Get the free Nursing Home Insurance Only Checklist for SERFF Filings - dfs ny

Show details

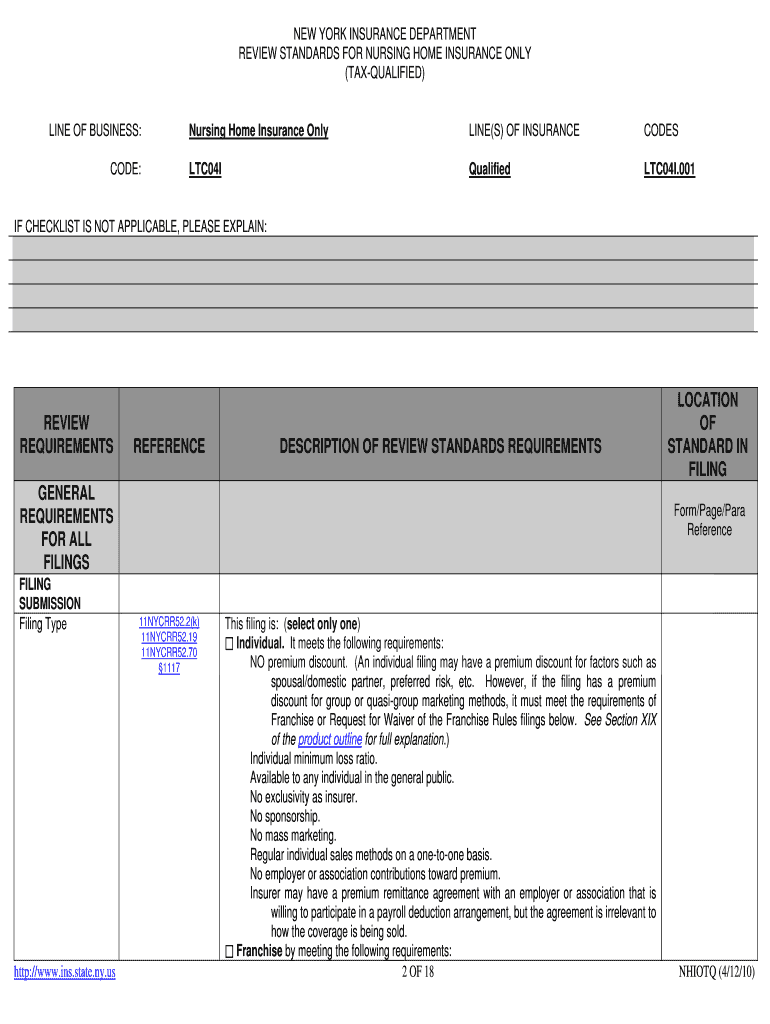

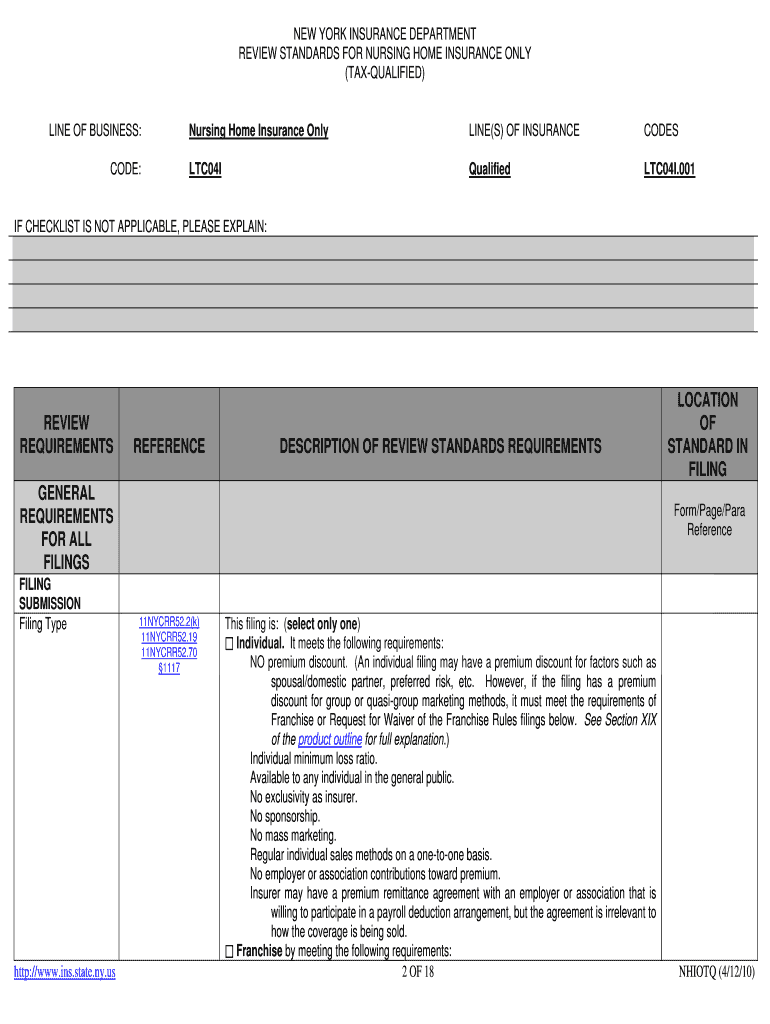

A checklist provided by the New York Insurance Department outlining the requirements and standards for filing nursing home insurance policies and rates, including instructions for SERFF submissions

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nursing home insurance only

Edit your nursing home insurance only form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nursing home insurance only form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nursing home insurance only online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit nursing home insurance only. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out nursing home insurance only

How to fill out Nursing Home Insurance Only Checklist for SERFF Filings

01

Gather necessary documents: Collect all relevant information and documents related to the nursing home insurance policy.

