Get the free Utility Services Tax Return — Gross Income - tax ny

Show details

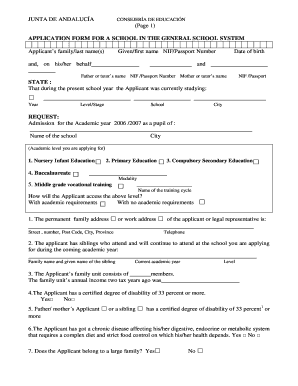

This form is used by businesses to report gross income for utility services in New York State, including tax computations and required information about the business.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign utility services tax return

Edit your utility services tax return form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your utility services tax return form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit utility services tax return online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit utility services tax return. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out utility services tax return

How to fill out Utility Services Tax Return — Gross Income

01

Obtain the Utility Services Tax Return form from your local tax authority's website or office.

02

Carefully read the instructions provided with the form to understand the filing process.

03

Fill in your business information, including name, address, and tax identification number.

04

Calculate your total gross income from utility services for the reporting period.

05

Itemize each type of utility service provided and the corresponding gross income.

06

Ensure all calculations are accurate and reflect your total gross income correctly.

07

Review the completed form for any errors or omissions.

08

Submit the form by the designated deadline, either electronically or via mail.

Who needs Utility Services Tax Return — Gross Income?

01

Businesses that provide utility services, such as electricity, water, gas, or telecommunications, need to file the Utility Services Tax Return.

02

Applicable service providers who are subject to taxation on their gross income from utility services.

03

Companies that are registered to collect and remit utility taxes on behalf of their customers.

Fill

form

: Try Risk Free

People Also Ask about

What is the NYC utility tax?

In New York City, the Utility Excise Tax (UXS) is a tax imposed on utility service providers that operate within the city. These providers include electricity, gas, steam, and telecommunications companies.

What is the income tax utility?

ITR Utility Software introduces by the Income Tax Department, which helps a taxpayer to file ITR easily. Every year, the Income Tax Department releases an updated version of the ITR Utility software for online filing of Income Tax Return.

Where are gross receipts on tax return?

If you operate your business as a Sole Proprietorship or a single-member Limited Liability Company (LLC), gross receipts go on Schedule C of your IRS Form 1040.

What tax document shows gross income?

The Form W-2 contains all wages and tax information for an employee regardless of the number of state agencies/campuses for which he or she worked during the tax year.

What is the NYC utilities tax?

The current tax rate for electric, gas, steam, water, refrigeration, and telecommunications services is 2.35%, and the tax rate for an omnibus operation is 1.17%. The revenue generated from this tax goes into the city's general fund and is used to support a variety of public services and programs.

What is a local utility tax?

UUT is a usage tax on communication, electric, and gas charges billed to a billing or service address in the unincorporated areas of the County of Los Angeles. On November 4, 2008, voters in the unincorporated areas of the County of Los Angeles approved the UUT. (

How much is NYC city tax?

If products are purchased, an 8.875% combined City and State tax will be charged. The City charges a 10.375% tax and an additional 8% surtax on parking, garaging, or storing motor vehicles in Manhattan.

What is the sales tax on utilities in NY?

Sales and uses of energy sources and services for residential purposes are exempt from state sales and use taxes and possibly local taxes.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Utility Services Tax Return — Gross Income?

The Utility Services Tax Return — Gross Income is a tax return specifically designed for reporting income generated from utility services provided by businesses to their customers. It captures the gross income received from all utility services rendered.

Who is required to file Utility Services Tax Return — Gross Income?

Businesses that provide utility services, such as electricity, natural gas, water, and telecommunications, are required to file the Utility Services Tax Return — Gross Income if they generate income from these services.

How to fill out Utility Services Tax Return — Gross Income?

To fill out the Utility Services Tax Return — Gross Income, businesses must provide details of their gross income from utility services, including the total amount billed to customers, adjustments for refunds or discounts, and any exemptions or deductions applicable. Accurate figures and relevant documentation should be included.

What is the purpose of Utility Services Tax Return — Gross Income?

The purpose of the Utility Services Tax Return — Gross Income is to ensure that businesses accurately report their income from utility services for taxation purposes, thereby enabling appropriate revenue collection for municipal or state services.

What information must be reported on Utility Services Tax Return — Gross Income?

The information that must be reported on the Utility Services Tax Return — Gross Income includes the total gross income from utility services, any applicable deductions or exemptions, customer billing amounts, and any necessary identification details of the business filing the return.

Fill out your utility services tax return online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Utility Services Tax Return is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.