NH BTLA A-12 2007-2025 free printable template

Show details

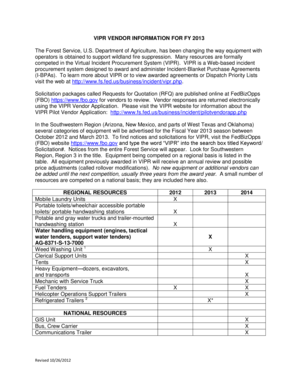

Form BTLA A-12 The State of New Hampshire CHARITABLE ORGANIZATION FINANCIAL STATEMENT Pursuant to RSA 72 23 VI every charitable organization or society must file a statement of its financial condition with the municipality in which the property is located. This statement is due annually before June 1. In compliance with this statute please complete and return this form with attachments if necessary to the municipality. For Fiscal Year to 1. In what municipality is this exemption claimed 2....

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NH BTLA A-12

Edit your NH BTLA A-12 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NH BTLA A-12 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NH BTLA A-12 online

To use the professional PDF editor, follow these steps below:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NH BTLA A-12. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out NH BTLA A-12

How to fill out NH BTLA A-12

01

Obtain the NH BTLA A-12 form from the official website or your local tax assessor's office.

02

Fill out the property owner's information including name, address, and contact details.

03

Provide the tax map and lot number specific to your property.

04

Indicate the reason for filing the BTLA A-12, such as an assessment dispute.

05

Complete the section detailing the assessed value and your opinion of the fair market value.

06

Include any additional documentation that supports your claim, like photographs or comparative sales.

07

Sign and date the form.

08

Submit the completed form to the appropriate local assessing office by the deadline.

Who needs NH BTLA A-12?

01

Property owners who believe their property has been inaccurately assessed for tax purposes.

02

Individuals or organizations that wish to appeal their property tax assessments in New Hampshire.

03

Those looking to clarify or contest the value placed on their property for tax calculations.

Fill

form

: Try Risk Free

People Also Ask about

What is the view tax in NH?

The view tax is a term for the fact that the appraisal of a piece of real estate in preparation for assessing property tax includes aspects of a property that are subjective, such as its view. It was also the informal name for a 2005 bill in the legislature of the U.S. state of New Hampshire (see below).

Do nonprofits pay property taxes in NH?

Nonprofit institutions are exempt from paying property taxes, but many New Hampshire cities and towns are now asking nonprofits to pay for municipal services through so-called PILOT agreements.

How are property taxes calculated in NH?

Tax rates are expressed in mills, with one mill equal to $1 of tax for every $1,000 in assessed property value. Because mill rates can differ so much between counties and towns, it's easiest to compare property taxes using effective property tax rates and not mill rates.

At what age do you stop paying property tax in New Hampshire?

Applicant must be 65 years old before April 1 of the tax year for which the application is being made. You must have resided in New Hampshire for at least three (3) years and owned your home individually or jointly prior to April 1st of the tax year for which you are applying.

How do property taxes work in NH?

New Hampshire has both state and local property taxes. In fact, any given property can pay up to four different property taxes: a county tax, a town tax, a local school tax and the state education tax. To determine the amount on which to base taxes, local assessors conduct annual appraisals.

Are New Hampshire property taxes paid in advance?

Property tax bills are sent semiannually. The first installment bill is due on July 1st, the second installment due date varies depending on the date the tax rate is set and the date the bills are postmarked, generally no later than December 20th.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make changes in NH BTLA A-12?

With pdfFiller, the editing process is straightforward. Open your NH BTLA A-12 in the editor, which is highly intuitive and easy to use. There, you’ll be able to blackout, redact, type, and erase text, add images, draw arrows and lines, place sticky notes and text boxes, and much more.

Can I create an electronic signature for the NH BTLA A-12 in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out NH BTLA A-12 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NH BTLA A-12 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is NH BTLA A-12?

NH BTLA A-12 is a form used in New Hampshire for reporting property tax exemptions and credits. It helps assessors evaluate property eligibility for certain tax benefits.

Who is required to file NH BTLA A-12?

Property owners seeking tax exemptions or credits are required to file NH BTLA A-12. This includes individuals and businesses that own properties that may qualify for exemptions.

How to fill out NH BTLA A-12?

To fill out NH BTLA A-12, property owners must provide their personal information, property details, and the specific exemptions for which they are applying. Clear instructions are provided on the form.

What is the purpose of NH BTLA A-12?

The purpose of NH BTLA A-12 is to allow property owners to apply for tax exemptions and credits, ensuring that eligible properties receive appropriate tax relief.

What information must be reported on NH BTLA A-12?

NH BTLA A-12 requires reporting information such as the property owner's name, address, details about the property, the type of exemption or credit being requested, and any supporting documentation needed.

Fill out your NH BTLA A-12 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NH BTLA A-12 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.