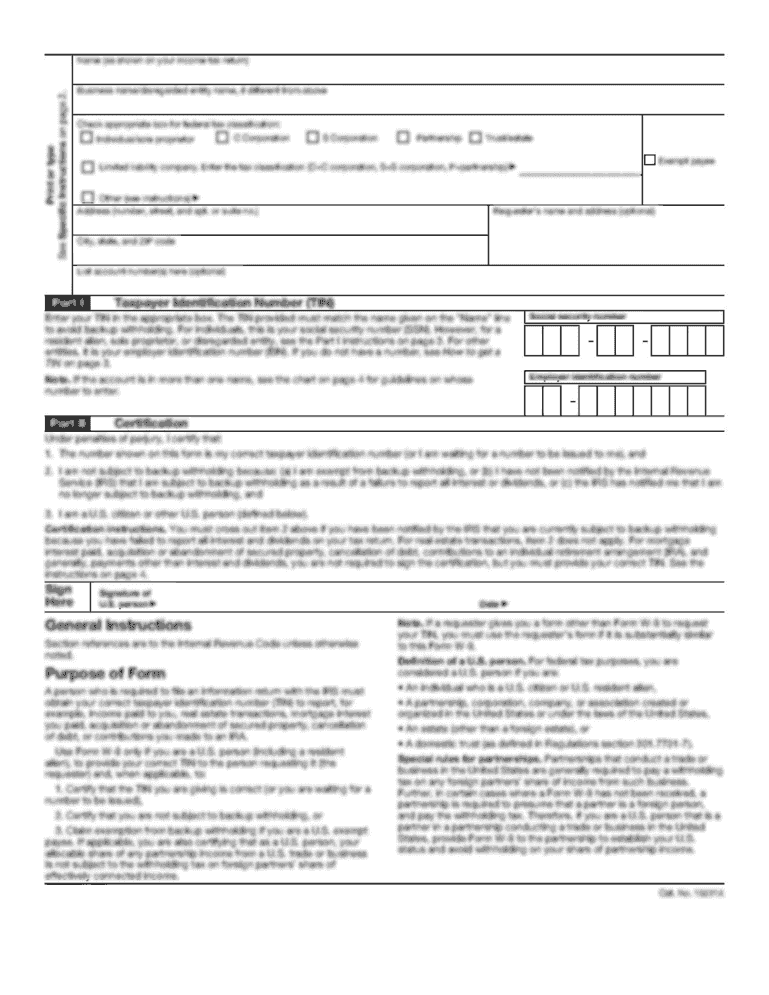

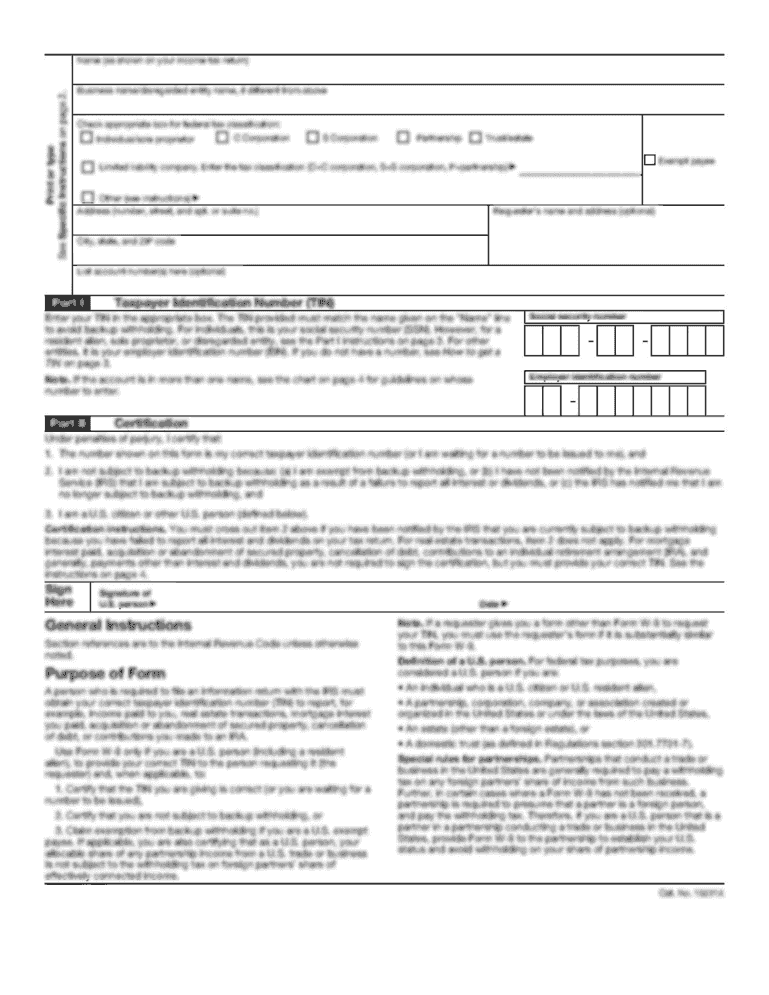

NY IRP-23 2011 free printable template

Show details

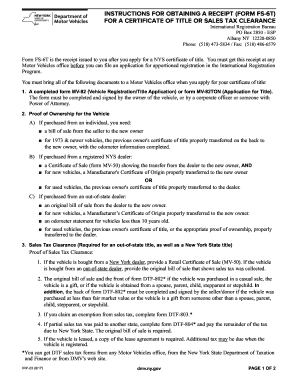

Upon receipt of the necessary documents and forms the Motor Vehicles Representative will process the title transaction and give you Form FS-6T receipt for Application of Title as it shown below FS-6T 1/15 If the receipt does not specify Title - 50. INSTRUCTIONS FOR OBTAINING A RECEIPT FORM FS-6T FOR A CERTIFICATE OF TITLE OR SALES TAX CLEARANCE International Registration Bureau PO Box 2850 - ESP Albany NY 12220-0850 Phone 518 473-5834 / Fax 518 486-6579 Form FS-6T is the receipt issued to you...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY IRP-23

Edit your NY IRP-23 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY IRP-23 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit NY IRP-23 online

Follow the steps down below to benefit from the PDF editor's expertise:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit NY IRP-23. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY IRP-23 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY IRP-23

How to fill out NY IRP-23

01

Start by downloading the NY IRP-23 form from the New York State Department of Taxation and Finance website.

02

Fill in your name, address, and contact information at the top of the form.

03

Indicate the year for which you are filing the IRP-23.

04

Provide details about your business, including the type of entity and the federal employer identification number (EIN).

05

Document the type of tax return you are submitting and check the appropriate boxes.

06

Complete the sections regarding your sales and use tax information accurately.

07

Review the calculations of your net taxable receipts to ensure they are correct.

08

Sign and date the form at the bottom.

09

Submit the completed form by the designated deadline, either by mail or electronically as instructed.

Who needs NY IRP-23?

01

The NY IRP-23 form is required for businesses that are registered to collect and remit sales tax in New York State.

02

It is specifically needed by retailers and vendors who are submitting sales and use tax returns or those who are registered as exempt sellers.

Fill

form

: Try Risk Free

People Also Ask about

How long do you have to surrender NY plates?

If you're unable to pay the fine, then you can surrender your plates and registration within those 90 days.

How many days do you have to surrender plates in NY?

If you're unable to pay the fine, then you can surrender your plates and registration within those 90 days.

How do I get proof of plate surrender in NY?

For New York State plate surrenders, you will receive via email an FS6-T receipt that you can then use to cancel your insurance or keep for your records. In order to obtain this receipt the DMV requires 1 or 2 plates or an MV78b form from a local police precinct if none of the plates are available.

What happens if you don't return license plates in NY?

If you do not turn in your plate(s), we will suspend your registration and can suspend your driver license.

