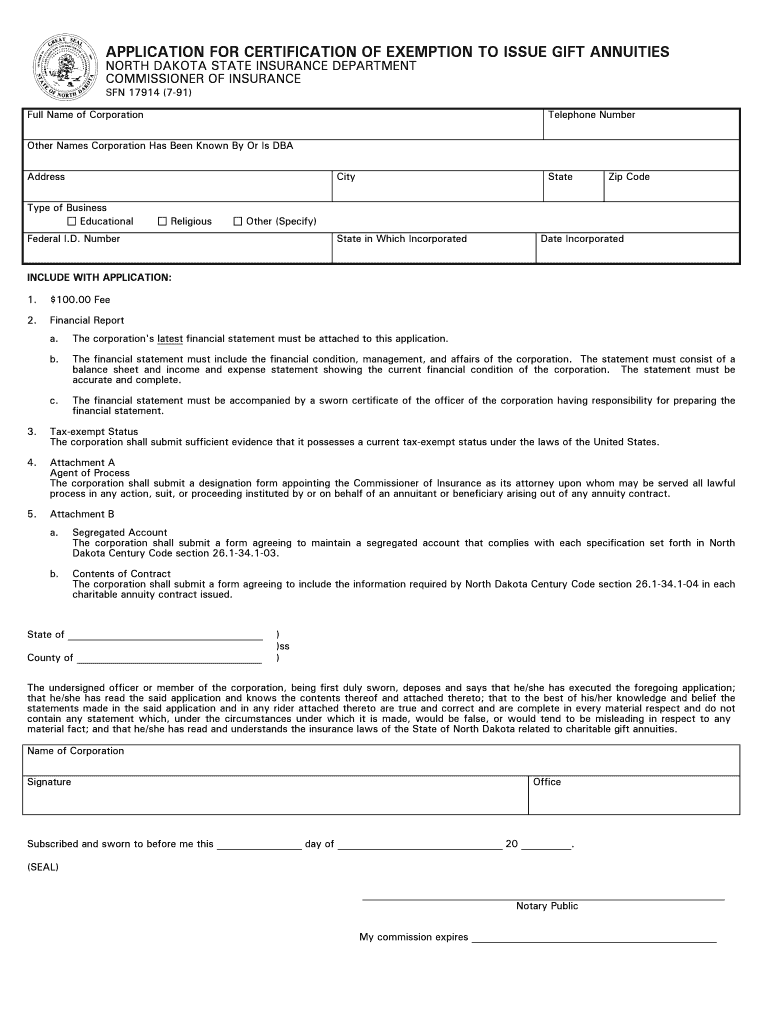

This document is an application to the North Dakota State Insurance Department for corporations seeking certification to issue gift annuities, detailing the requirements including a financial report

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign application for certification of

Edit your application for certification of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your application for certification of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing application for certification of online

Follow the steps down below to benefit from a competent PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit application for certification of. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out application for certification of

How to fill out APPLICATION FOR CERTIFICATION OF EXEMPTION TO ISSUE GIFT ANNUITIES

01

Obtain the APPLICATION FOR CERTIFICATION OF EXEMPTION TO ISSUE GIFT ANNUITIES form from the appropriate regulatory body.

02

Fill in your organization's legal name, address, and contact information in the designated fields.

03

Specify the type of organization (e.g., nonprofit, charity) and provide the organization's tax identification number.

04

Include details about the proposed gift annuity program, including the expected number of annuities and total anticipated contributions.

05

Attach financial statements or supporting documentation that demonstrate the organization's ability to fulfill its obligations under the gift annuities.

06

Review the completed application for accuracy and completeness.

07

Sign and date the application as required.

08

Submit the application along with any required fees to the appropriate regulatory agency.

Who needs APPLICATION FOR CERTIFICATION OF EXEMPTION TO ISSUE GIFT ANNUITIES?

01

Organizations that wish to issue gift annuities as part of their fundraising efforts, typically nonprofits or charities.

Fill

form

: Try Risk Free

People Also Ask about

Can I give an annuity as a gift?

Types of Annuities That Can Be Gifted Several types of gift annuities can be gifted, each with its own set of rules and benefits. One such option is charitable gift annuities, which provide a unique way to support a cause while receiving financial benefits.

Do you pay taxes on a charitable gift annuity?

Each payment is partially tax-free for a number of years, a period measured by the donor's life expectancy. After that period, the entire payment will be treated as ordinary income to the donor.

What is required for a charitable gift annuity?

To qualify, applying charities must have been in continuous operation for 10 years and must maintain a segregated reserve fund in trust for California annuitants only that is both legally and physically separated from the charity's other accounts and assets.

Is a gift annuity included in your gross estate?

The donor's revocation power is a "string" that pulls the annuity back into his gross estate at death. The present value of the remaining payments under the annuity is the amount includible.

How to report a charitable gift annuity on a tax return?

The charity that issues the annuity will send a Form 1099-R to the annuitant. This form will specify how the payments should be reported for income tax purposes.

How to report charitable gift annuity?

The charity that issues the annuity will send a Form 1099-R to the annuitant. This form will specify how the payments should be reported for income tax purposes.

What is the difference between an annuity and a charitable gift annuity?

Compared to a traditional, non-charitable annuity, though, rates of return may be lower because the primary purpose of a charitable gift annuity is to benefit the charity. This is a consideration for anyone thinking about how to best balance their charitable goals with their financial plans.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is APPLICATION FOR CERTIFICATION OF EXEMPTION TO ISSUE GIFT ANNUITIES?

The APPLICATION FOR CERTIFICATION OF EXEMPTION TO ISSUE GIFT ANNUITIES is a formal request submitted to obtain legal permission for an organization to issue charitable gift annuities, which are financial products that provide fixed payments to beneficiaries in exchange for a donation.

Who is required to file APPLICATION FOR CERTIFICATION OF EXEMPTION TO ISSUE GIFT ANNUITIES?

Non-profit organizations seeking to offer gift annuities to donors are required to file the APPLICATION FOR CERTIFICATION OF EXEMPTION. This typically includes charities and other eligible entities that aim to provide charitable gift annuities as part of their fundraising strategies.

How to fill out APPLICATION FOR CERTIFICATION OF EXEMPTION TO ISSUE GIFT ANNUITIES?

To fill out the APPLICATION FOR CERTIFICATION OF EXEMPTION, organizations must provide detailed information about their structure, financial condition, and compliance with state regulations. They may need to include their financial statements, organizational bylaws, and a description of their programs.

What is the purpose of APPLICATION FOR CERTIFICATION OF EXEMPTION TO ISSUE GIFT ANNUITIES?

The purpose of the APPLICATION FOR CERTIFICATION OF EXEMPTION is to ensure that organizations are qualified and capable of responsibly managing gift annuity arrangements, protecting both the donors and the integrity of the charitable funds.

What information must be reported on APPLICATION FOR CERTIFICATION OF EXEMPTION TO ISSUE GIFT ANNUITIES?

The application must report key information including the organization's mission, financial health, governance structure, projected annuity payouts, and the intended use of the funds raised through the gift annuities.

Fill out your application for certification of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Application For Certification Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.