Get the free Comprehensive General Liability Insurance Acknowledgement Form - nh

Show details

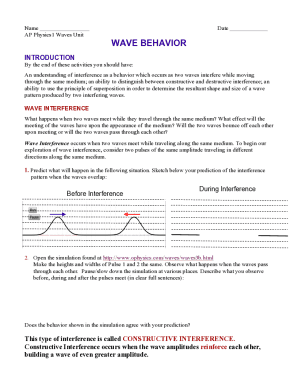

This form is used by contractors submitting proposals to the State of New Hampshire to acknowledge their understanding of the general liability insurance requirements as mandated by the New Hampshire

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign comprehensive general liability insurance

Edit your comprehensive general liability insurance form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your comprehensive general liability insurance form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit comprehensive general liability insurance online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit comprehensive general liability insurance. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out comprehensive general liability insurance

How to fill out Comprehensive General Liability Insurance Acknowledgement Form

01

Obtain a copy of the Comprehensive General Liability Insurance Acknowledgement Form from your insurer or the relevant authority.

02

Read the form carefully to understand each section and requirement.

03

Fill in your business name and contact information in the appropriate fields.

04

Provide details about your insurance policy, including the policy number, coverage limits, and expiration date.

05

Specify the type of activities your business is engaged in, as this may affect coverage.

06

Include the names of additional insured parties if required.

07

Review the form for accuracy and completeness before submitting.

08

Sign and date the form to validate your acknowledgment of the terms.

Who needs Comprehensive General Liability Insurance Acknowledgement Form?

01

Any business or organization that operates in a field that requires liability insurance.

02

Contractors and subcontractors working on projects where liability coverage is mandated.

03

Companies wanting to protect themselves from potential claims related to injuries or damages caused by their operations.

04

Individuals or businesses entering into agreements that necessitate proof of liability coverage.

Fill

form

: Try Risk Free

People Also Ask about

What is a cg 20-26 form?

CG 20 26 Additional Insured - Designated Person or Organization. Adds a designated person or organization as an additional insured for liability arising out of the named insured's premises or operations. This endorsement can be used to add any interest to the policy, subject to company approval.

How much is $1,000,000 general liability?

How Much Is a $1 Million General Liability Insurance Policy? On average, a $1 million liability insurance policy costs $69 a month, or $824 a year, for our small business owners. ** Keep in mind that every business is different, so the $1 million liability insurance cost will vary.

Is comprehensive general liability insurance the same as general liability insurance?

Comprehensive general liability insurance is an outdated term for general liability insurance. Another common name for general liability coverage is commercial general liability (CGL) insurance. It helps protect your business from claims that it caused: Bodily injuries.

How much is $100,000 in liability insurance?

On average, a renters insurance policy with $100,000 in liability coverage and a $500 deductible costs $22 per month, or $268 a year. With a higher deductible of $1,000, a renters insurance policy costs an average of $20 per month, or $246 a year.

How do I fill out a general release of liability form?

What to Include in a Release of Liability Form Releasor: Full name of the releasor. Releasee: Full name of the releasee. Effective date: The date the waiver takes effect. Incident: Details of the injury, debt, or accident. Compensation: The total that must be paid in exchange for signing the waiver.

How much does a $2 million business insurance policy cost?

How much is a 2-million dollar insurance policy for a business? On average, an insurance policy that offers coverage for up to $2 million can cost about $30 a month in premiums.

How much does a $1 million insurance policy cost?

On average, a $1 million life insurance policy costs about $23 per month for a 30-year-old female nonsmoker seeking a 10-year term plan. For a policy with a 20-year term, the same applicant would pay about $34 monthly, and a 30-year term would cost about $64 per month.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Comprehensive General Liability Insurance Acknowledgement Form?

The Comprehensive General Liability Insurance Acknowledgement Form is a document that indicates a party's acknowledgment of having comprehensive general liability insurance coverage, which protects against various claims such as bodily injury, property damage, and personal injury.

Who is required to file Comprehensive General Liability Insurance Acknowledgement Form?

Typically, individuals or businesses that engage in contracts or agreements that require proof of general liability insurance coverage are required to file this form.

How to fill out Comprehensive General Liability Insurance Acknowledgement Form?

To fill out the form, you need to provide details such as the insured party's name, policy number, insurance provider, coverage limits, and any additional relevant information as per the form's instructions.

What is the purpose of Comprehensive General Liability Insurance Acknowledgement Form?

The purpose of the form is to document and verify that a business or individual carries the necessary insurance coverage required for specific contracts, ensuring protection against potential liabilities.

What information must be reported on Comprehensive General Liability Insurance Acknowledgement Form?

The form must typically include the insured's name, address, insurance policy number, insurance carrier details, coverage limits, effective dates of the policy, and signature of the insured or authorized representative.

Fill out your comprehensive general liability insurance online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Comprehensive General Liability Insurance is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.