Get the free 401-UT - nd

Show details

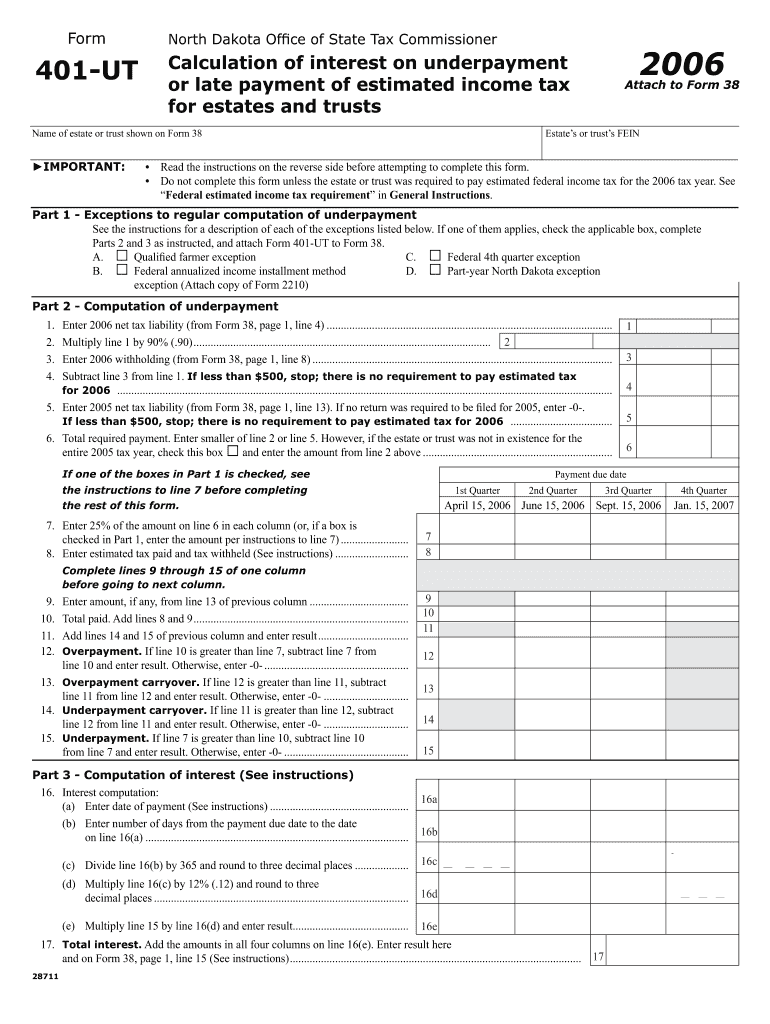

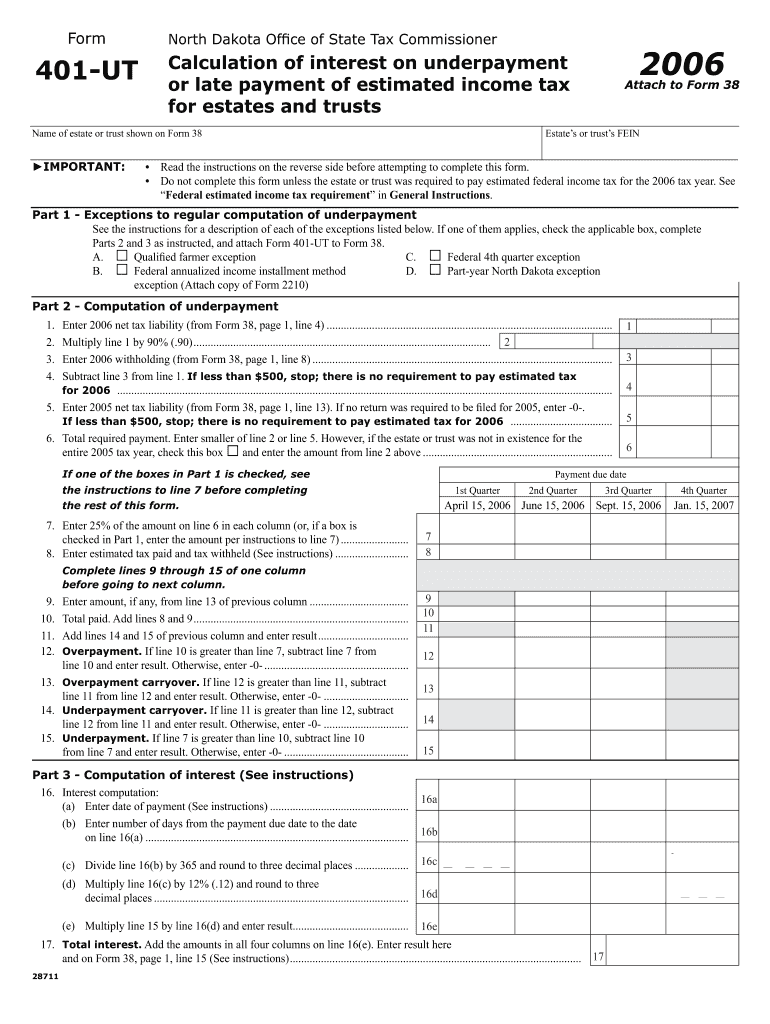

This form is used by fiduciaries of estates or trusts to determine if enough estimated North Dakota income tax was paid by payment due dates and to calculate interest due on underpayments or late

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 401-ut - nd

Edit your 401-ut - nd form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 401-ut - nd form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 401-ut - nd online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit 401-ut - nd. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, dealing with documents is always straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 401-ut - nd

How to fill out 401-UT

01

Gather required information like your identification details.

02

Obtain a copy of form 401-UT from the relevant tax authority website.

03

Read the instructions carefully to understand each section of the form.

04

Fill out your personal information, including name, address, and Social Security number.

05

Input relevant financial information as required by the form.

06

Double-check all entries for accuracy and completeness.

07

Sign and date the form.

08

Submit the completed form to the appropriate tax agency by the deadline.

Who needs 401-UT?

01

Individuals or entities that need to report specific tax information.

02

Taxpayers who have income that requires reporting for state tax purposes.

03

People claiming certain tax credits or exemptions.

Fill

form

: Try Risk Free

People Also Ask about

What is UT Austin known for academically?

Minimum scores acceptable for admission are: TOEFL: 79 (internet-based test) IELTS: An overall band of 6.5 on the Academic Examination.

What is the English proficiency for UT Austin?

University of Texas--Austin is ranked No. 6 (tie) out of 255 in Best Education Schools. Schools were assessed on their performance across a set of widely accepted indicators of excellence.

