Get the free STREAMLINED SALES TAX COMPLIANCE CHECKLIST - nd

Show details

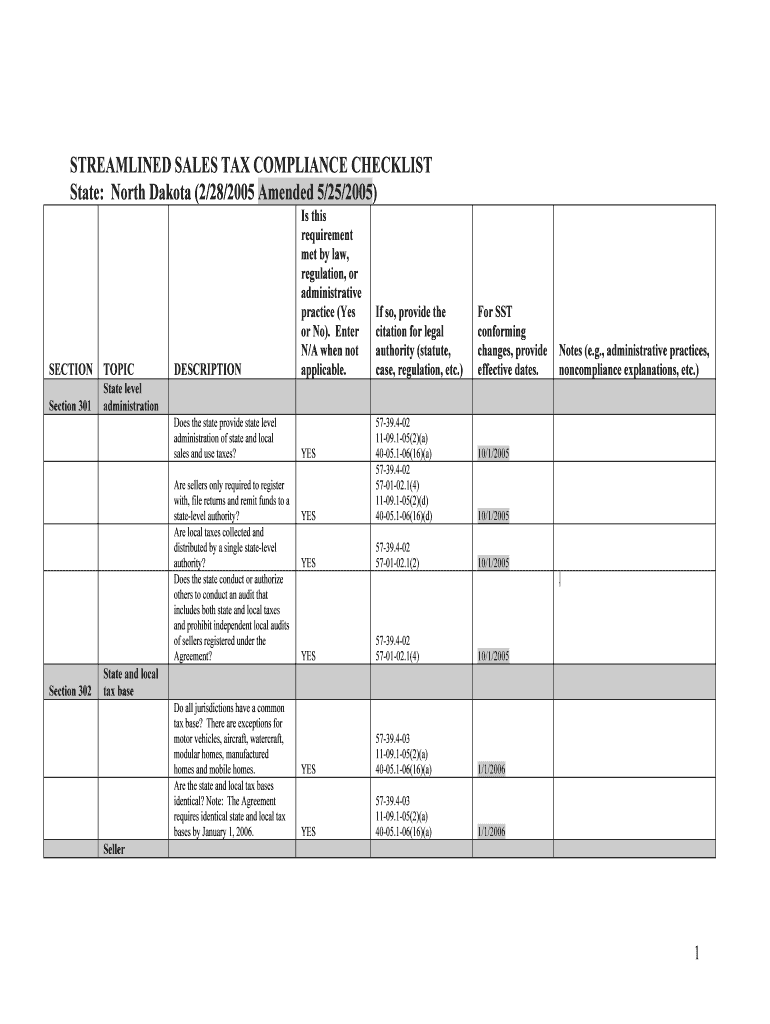

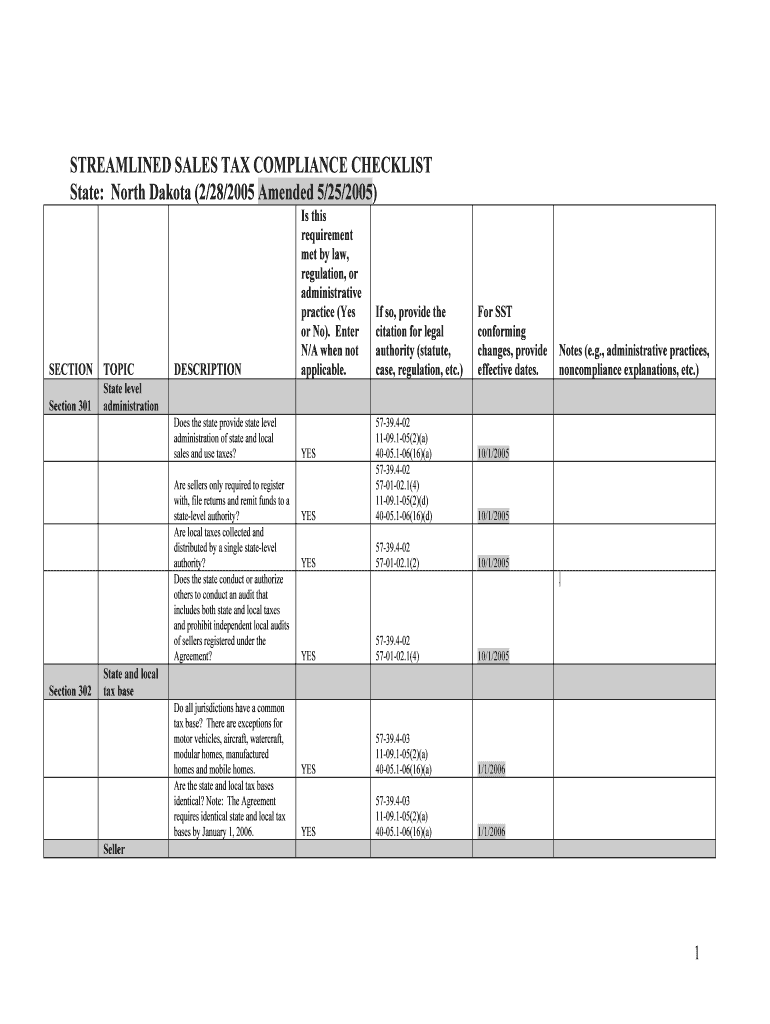

This document outlines the compliance requirements and administrative practices related to sales and use taxes in North Dakota, including sections on state-level administration, registration, tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign streamlined sales tax compliance

Edit your streamlined sales tax compliance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your streamlined sales tax compliance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing streamlined sales tax compliance online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit streamlined sales tax compliance. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out streamlined sales tax compliance

How to fill out STREAMLINED SALES TAX COMPLIANCE CHECKLIST

01

Gather all relevant sales tax documentation and records.

