Get the free North Dakota Financial Institution Tax Payment Voucher 2008 - nd

Show details

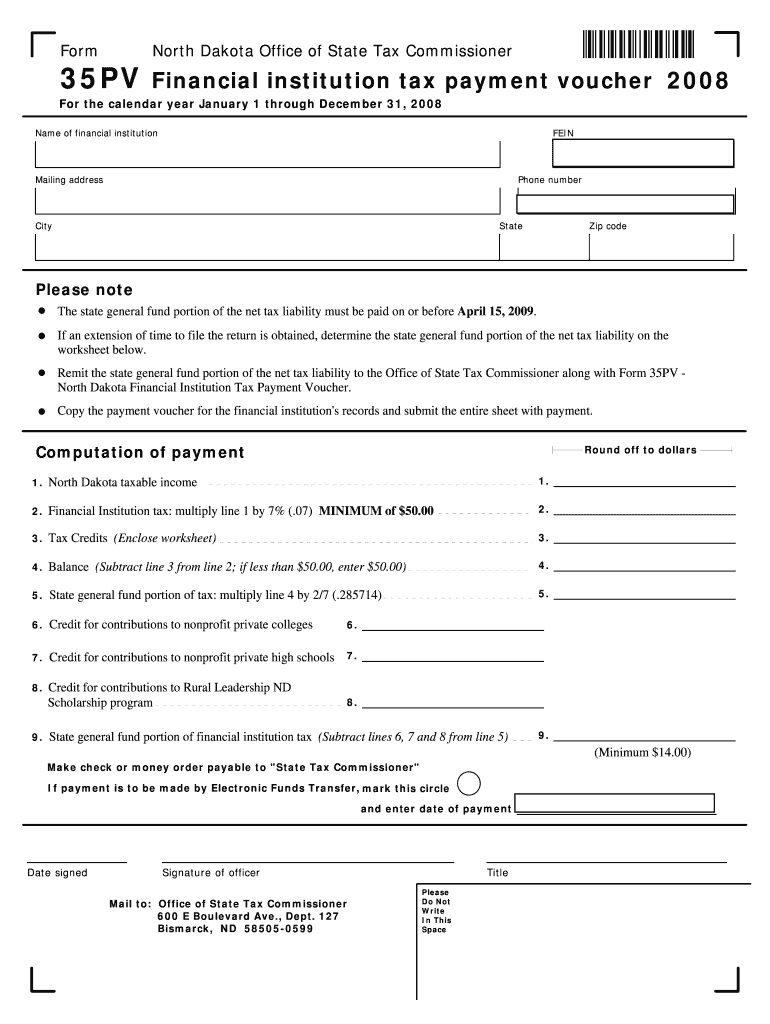

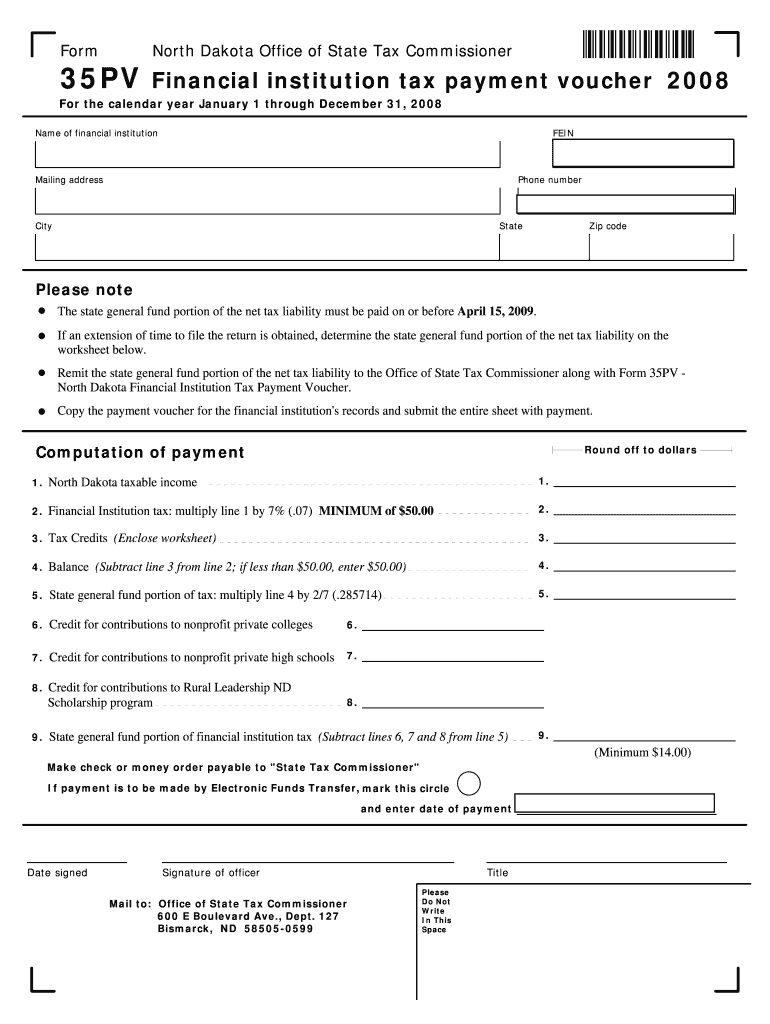

This document serves as a tax payment voucher for financial institutions to report and remit state taxes for the year 2008, including computation of taxable income and applicable tax credits.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign north dakota financial institution

Edit your north dakota financial institution form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your north dakota financial institution form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing north dakota financial institution online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit north dakota financial institution. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out north dakota financial institution

How to fill out North Dakota Financial Institution Tax Payment Voucher 2008

01

Obtain the North Dakota Financial Institution Tax Payment Voucher 2008 form from the North Dakota Office of State Tax Commissioner website or relevant office.