What is the English language requirement for UT Austin?

TOEFL: 79 (internet-based test) IELTS: An overall band of 6.5 on the Academic Examination.

Does UT have a good English program?

UT Austin English Language & Literature Rankings It is also ranked #1 in Texas.

What is English 94?

English 094 develops the reading and writing skills needed to be successful further academic work or in the workplace, including the rhetorical principles and compositional practices necessary for writing effective business letters, memos, resumes, instructions, proposals, annotated bibliographies, and reports.

Does UT have a good teaching program?

That said, based on historical trend, the College of Liberal Arts and the College of Education at UT Austin often have higher acceptance rates compared to highly selective ones like McCombs School of Business or Cockrell School of Engineering.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 401-UT?

401-UT is a tax form used for reporting uncollected taxes on certain transactions and activities, often related to the use tax liability.

Who is required to file 401-UT?

Businesses and individuals who have incurred uncollected use taxes from purchases without sales tax must file 401-UT.

How to fill out 401-UT?

To fill out 401-UT, taxpayers must provide their identifying information, details of purchases subject to use tax, and calculate the total tax owed based on applicable rates.

What is the purpose of 401-UT?

The purpose of 401-UT is to report and remit uncollected use taxes to ensure compliance with tax regulations and to fund public services.

What information must be reported on 401-UT?

The information that must be reported on 401-UT includes the taxpayer’s identification, total purchases, amount of use tax owed, and any applicable exemptions.

Fill out your 401-ut - nd online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

401-Ut - Nd is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.