Get the free New Hampshire Personal Automobile Insurance Premiums - nh

Show details

A comprehensive exhibit providing estimates of personal automobile insurance premiums in New Hampshire, detailing coverage options and company rates based on different zip codes and carrier information.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new hampshire personal automobile

Edit your new hampshire personal automobile form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new hampshire personal automobile form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit new hampshire personal automobile online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. It's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit new hampshire personal automobile. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

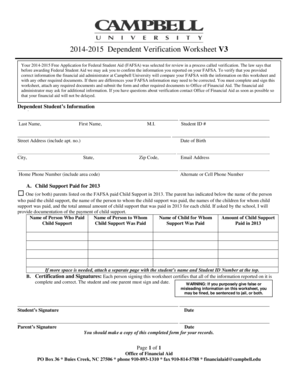

How to fill out new hampshire personal automobile

How to fill out New Hampshire Personal Automobile Insurance Premiums

01

Gather necessary personal information including driver's license number, vehicle identification number, and personal details.

02

Determine the coverage options you need, such as liability, collision, or comprehensive coverage.

03

Calculate your premium based on the coverage options and any discounts you may qualify for.

04

Fill out the application form accurately, ensuring all information is correct.

05

Review the policy terms and conditions before submitting the application.

Who needs New Hampshire Personal Automobile Insurance Premiums?

01

All vehicle owners in New Hampshire must have personal automobile insurance to legally operate a vehicle.

02

Individuals seeking financial protection against car accidents, theft, or damage should consider this insurance.

03

Those who frequently drive or commute and want to ensure they are covered in case of an accident.

Fill

form

: Try Risk Free

People Also Ask about

What state allows no car insurance?

Almost every state in the U.S. requires drivers to have some form of car insurance. The only state that doesn't require car insurance is New Hampshire. Instead, drivers must prove they have enough funds to cover any costs if they cause an accident.

Why does New Hampshire have no car insurance?

Because it's not required in NH, it's more affordable here than most other states and that's likely why we have one of the lowest rates of uninsured drivers as well. Any private service that's mandated will be more expensive, because an increase in demand increases prices.

What is the average cost of auto insurance in NH?

The average cost of car insurance in New Hampshire is $1,737 per year for a full coverage policy and $470 for a minimum coverage policy. Manchester has the highest average full coverage rates of New Hampshire's most populous cities.

What are the rules for auto insurance in NH?

If you buy auto insurance in New Hampshire, the minimum limits available for Liability Coverage are 25/50/25, meaning $25,000 per person for bodily injury, up to $50,000 if 2 or more persons are hurt, and up to $25,000 for property damage. Liability Coverage does not pay to repair damage to your own vehicle.

How much is the average annual auto insurance premium?

Average cost of car insurance by state StateAverage annual cost for full coverageAverage annual cost for minimum coverage California $3,207 $585 Colorado $3,207 $585 Connecticut $2,689 $1,036 Delaware $2,878 $1,03447 more rows • Apr 26, 2025

Why do you not need car insurance in New Hampshire?

New Hampshire motor vehicle laws do not require you to carry auto insurance, but you must be able to demonstrate that you are able to provide sufficient funds to meet New Hampshire motor vehicle financial responsibility requirements in the event of an “at- fault” accident.

What percentage of NH drivers are uninsured?

Unlike in the rest of the U.S., Virginia and New Hampshire don't require that drivers carry any amount of auto insurance coverage. ing to a 2021 study by the Insurance Research Council, nearly 11% of drivers in Virginia and 6% of New Hampshire motorists were uninsured.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New Hampshire Personal Automobile Insurance Premiums?

New Hampshire Personal Automobile Insurance Premiums refer to the costs associated with purchasing automobile insurance coverage specific to individuals residing in New Hampshire. These premiums are calculated based on various factors including the driver's history, the type of vehicle, and local regulations.

Who is required to file New Hampshire Personal Automobile Insurance Premiums?

Insurance companies that provide automobile insurance in New Hampshire are required to file their premiums with the state regulatory authority to ensure compliance with state laws.

How to fill out New Hampshire Personal Automobile Insurance Premiums?

To fill out New Hampshire Personal Automobile Insurance Premiums, insurers must provide detailed information about their coverage options, rates, and the methodology used to develop their premium rates as required by the state regulations.

What is the purpose of New Hampshire Personal Automobile Insurance Premiums?

The purpose of New Hampshire Personal Automobile Insurance Premiums is to regulate and ensure fair pricing for automobile insurance policies, protect consumers, and maintain a stable insurance market within the state.

What information must be reported on New Hampshire Personal Automobile Insurance Premiums?

Insurers must report information including the types of coverage offered, premium rates, loss experience data, and any other relevant underwriting criteria.

Fill out your new hampshire personal automobile online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New Hampshire Personal Automobile is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.