Get the free Schedule NR - Nonresident Filers - nd

Show details

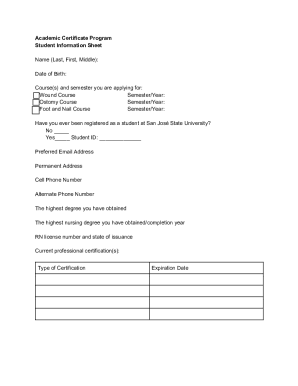

This schedule is used by nonresidents of North Dakota to report their income and adjustments for state tax purposes. It helps in determining the portion of federal adjusted gross income that is reportable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schedule nr - nonresident

Edit your schedule nr - nonresident form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schedule nr - nonresident form via URL. You can also download, print, or export forms to your preferred cloud storage service.

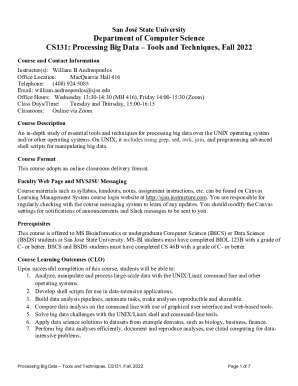

How to edit schedule nr - nonresident online

To use the services of a skilled PDF editor, follow these steps below:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit schedule nr - nonresident. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schedule nr - nonresident

How to fill out Schedule NR - Nonresident Filers

01

Obtain Schedule NR from the tax authority's website or request a copy.

02

Fill in your personal information at the top of the form including your name, address, and identification number.

03

Report your U.S. income for the tax year, specifying the source of income.

04

List any deductions or exemptions you are eligible for as a nonresident filer.

05

Calculate your taxable income by subtracting your deductions from your total U.S. income.

06

Determine your tax liability based on the applicable nonresident tax rates.

07

Complete any additional sections relevant to your specific situation.

08

Review your filled-out Schedule NR for accuracy.

09

Submit the completed Schedule NR along with your main tax return by the due date.

Who needs Schedule NR - Nonresident Filers?

01

Nonresident individuals who earn income from U.S. sources.

02

Foreign nationals who are required to report and pay taxes on U.S. income.

03

Individuals who do not meet the residency requirements for filing as a resident but have taxable income in the U.S.

Fill

form

: Try Risk Free

People Also Ask about

What is the 90% rule for non-residents?

Here's how it works: If 90% or more of your worldwide income for the tax year comes from Canadian sources, you may be eligible for the basic personal amount (the most common non-refundable tax credit) and other credits that residents are typically entitled to.

What does form filed nr mean?

IRS Form 1040-NR—non-resident alien income tax return for individuals, partnerships, estates, and trusts. Note: If you (and your spouse or, if you're a dependent student, your parents) filed or will file a 2022 tax return directly with a U.S. territory, you should answer “no” to this question.

How are non-resident US citizens taxed?

Tax treatment of nonresident alien If you are not engaged in a trade or business, the payment of U.S. source income that is fixed, determinable, annual, or periodical is taxed at a flat 30 percent (or lower treaty rate) and no deductions are allowed against such income.

What is the penalty for filing 1040-NR?

Penalties for Failure to File IRS Form 1040NR You may be subject to the failure to file penalty and the failure to pay penalty. Both penalties impose a fine that's 5% of your unpaid taxes, up to 25%.

What does nr mean on a tax return?

You MUST File Form 1040-NR if: You were a nonresident alien engaged in a trade or business in the U.S. during 2023, even if: You had no income from that business. You had no U.S. source income. Your income is exempt under a tax treaty or a section of the Internal Revenue Code.

How do you file taxes in a state you don't live in?

For your non-resident state, you'll typically file a return to report and pay taxes on income earned there. For your resident state, file a return reporting all income earned that year, regardless of where it was earned. Most states offer tax credits, so you aren't taxed twice on the same income.

Can I use TurboTax if I am non-resident?

If you are a nonresident, you can use the Sprintax software to prepare your tax forms. You can't use TurboTax or other tax software designed for residents! Sprintax will generate your tax return and allow you to file it electronically.

How do I file a non resident tax return?

When you prepare your U.S. tax return, you'll use Form 1040NR. Regardless of the form you use, you will only report amounts that are considered US-source income. Just like resident aliens and U.S. citizens, there are deductions and credits you can claim to reduce your taxable income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schedule NR - Nonresident Filers?

Schedule NR - Nonresident Filers is a tax form used by nonresident individuals who need to report income derived from sources within a specific jurisdiction, typically for state or local tax purposes.

Who is required to file Schedule NR - Nonresident Filers?

Nonresident individuals who earn income from sources within the jurisdiction, including wages, business income, or other types of income, are required to file Schedule NR.

How to fill out Schedule NR - Nonresident Filers?

To fill out Schedule NR, individuals must provide their personal information, details about the income earned in the jurisdiction, applicable deductions, and calculate their tax liability based on the nonresident tax rates.

What is the purpose of Schedule NR - Nonresident Filers?

The purpose of Schedule NR is to ensure that nonresident individuals accurately report and pay taxes on income earned within the jurisdiction, even though they may not reside there.

What information must be reported on Schedule NR - Nonresident Filers?

Information that must be reported includes personal identification details, types and amounts of income earned within the jurisdiction, any deductions claimed, and the total tax liability calculated.

Fill out your schedule nr - nonresident online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schedule Nr - Nonresident is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.