Get the free Motor Fuel Tax Bond

Show details

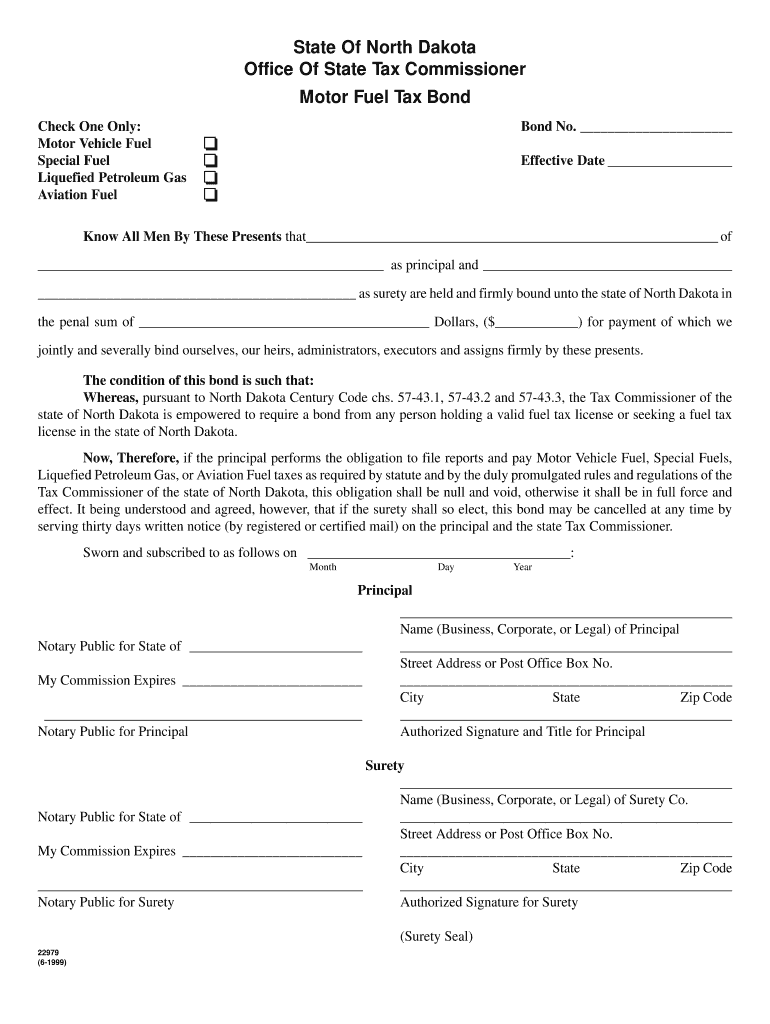

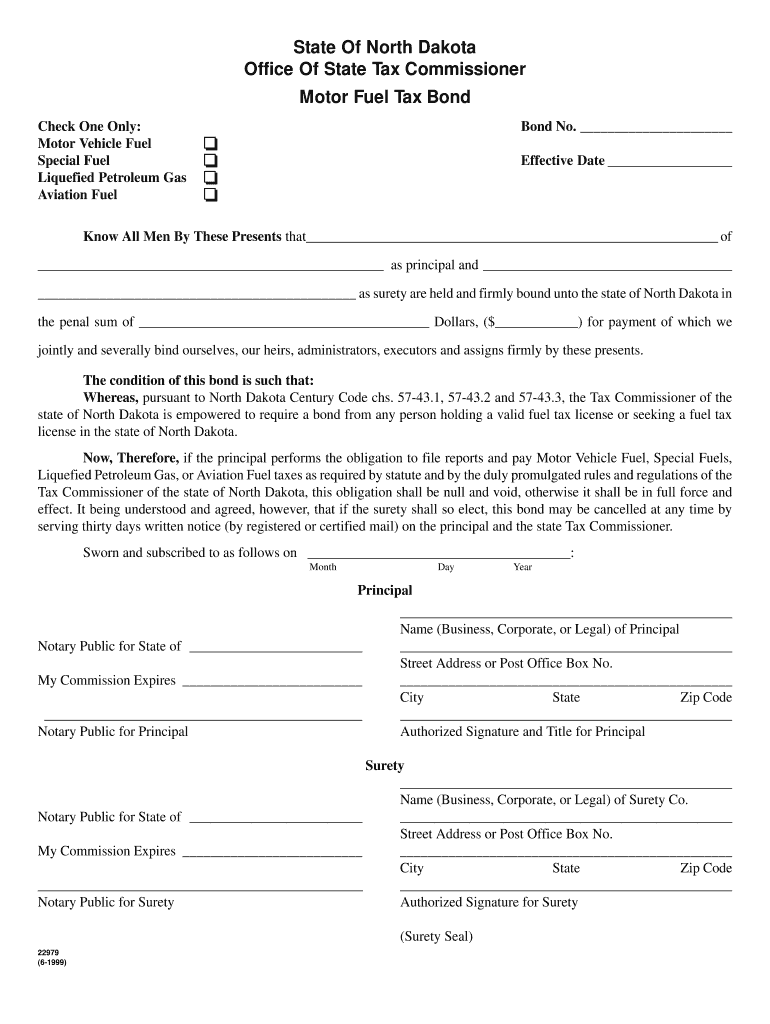

This document serves as a bond application for individuals or entities seeking to hold a valid fuel tax license in North Dakota, ensuring compliance with tax obligations for various fuel types.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign motor fuel tax bond