02

Access SERFF: Log in to the System for Electronic Rate and Form Filing (SERFF) portal.

03

Locate the checklist: Navigate to the Nursing Home Insurance Only Checklist section within SERFF.

04

Fill out the headers: Complete the header section with your company name, filing number, and contact information.

05

Provide policy details: Enter comprehensive details about the nursing home insurance policy, including coverage types and limits.

06

Include supporting documents: Attach all required supporting documents, such as outlines of coverage and actuarial justifications.

07

Review accuracy: Thoroughly review the checklist for accuracy and completeness to avoid delays.

08

Submit the filing: Finalize and submit the checklist through the SERFF system.

09

Monitor status: Regularly check the status of your filing in SERFF for any updates or required actions.

Who needs Nursing Home Insurance Only Checklist for SERFF Filings?

01

Insurance providers offering nursing home insurance products.

02

Underwriters assessing nursing home insurance policies.

03

Regulators reviewing nursing home insurance submissions.

04

Actuaries involved in evaluating insurance risk for nursing home products.

05

Compliance officers ensuring adherence to insurance filing requirements.

Fill

form

: Try Risk Free

People Also Ask about

What are rate filings?

The rate filing contains the information justifying, or purporting to justify, the rates the insurer seeks to charge.

What are filings in insurance?

Filings provide protection for an accident when there is no coverage, or not enough coverage, under the Liability insurance.

What documents are needed for insurance policy?

Ans. The specific documents required may vary depending on the insurance company and the type of policy being applied for. However, common documents include proof of identity, proof of age, proof of residence, income proof, bank statements, medical history, and beneficiary information.

Which documents may be required on insurance applications?

When applying for insurance, documents such as MVR, proof of previous insurance, driver's license, and vehicle registration may be required. These documents help insurance companies assess risk and determine appropriate coverage.

What are considered insurance documents?

What Counts as Proof of Insurance? A current member ID card. A letter from your insurance company verifying coverage, sometimes called a certificate of coverage. Explanation of benefits. Form 1095-A if you are covered by a plan purchased through the health insurance marketplace.

What is documentation for insurance?

Certificates of Insurance. Every time an insurance policy is approved, the policyholder is issued a certificate of insurance. This insurance document contains a summary of the insurance policy as well as details of the holder of that policy.

What information do you need to provide for insurance?

When you sign up for an auto insurance policy, your provider will need information such as your name, address, driver's license and vehicle identification number. You'll also need to update your carrier on any changes to your policy, such as adding a new driver or buying a new vehicle.

What does a rate in insurance mean?

An insurance rate is the amount of money necessary to cover losses, cover expenses, and provide a profit to the insurer for a single unit of exposure. Rates, as contrasted with loss costs, include provision for the insurer's profit and expenses.

What are insurance filings?

A filing is a document that shows proof of financial responsibility. It certifies to the government that you have Liability insurance and cargo insurance coverage with at least the minimum required limits.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Nursing Home Insurance Only Checklist for SERFF Filings?

The Nursing Home Insurance Only Checklist for SERFF Filings is a comprehensive document that outlines the necessary requirements and information needed for filing insurance products specifically related to nursing home coverage with the System for Electronic Rate and Form Filing (SERFF).

Who is required to file Nursing Home Insurance Only Checklist for SERFF Filings?

Insurance companies and organizations offering nursing home insurance products are required to file the Nursing Home Insurance Only Checklist as part of their SERFF submissions to ensure compliance with regulatory standards.

How to fill out Nursing Home Insurance Only Checklist for SERFF Filings?

To fill out the Nursing Home Insurance Only Checklist, entities must complete each section of the form by providing detailed information regarding the insurance product, including coverage details, premiums, benefits, and any other relevant data required by the checklist.

What is the purpose of Nursing Home Insurance Only Checklist for SERFF Filings?

The purpose of the Nursing Home Insurance Only Checklist is to streamline the filing process by ensuring that all necessary information is submitted accurately and completely, facilitating quicker review and approval by regulatory authorities.

What information must be reported on Nursing Home Insurance Only Checklist for SERFF Filings?

The information reported on the Nursing Home Insurance Only Checklist includes the policyholder details, coverage options, premium rates, benefit limits, exclusions, and any specific regulatory disclosures required for nursing home insurance.

Fill out your nursing home insurance only online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nursing Home Insurance Only is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.