Get the free Taxpayer Property Tax Hardship Relief Decision - nh

Show details

This document details the board's ruling regarding the Taxpayers' appeal for property tax hardship relief, outlining the findings and legal interpretations related to their application and the resulting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign taxpayer property tax hardship

Edit your taxpayer property tax hardship form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your taxpayer property tax hardship form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing taxpayer property tax hardship online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit taxpayer property tax hardship. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

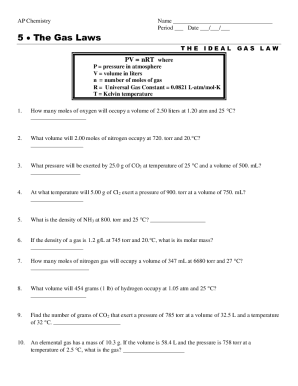

How to fill out taxpayer property tax hardship

How to fill out Taxpayer Property Tax Hardship Relief Decision

01

Obtain the Taxpayer Property Tax Hardship Relief Decision form from your local tax authority or their website.

02

Read the instructions carefully to understand the eligibility criteria and required documentation.

03

Fill out your personal information including name, address, and contact details accurately.

04

Provide information about your property including the address and type of property.

05

Detail your financial situation by providing information about your income, expenses, and any financial hardships you are experiencing.

06

Attach any required documentation, such as proof of income, tax returns, or other relevant financial statements.

07

Review your application for completeness and accuracy before submission.

08

Submit the completed form and required documentation to your local tax authority by the specified deadline.

Who needs Taxpayer Property Tax Hardship Relief Decision?

01

Homeowners or property owners experiencing financial difficulties that affect their ability to pay property taxes.

02

Individuals who have had significant changes in income or unexpected expenses leading to hardship.

03

People seeking relief from property tax burdens due to medical emergencies, job loss, or other qualifying hardships.

Fill

form

: Try Risk Free

People Also Ask about

How do I write an appeal letter for taxes?

The following should be provided in the protest: Taxpayer's name and address, and a daytime telephone number. A statement that taxpayer wants to appeal the IRS findings to the Appeals Office. A copy of the letter proposed tax adjustment. The tax periods or years involved.

What is the best evidence to protest property taxes?

The best type of documents is usually estimates for repairs from contractors and photographs of physical problems. All documentation should be signed and attested. This means you must furnish "documented" evidence of your property's needs.

What is the new law in Texas about property taxes?

In 2023, the $100,000 Homestead Exemption was permanently codified into the Texas Constitution when voters passed Proposition 4 with 83% of voters in support. This makes the $100,000 Homestead Exemption permanent, and homeowners will receive tax relief every single year, forever.

What does property tax relief mean?

Sliding-scale formulas reduce property taxes by a set percentage for each income bracket, with lower relief percentages for higher income brackets. All claimants in a given income bracket receive the same percentage of relief regardless of their property tax bill.

What do you say when appealing property taxes?

Keep it simple: Include phrasing that indicates the letter is a “formal notice of protest.” List the account number or numbers you plan to protest. State the reason(s) for protesting. Sign it and send it.

What is the best reason for property tax appeal?

The following are examples of good reasons to file an appeal: Your property has deferred maintenance or damage in the last 3 years. The property has been sold on the open market or an appraisal has been completed in the last three years that indicates a value different from the value set by the county.

What to say on a property tax appeal?

Keep it simple: Include phrasing that indicates the letter is a “formal notice of protest.” List the account number or numbers you plan to protest. State the reason(s) for protesting. Sign it and send it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Taxpayer Property Tax Hardship Relief Decision?

The Taxpayer Property Tax Hardship Relief Decision is a determination issued to taxpayers who apply for relief from property taxes due to financial hardship. It assesses the eligibility for reductions or exemptions based on individual circumstances.

Who is required to file Taxpayer Property Tax Hardship Relief Decision?

Homeowners who are experiencing significant financial difficulties that impact their ability to pay property taxes are required to file for the Taxpayer Property Tax Hardship Relief Decision.

How to fill out Taxpayer Property Tax Hardship Relief Decision?

To fill out the Taxpayer Property Tax Hardship Relief Decision form, applicants should provide their personal information, financial details, reason for hardship, and any supporting documentation that validates their situation.

What is the purpose of Taxpayer Property Tax Hardship Relief Decision?

The purpose of the Taxpayer Property Tax Hardship Relief Decision is to provide financial relief to taxpayers who are struggling to pay their property taxes due to unforeseen hardships, ensuring that they do not lose their homes.

What information must be reported on Taxpayer Property Tax Hardship Relief Decision?

The information that must be reported includes the taxpayer's name, address, property details, income information, expenses, and a detailed explanation of the financial hardship faced.

Fill out your taxpayer property tax hardship online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Taxpayer Property Tax Hardship is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.