How much does it cost to surrender license plates in NY?

You surrender the vehicle plates during the first year of the registration, and you qualify for a refund of $30.25. This is a refund of the $31.25 fee for the second year of the registration with the $1 processing fee subtracted. There is no refund of other fees or taxes.

What happens if you don't surrender your plates in NY?

If you do not turn in your plate(s), we will suspend your registration and can suspend your driver license.

How do I get proof of plate surrender in NY?

We will mail you a plate surrender receipt (form FS-6T) as well as a refund check, if applicable. DMV will mail these to the address on the registration.

How do I clear a suspended registration in NY?

What do I do? You may pay the amount due prior to the suspension effective date listed on the NYS DMV's Notice of Registration Suspension. If payment is received at least five (5) days prior to the suspension effective date, the pending registration suspension will be cleared.

How long do you have to return license plates in NY?

If you're unable to pay the fine, then you can surrender your plates and registration within those 90 days.

Do I need an appointment to surrender plates in NY?

You can return your license plate to the DMV in person. Just schedule an appointment or walk in and wait in line. You can also mail your old plates to your local DMV licensing office.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my NY IRP-23 in Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign NY IRP-23 and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

Can I sign the NY IRP-23 electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your NY IRP-23 in seconds.

How do I fill out the NY IRP-23 form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NY IRP-23 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is NY IRP-23?

NY IRP-23 is an informational return required by the New York State Department of Taxation and Finance for certain organizations to report their income and other tax-related information.

Who is required to file NY IRP-23?

Organizations that are exempt from federal income tax and have income exceeding a specific threshold are required to file NY IRP-23.

How to fill out NY IRP-23?

To fill out NY IRP-23, organizations must provide their basic identification information, income details, and any applicable deductions or credits as specified in the form instructions.

What is the purpose of NY IRP-23?

The purpose of NY IRP-23 is to ensure compliance with state tax regulations by requiring tax-exempt organizations to report their financial activities and maintain transparency.

What information must be reported on NY IRP-23?

NY IRP-23 requires reporting of the organization’s name, address, federal employer identification number (EIN), income, expenses, and any other relevant financial data as mandated by the state.

Fill out your NY IRP-23 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY IRP-23 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.