Get the free Owners Certification 100% LIHTC Properties - housing ny

Show details

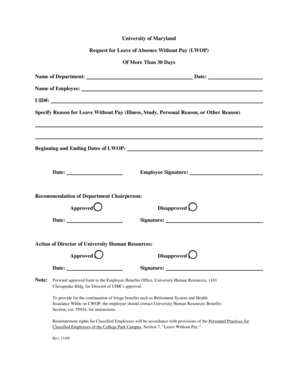

This document outlines the certification procedure for owners or managing agents of properties receiving Low-Income Housing Tax Credits (LIHTC), detailing the steps required to obtain annual recertification

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign owners certification 100 lihtc

Edit your owners certification 100 lihtc form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your owners certification 100 lihtc form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit owners certification 100 lihtc online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit owners certification 100 lihtc. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out owners certification 100 lihtc

How to fill out Owners Certification 100% LIHTC Properties

01

Obtain the Owners Certification form from the relevant housing authority or government agency.

02

Fill out your name and the name of the property owner or organization.

03

Provide the property address and any identification numbers associated with the property.

04

Indicate the type of ownership, whether it is sole proprietorship, partnership, corporation, etc.

05

List the details of all owners and partners, including names, addresses, and percentage of ownership.

06

Complete the financial information sections, including income and expense details related to the property.

07

Confirm that the information provided is true and accurate to the best of your knowledge by signing and dating the form.

08

Submit the completed form to the designated agency by the specified deadline.

Who needs Owners Certification 100% LIHTC Properties?

01

Property owners of Low-Income Housing Tax Credit (LIHTC) properties.

02

Developers and investors involved in LIHTC projects.

03

Housing agencies and authorities requiring compliance documentation.

04

Tax professionals and consultants assisting owners with LIHTC properties.

Fill

form

: Try Risk Free

People Also Ask about

Who owns a LIHTC property?

Developers may claim LIHTCs themselves. However, due to limitations and the lack of enough taxable income, most developers choose to find tax credit investors, who provide cash that is channeled into the development.

How to qualify for 4% LIHTC?

4% Low Income Housing Tax Credits (4% Credits) are utilized to finance new construction and/or acquisition & rehabilitation of affordable housing projects. To receive an allocation of 4% Credits a developer must first apply for and receive an allocation of tax-exempt volume cap limited bonds (Tax-Exempt Bonds).

What is the difference between hud and LIHTC?

While the LIHTC program requires the property to be affordable for a certain period, HUD requires the property to remain affordable permanently, so your housing affordability will not be impacted by the LIHTC program.

What is the maximum income to qualify for tax credits?

You qualify for the full amount of the 2024 Child Tax Credit for each qualifying child if you meet all eligibility factors and your annual income is not more than $200,000 ($400,000 if filing a joint return).

What is the 40-60 rule for tax credits?

40-60 |A minimum of 40% of a project's units must be maintained as tax credit continually. The definition of “low income” at the property is 60% MTSP, so all units that will be considered tax credit must be at or below 60%.

What is the 10 year rule for tax credits?

10-Year Rule: The building is eligible for acquisition credit so long as the existing building was not placed-in-service during the 10-year period preceding the acquisition.

How do LIHTC developers make money?

The Low-Income Housing Tax Credit (LIHTC) program has been the backbone of new affordable housing construction nationwide for the last 37 years. Developers who receive LIHTC financing are paid twice: they collect a developer fee, and they own the building.

What is the tax credit 40 60?

40-60 |A minimum of 40% of a project's units must be maintained as tax credit continually. The definition of “low income” at the property is 60% MTSP, so all units that will be considered tax credit must be at or below 60%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Owners Certification 100% LIHTC Properties?

Owners Certification 100% LIHTC Properties is a document that certifies compliance with the requirements of the Low-Income Housing Tax Credit (LIHTC) program, specifically for properties that are 100% designated as LIHTC.

Who is required to file Owners Certification 100% LIHTC Properties?

The owners of properties that receive 100% Low-Income Housing Tax Credits are required to file Owners Certification to ensure adherence to program guidelines and regulations.

How to fill out Owners Certification 100% LIHTC Properties?

To fill out the Owners Certification, the property owner must provide accurate information regarding rental income, tenant compliance, and property occupancy rates, along with any other relevant data as required by the LIHTC regulations.

What is the purpose of Owners Certification 100% LIHTC Properties?

The purpose of Owners Certification is to verify that the property meets the requirements set forth by the LIHTC program, ensuring that it continues to provide affordable housing to eligible low-income tenants.

What information must be reported on Owners Certification 100% LIHTC Properties?

The Owners Certification must report information such as tenant income levels, occupancy status, compliance with rent limits, and any other specific data required by the LIHTC guidelines.

Fill out your owners certification 100 lihtc online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Owners Certification 100 Lihtc is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.