Get the free Waiver of Insurance Coverage - nd

Show details

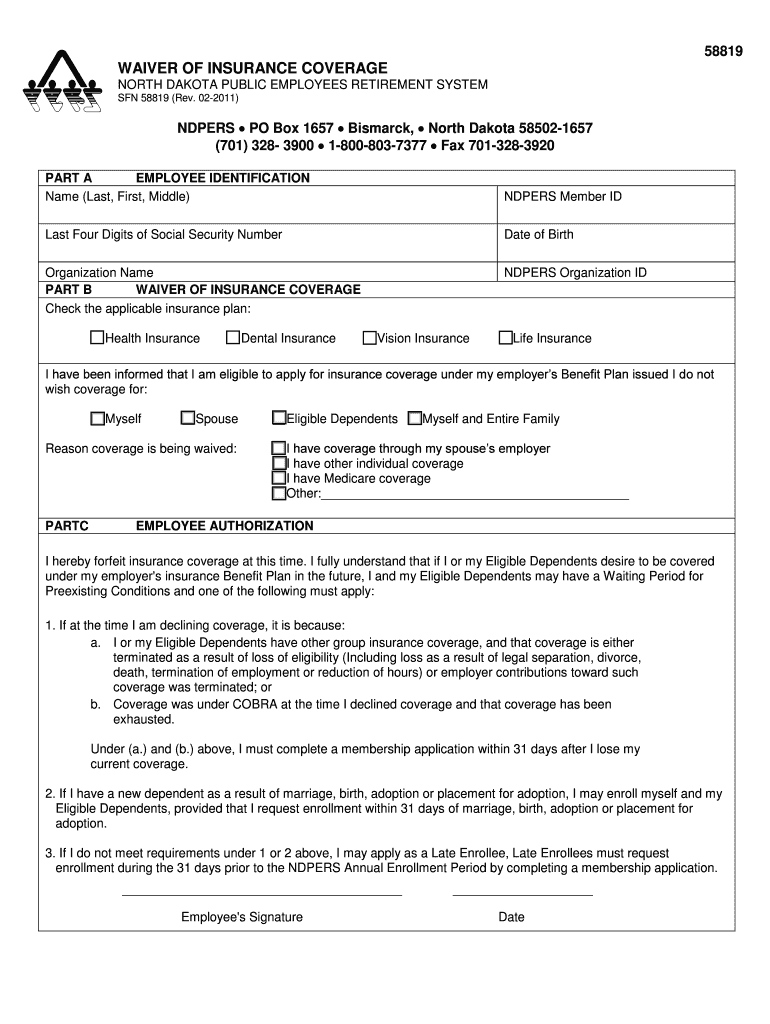

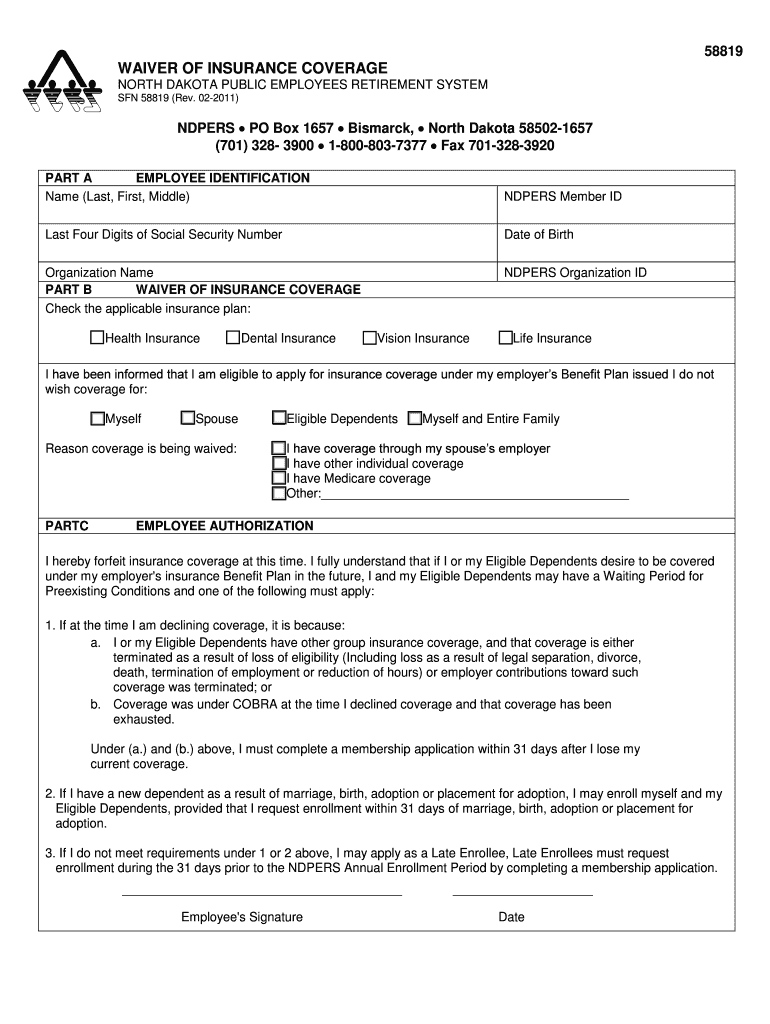

This document serves as a waiver form for employees of the North Dakota Public Employees Retirement System to waive insurance coverage such as health, dental, vision, or life insurance under the employer's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign waiver of insurance coverage