02

Enter your financial institution's name, address, and contact information at the top of the form.

03

Fill in the tax period for which you are making the payment in the designated section.

04

Calculate the total amount of tax due for the specified period according to the guidelines provided.

05

Include any applicable penalties or interest if payment is being made after the due date.

06

Sign and date the voucher in the designated area to certify the accuracy of the information provided.

07

Make sure to keep a copy of the completed voucher for your records.

08

Submit the payment voucher along with your payment to the address specified on the form.

Who needs North Dakota Financial Institution Tax Payment Voucher 2008?

01

Any financial institution operating in North Dakota that is required to report and pay the financial institution tax.

02

Organizations conducting business activities within the state that fall under the regulations governing financial institutions.

Fill

form

: Try Risk Free

People Also Ask about

Is there a tax credit for a stillborn baby?

To qualify for the Birth of a Stillborn Child Tax Credit you need to meet the following requirements: your stillborn child would have been a dependent on your federal tax return, your stillbirth certificate was issued by the State Vital Records Office of the Department of Public Health during 2024.

Who is eligible for the North Dakota tax credit?

To be eligible for the credit, you must own a home (house, mobile home, town home, duplex, or condo) in North Dakota, and reside in it as your primary residence. There are No Age Restrictions or Income Limitations for this credit. Only one Primary Residence Credit is available per household.

Is the stillborn child deduction in North Dakota?

Line 8 - Stillborn child deduction This deduction is allowed only if a Fetal Death Record was filed with the North Dakota Division of Vital Records. You would have been eligible to claim the child as a dependent on your 2024 federal income tax return if the child had been born alive.

Does North Dakota accept federal extensions?

You may have extended time to file your North Dakota individual, corporation, S corporation, partnership, or fiduciary income tax return by receiving a federal extension or a North Dakota extension.

How does the new tax credit work?

Nonrefundable tax credits reduce your tax liability by the corresponding credit amount. In other words, if you qualify for a $500 nonrefundable credit, your taxes owed are reduced by $500. Once you zero out your taxes owed, though, you won't get any overage of the unused tax credit back as a refund.

Is North Dakota getting a credit for taxes paid to another state?

The credit for taxes paid to another state is automatically calculated in your account when you add a Nonresident return to your already created resident or part-year resident North Dakota return if you pay taxes to both North Dakota and another state.

What is the stillborn credit in North Dakota?

Senate Bill 414 allows a parent of a stillborn child a refundable credit of $1,000 against the State income tax for each birth for which a certain certificate of birth resulting in stillbirth or a certificate of fetal death has been issued; and applying the Act to taxable years beginning after December 31, 2025.

How to pay North Dakota taxes online?

North Dakota State Tax Payment Options. Description:Go to OKTAP to submit your payment. Click on "Make an Electronic Payment", "Identify by Entering Information", then follow the on screen prompt. Make sure to select "Individual", and "Individual Income Tax" as your ownership, and account type.

What does tax relief credit mean on transcript?

Definition and Significance If you see IRS Code 766 on your tax transcript, it means that you have a credit on your account. This credit may be the result of a refund, an overpayment from a previous year, or a credit from the current year's return. In any case, it means that your tax liability has been reduced.

What is the North Dakota tax Relief credit?

The bill more than triples the state's existing primary residence property tax credit from $500 per year to $1,600 per year. A dedicated stream of earnings from the state's $12 billion Legacy Fund will pay for the relief, estimated at $409 million in the 2025-2027 biennium.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is North Dakota Financial Institution Tax Payment Voucher 2008?

The North Dakota Financial Institution Tax Payment Voucher 2008 is a form used by financial institutions to remit their tax payments to the state of North Dakota for the 2008 tax year.

Who is required to file North Dakota Financial Institution Tax Payment Voucher 2008?

Financial institutions operating in North Dakota that are subject to the financial institution tax are required to file the North Dakota Financial Institution Tax Payment Voucher 2008.

How to fill out North Dakota Financial Institution Tax Payment Voucher 2008?

To fill out the voucher, provide the necessary financial information, including the institution's name, address, tax identification number, and the amount of tax due, and ensure all sections are completed accurately before submission.

What is the purpose of North Dakota Financial Institution Tax Payment Voucher 2008?

The purpose of the North Dakota Financial Institution Tax Payment Voucher 2008 is to facilitate the payment of the financial institution tax to the state, ensuring compliance with state tax regulations.

What information must be reported on North Dakota Financial Institution Tax Payment Voucher 2008?

The information that must be reported includes the institution's name, address, tax identification number, the total amount of tax owed, and any other relevant financial data as required by the form.

Fill out your north dakota financial institution online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

North Dakota Financial Institution is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.