Get the free Grant Program Documentation of Donated Equipment Value - parkrec nd

Show details

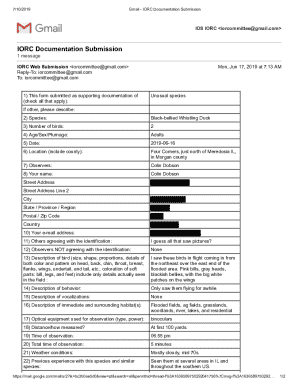

This form is used by project sponsors to document the value of equipment donated for approved grant work. It must be submitted with a Grant Program Reimbursement Request.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign grant program documentation of

Edit your grant program documentation of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your grant program documentation of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing grant program documentation of online

Follow the guidelines below to use a professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit grant program documentation of. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out grant program documentation of

How to fill out Grant Program Documentation of Donated Equipment Value

01

Gather all relevant documentation regarding the donated equipment.

02

Clearly identify each item of donated equipment, including descriptions, quantities, and serial numbers.

03

Determine the fair market value of each equipment item at the time of donation.

04

Include any appraisal documents if available to support the stated values.

05

Fill out the Grant Program Documentation form, ensuring all equipment details are accurately recorded.

06

Sign and date the documentation to certify its accuracy.

07

Submit the completed documentation according to the grant program guidelines.

Who needs Grant Program Documentation of Donated Equipment Value?

01

Organizations or nonprofits that receive donated equipment and wish to apply for grants utilizing that equipment.

02

Grant applicants who need to provide evidence of equipment value for funding purposes.

03

Anyone involved in the management of donated equipment for grant applications.

Fill

form

: Try Risk Free

People Also Ask about

How to record donated items?

When you make a donation of your own products or inventory, keep in mind that you are giving away a product, not selling it. To record this type of donation, debit your Donation account and credit your Purchases account for the original cost of goods.

How to determine the value of donated items for tax purposes?

There are multiple methods to determine FMV, including recent selling prices, comparable sales, replacement cost, and expert opinions.

How do you record donated equipment?

Proof can be provided in the form of an official receipt or invoice from the receiving qualified charitable organization, but it can also be provided via credit card statements or other financial records detailing the donation.

How to determine the value of donated items?

The company should record the received asset at its fair market value, which can be determined through an appraisal, the market rate on similar assets, or the net present value of the expected future cash flows generated by the asset.

How do you document donations?

Purpose: Grants are typically given for specific projects or initiatives, and recipients must use the funds for their intended purpose. Donations are more flexible and can be used for a variety of purposes, depending on the needs of the organization.

How do you record disposal of equipment?

Like any transaction, recording a donated asset requires making two entries. For a generalized donated asset transaction, use the following entries: Debit an asset account (cash, inventory, buildings, land, etc.) Credit "contribution revenue" (for a for-profit company) or "contributions" (for a nonprofit company).

What is the journal entry to record a donated asset?

Yes, businesses can take deductions for donating inventory! The FMV represents the price that the inventory would reasonably sell for on the open market. In most cases, businesses can deduct the FMV of the donated inventory, subject to certain limitations and qualifications outlined by the IRS.

How much can you deduct for donated items?

The cost basis for non-cash charitable contributions refers to the original value of the donated property at the time of acquisition by the donor. It is typically used to determine the amount of the charitable contribution and any potential tax benefits associated with the donation.

How to determine the fair market value of an item?

You may deduct charitable contributions of money or property made to qualified organizations if you itemize your deductions. Generally, you may deduct up to 50 percent of your adjusted gross income, but 20 percent and 30 percent limitations apply in some cases.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Grant Program Documentation of Donated Equipment Value?

Grant Program Documentation of Donated Equipment Value is a form or report that outlines the value of equipment donated to a grant recipient, serving as a record for both the donor and the receiving organization.

Who is required to file Grant Program Documentation of Donated Equipment Value?

Organizations or grant recipients that have received equipment donations and are utilizing those donations as part of their grant-funded projects are required to file this documentation.

How to fill out Grant Program Documentation of Donated Equipment Value?

To fill out the documentation, the recipient must provide details such as the donor's information, description of the donated equipment, its fair market value, the date of donation, and any relevant supporting documents.

What is the purpose of Grant Program Documentation of Donated Equipment Value?

The purpose is to ensure accurate reporting of donated equipment's value for compliance with grant requirements, to maintain transparency, and to provide accountability for the use of grant funds.

What information must be reported on Grant Program Documentation of Donated Equipment Value?

The information that must be reported includes the donor's name and contact information, a description of the equipment, its estimated fair market value at the time of donation, the date of donation, and any relevant agreements associated with the donation.

Fill out your grant program documentation of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Grant Program Documentation Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.