Edit your waiver of insurance coverage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your waiver of insurance coverage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing waiver of insurance coverage online

Follow the steps below to take advantage of the professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit waiver of insurance coverage. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out waiver of insurance coverage

How to fill out Waiver of Insurance Coverage

01

Obtain the Waiver of Insurance Coverage form from the relevant authority or company.

02

Read the instructions carefully to understand the conditions and requirements.

03

Fill in your personal information, including your name, address, and contact details.

04

Indicate the specific insurance coverage you are waiving.

05

Sign and date the form to confirm your agreement to waive the coverage.

06

Submit the completed form to the designated office or email it as instructed.

Who needs Waiver of Insurance Coverage?

01

Individuals who are currently covered by their own insurance policies.

02

Employees who are offered group insurance through their employer but choose not to participate.

03

Students who have private health insurance and are exempt from school or university health plans.

04

Individuals participating in activities or events that allow for insurance waivers.

Fill

form

: Try Risk Free

People Also Ask about

What does it mean to waive insurance coverage?

When an employee doesn't want health insurance from their employer, they waive coverage. Or, employees can waive coverage on behalf of a family member who was previously under their plan. A waiver of coverage is a form employees sign to opt-out of insurance.

What is the purpose of a waiver?

The basic purpose of a waiver form is to shield a business from liability and risk. While no one is ever required to sign off a waiver form, businesses may refuse service if all parties do not sign off on the waiver form.

How do you write a simple waiver?

Key Takeaways On How To Write A Waiver Choose a waiver template. Determine the type of activity or service. State the purpose of the waiver. Identify the risks. Include a title. Include customer information. Include waiver terms. Include a statement of understanding.

What is the meaning of waiver in insurance?

Insurance waivers allow individuals to decline specific coverage based on existing protection or personal choice. Understanding waiver implications helps make informed insurance decisions.

What is a simple example of a waiver?

Examples of waivers include the waiving of parental rights, waiving liability, tangible goods waivers, and waivers for grounds of inadmissibility. Waivers are common when finalizing lawsuits, as one party does not want the other pursuing them after a settlement is transferred.

What is an example of a waiver?

Examples of waivers include the waiving of parental rights, waiving liability, tangible goods waivers, and waivers for grounds of inadmissibility. Waivers are common when finalizing lawsuits, as one party does not want the other pursuing them after a settlement is transferred.

What is the meaning of waiver in simple words?

1. : the act of intentionally relinquishing or abandoning a known right, claim, or privilege. also : the legal instrument evidencing such an act. 2.

What is an example of a waiver statement?

I understand and confirm that by signing this WAIVER AND RELEASE I have given up considerable future legal rights. I have signed this WAIVER AND RELEASE freely, voluntarily, under no duress or threat of duress, without inducement, promise, or guarantee being communicated to me.

How do I write an insurance waiver?

To build a waiver of liability: Choose a waiver template. Determine the type of activity or service. State the purpose of the waiver. Identify the risks. Include a title. Include customer information. Include waiver terms. Include a statement of understanding.

How to write a formal letter of waiver?

Waiver letters are usually brief and limited to two or three paragraphs. Stick to the facts. Don't exaggerate the reasons why you require the waiver or dramatize your situation. Include evidence that supports your reasons for requesting a waiver such as names, dates or anything else that backs up what you say.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Waiver of Insurance Coverage?

A Waiver of Insurance Coverage is a formal document in which an individual or entity relinquishes their right to insurance coverage for certain risks or specifies that they do not wish to maintain certain types of insurance.

Who is required to file Waiver of Insurance Coverage?

Typically, individuals or businesses that opt out of certain insurance coverage, such as liability insurance, when it is not mandated by law or contractual obligations are required to file a Waiver of Insurance Coverage.

How to fill out Waiver of Insurance Coverage?

To fill out a Waiver of Insurance Coverage, one must provide personal or business information, specify the coverage being waived, acknowledge understanding of the risks involved, and sign the document to confirm the waiver.

What is the purpose of Waiver of Insurance Coverage?

The purpose of a Waiver of Insurance Coverage is to document an individual's or entity's decision to forgo insurance coverage for specific risks, protecting the insurer from potential liability claims related to those risks.

What information must be reported on Waiver of Insurance Coverage?

The Waiver of Insurance Coverage must typically include the name and contact information of the individual or entity waiving coverage, details of the specific coverage being waived, acknowledgment of the risks, and the date and signature of the individual or authorized representative.

Fill out your waiver of insurance coverage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Waiver Of Insurance Coverage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.