Edit your motor fuel tax bond form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your motor fuel tax bond form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit motor fuel tax bond online

Follow the steps below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit motor fuel tax bond. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out motor fuel tax bond

How to fill out Motor Fuel Tax Bond

01

Obtain a Motor Fuel Tax Bond form from your state tax agency or website.

02

Fill in your personal or business information as required, including your name, address, and tax ID number.

03

Specify the bond amount needed, which is typically determined by your estimated fuel tax liability.

04

Provide details about the type of motor fuel you will be distributing or selling.

05

Sign and date the form to validate your application.

06

Attach any required documents, such as proof of insurance or business registration.

07

Submit the completed form and documents to the appropriate state agency, either by mail or electronically.

Who needs Motor Fuel Tax Bond?

01

Fuel distributors and suppliers who sell motor fuel.

02

Retailers who operate gas stations and sell fuel to consumers.

03

Businesses that are required to pay motor fuel taxes in the state where they operate.

Fill

form

: Try Risk Free

People Also Ask about

What is motor fuel tax?

How do state and local motor fuel taxes work? Motor fuel taxes are taxes levied on gasoline, diesel, and gasohol (a mixture of ethanol and unleaded gasoline). State and local governments collected a combined $53 billion in revenue from motor fuel taxes in 2021.

How much does a $5000 tax preparer bond cost?

How Much Does a $5,000 California Tax Preparer Bond Cost? CTEC tax preparer bonds cost $20 to $27.50 per year, depending on your term length. These bonds are issued instantly online with no credit check required, meaning you are pre-approved at a flat rate.

Who qualifies for fuel tax credit?

The credit is available only for nontaxable uses of gasoline, aviation gasoline, undyed diesel and undyed kerosene. Nontaxable uses are purposes where fuel isn't used for regular driving purposes, such as: On a farm for farming purposes.

What does tax bond mean?

For anyone asking themselves "What is a tax bond?," it's a financial guarantee bond that offers security for a business that will automatically cover all of the various sales taxes that are owed on a state and federal level.

What is a fuel bond?

Taxable fuel bonds protect the state and the public if a fuel seller does not comply with industry regulations. Maintaining a surety bond is a license requirement in every state. It guarantees fuel sellers will pay all taxes, penalties and interest owed to the government.

Who qualifies for fuel tax credit?

The credit is available only for nontaxable uses of gasoline, aviation gasoline, undyed diesel and undyed kerosene. Nontaxable uses are purposes where fuel isn't used for regular driving purposes, such as: On a farm for farming purposes.

What is the motor fuel tax in NY?

motor fuel excise tax (8 cents) and petroleum testing fee (0.05 cents)—8.05 cents; CNG and E85—0.05 cents; highway diesel motor fuel—8.0 cents; highway B20—6.4 cents; and.

What is a fuel tax bond?

Fuel tax bonds ensure that fuel sellers pay all taxes, interest, and penalties they owe the state. It's a type of license bond required as part of the licensing process for those wanting to sell fuel. These bonds are three-party agreements between a principal, an obligee, and a surety.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Motor Fuel Tax Bond?

A Motor Fuel Tax Bond is a type of surety bond that ensures compliance with state fuel tax regulations. It acts as a guarantee that fuel tax will be paid by businesses involved in the distribution or sale of motor fuel.

Who is required to file Motor Fuel Tax Bond?

Businesses and individuals who are involved in the production, distribution, or sale of motor fuel and are subject to state fuel tax regulations are required to file a Motor Fuel Tax Bond.

How to fill out Motor Fuel Tax Bond?

To fill out a Motor Fuel Tax Bond, one must complete a bond application that includes the business name, address, and the specific amount of the bond. The applicant must also provide their tax identification number and details about their fuel operations.

What is the purpose of Motor Fuel Tax Bond?

The purpose of a Motor Fuel Tax Bond is to protect the state and the public by ensuring that tax obligations associated with motor fuel sales and distribution are met and fulfilled.

What information must be reported on Motor Fuel Tax Bond?

The information that must be reported on a Motor Fuel Tax Bond includes the bond amount, the name and address of the principal (business), the surety company's information, and the specific state laws or regulations being complied with.

Fill out your motor fuel tax bond online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Motor Fuel Tax Bond is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.