02

Identify the states where you conduct business and are required to collect sales tax.

03

Review the sales tax rates for each state applicable to your products or services.

04

Check your business's registration status with each state for sales tax purposes.

05

Ensure you have accurate records of sales transactions, including dates, amounts, and locations.

06

Complete the checklist by marking items off as you verify compliance with each requirement.

07

Submit the completed checklist and any required documentation to the appropriate state tax authorities.

Who needs STREAMLINED SALES TAX COMPLIANCE CHECKLIST?

01

Businesses selling goods or services that are subject to sales tax.

02

Online retailers operating in multiple states.

03

Companies looking to ensure compliance with sales tax laws in different jurisdictions.

04

Accountants and tax professionals assisting clients with sales tax compliance.

Fill

form

: Try Risk Free

People Also Ask about

What are the benefits of streamlined sales tax?

LEW or LOOP: Listed Elsewhere or Listed On Other Pages This is especially important if you're using the Marketplace functionality to cross-post your item to multiple groups.

What does SSTP stand for?

The SSUTA minimizes costs and administrative burdens on retailers that collect sales tax, particularly retailers operating in multiple states. It encourages "remote sellers" selling over the Internet and by mail order to collect tax on sales to customers living in the Streamlined Member States.

What does lew mean when selling something?

California: California's sales tax exemption certificates do not have a specific expiration period unless they are tied to temporary exemptions.

What is model 1 streamlined sales tax?

The Streamlined Sales Tax™ (SST) Model 1 program makes it easier for businesses to comply with the sales tax laws of a given jurisdiction by allowing them to outsource most compliance responsibilities to a Certified Service Provider™ (CSP).

What does Streamlined Sales Tax mean?

Streamlined Sales Tax is a national effort by state and local governments and the private sector to simplify and modernize sales and use tax collection and administration.

What are the three types of sales tax?

There are the three general types of sales taxes: Seller (vendor) privilege taxes. These taxes are imposed on retailers for the privilege of making retail sales in the state. Consumer excise (sales) taxes. A consumer sales tax is imposed on the person who makes retail purchases in the state. Retail transaction taxes.

What is a streamlined sales tax CSP?

A CSP is an agent certified under the Streamlined Sales and Use Tax Agreement to perform all the seller's sales and use tax functions, other than the seller's obligation to remit tax on its own purchases. A CSP is designed to allow a business to outsource most of its sales tax administration responsibilities.

How does streamlined sales tax work?

With few exceptions, a Streamlined Member State has one state sales and use tax rate and may have a second (generally lower) state rate for food and drugs. Each local jurisdiction has one local rate. For example, a state or local government may not choose to tax telecommunications services at 5% and clothing 3%.

What does sstp mean when selling?

SSTP is a property term for 'subject to planning permission' and means a property is being sold that you could extend in the form of an extension etc. Using 'subject to planning permission' would be used as a disclaimer by the selling agent in case planning permission is denied.

How many Streamlined Sales Tax states are there?

As of February 2017, there are 23 participating states in addition to Washington, D.C. Full member states are states that are "in compliance with the Streamlined Sales and Use Tax Agreement through its laws, rules, regulations, and policies".

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is STREAMLINED SALES TAX COMPLIANCE CHECKLIST?

The STREAMLINED SALES TAX COMPLIANCE CHECKLIST is a tool designed to help businesses comply with sales tax regulations in multiple states by providing a standardized way to report and assess their sales tax obligations.

Who is required to file STREAMLINED SALES TAX COMPLIANCE CHECKLIST?

Businesses that sell goods or services across multiple states and are seeking to simplistically manage their sales tax compliance obligations may be required to file the STREAMLINED SALES TAX COMPLIANCE CHECKLIST.

How to fill out STREAMLINED SALES TAX COMPLIANCE CHECKLIST?

To fill out the STREAMLINED SALES TAX COMPLIANCE CHECKLIST, businesses should gather necessary sales data, complete the checklist according to the specific guidelines provided, and ensure all required information is accurately reported before submitting it to the relevant state tax authorities.

What is the purpose of STREAMLINED SALES TAX COMPLIANCE CHECKLIST?

The purpose of the STREAMLINED SALES TAX COMPLIANCE CHECKLIST is to streamline the process of sales tax reporting, make it easier for businesses to comply with tax laws, and reduce the administrative burdens associated with managing sales tax across multiple states.

What information must be reported on STREAMLINED SALES TAX COMPLIANCE CHECKLIST?

The STREAMLINED SALES TAX COMPLIANCE CHECKLIST must report information such as total sales, taxable sales, sales tax collected, and details of exemptions claimed, along with any pertinent business identification information and local tax rates applicable.

Fill out your streamlined sales tax compliance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Streamlined Sales Tax Compliance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.