Get the free 2009 Annual Review of Depreciation Certification - psc nd

Show details

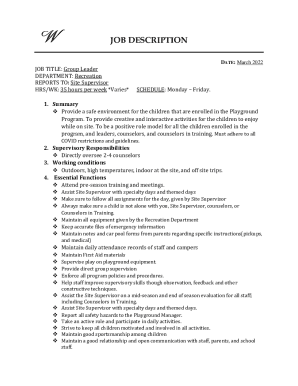

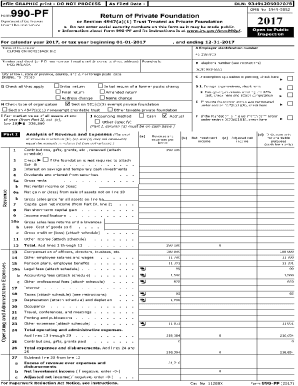

This document provides Otter Tail Power Company's annual review of depreciation certification, detailing proposed service lives, net salvage values, and resulting depreciation rates based on the company's

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign 2009 annual review of

Edit your 2009 annual review of form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your 2009 annual review of form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing 2009 annual review of online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit 2009 annual review of. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out 2009 annual review of

How to fill out 2009 Annual Review of Depreciation Certification

01

Begin by gathering all necessary financial records related to assets that have been depreciated during 2009.

02

Ensure that you have the depreciation schedule for each asset, which shows the acquisition date, cost, useful life, and depreciation method used.

03

Review the applicable tax regulations and guidelines for depreciation to ensure compliance.

04

Fill out the certification form, starting with your organization’s information, including name and tax identification number.

05

List each asset individually and provide the required details: asset description, acquisition cost, total depreciation taken for the year, and estimated remaining life.

06

Sign and date the certification to verify the accuracy of the information provided.

07

Submit the completed certification to the appropriate tax authority or department as instructed.

Who needs 2009 Annual Review of Depreciation Certification?

01

Businesses and organizations that claimed depreciation on assets for the tax year 2009.

02

Tax professionals who assist clients in preparing and filing tax documents related to asset depreciation.

03

Individuals who own rental properties or other depreciable assets for income purposes.

Fill

form

: Try Risk Free

People Also Ask about

What are the new depreciation rules?

The rules allowed Bonus Depreciation to 100% for all qualified purchases made between September 27, 2017 and January 1, 2023. Bonus Depreciation ramped down to 80% in 2023 and 60% for 2024. Bonus depreciation continues to ramp down for ensuing years: 40% in 2025, 20% in 2026, and 0% beginning in 2027.

Are land improvements depreciated over 15 years?

Key Takeaways. Land improvements, unlike the land itself, are depreciable assets eligible for bonus depreciation, with a 15-year recovery period. The Tax Cuts and Jobs Act has phased down bonus depreciation rates, mandating strategic planning for asset acquisitions to optimize tax benefits.

How does the IRS define depreciation?

Depreciation is an annual income tax deduction that allows you to recover the cost or other basis of certain property over the time you use the property. It is an allowance for the wear and tear, deterioration, or obsolescence of the property.

How do you correct prior year depreciation?

Depreciation errors are corrected by either filing an amended return or filing a change in accounting method form.

What is the IRS overview of depreciation?

Depreciation is the recovery of the cost of the property over a number of years. You deduct a part of the cost every year until you fully recover its cost.

How do you calculate IRS depreciation?

Straight-line method: This is the most commonly used method for calculating depreciation. To calculate the value, the difference between the asset's cost and the expected salvage value is divided by the total number of years a company expects to use it.

What is the $300 depreciation rule?

To claim the immediate deduction, the cost of the depreciating asset must be $300 or less. The cost of an asset is generally what you pay for it (the purchase price), and other expenses you incur to buy it – for example, delivery costs.

What is the IRS depreciation recapture?

Depreciation recapture reflects a simple idea: If you claimed tax breaks because an asset was supposedly losing value but then sold it for more than its depreciated worth, those tax breaks weren't, in the end, justified—after all, the equipment wasn't really losing value if someone paid more for it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is 2009 Annual Review of Depreciation Certification?

The 2009 Annual Review of Depreciation Certification is a document that allows businesses to report the depreciation of their assets for the fiscal year of 2009, ensuring compliance with accounting standards and tax regulations.

Who is required to file 2009 Annual Review of Depreciation Certification?

Businesses that own depreciable assets and are subject to tax regulations are required to file the 2009 Annual Review of Depreciation Certification to report their asset depreciation.

How to fill out 2009 Annual Review of Depreciation Certification?

To fill out the 2009 Annual Review of Depreciation Certification, businesses must provide detailed information about each depreciable asset, including acquisition date, cost, method of depreciation used, and any adjustments made during the year.

What is the purpose of 2009 Annual Review of Depreciation Certification?

The purpose of the 2009 Annual Review of Depreciation Certification is to accurately report the depreciation expenses of a business, which can impact tax calculations and financial statements.

What information must be reported on 2009 Annual Review of Depreciation Certification?

The information that must be reported includes the asset description, date of acquisition, purchase cost, depreciation method, accumulated depreciation, and any impairment or adjustments.

Fill out your 2009 annual review of online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

2009 Annual Review Of is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.