Get the free IT-203-X-I - tax ny

Show details

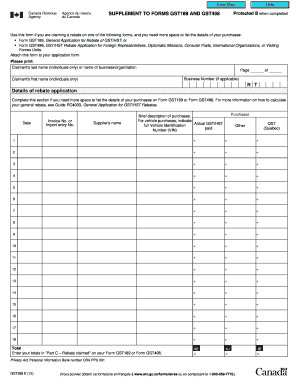

Instructions for filing an amended New York State income tax return for nonresidents and part-year residents to correct errors or report changes made after the original return was filed.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-203-x-i - tax ny

Edit your it-203-x-i - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-203-x-i - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-203-x-i - tax ny online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Check your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit it-203-x-i - tax ny. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-203-x-i - tax ny

How to fill out IT-203-X-I

01

Obtain the IT-203-X-I form from the New York State Department of Taxation and Finance website.

02

Fill in your personal information at the top of the form, including your name, address, and Social Security number.

03

Indicate the tax year you are amending in the appropriate section.

04

Complete the sections relevant to your changes, such as income adjustments, deductions, and credits.

05

Provide a clear explanation of the changes on the form or attach a separate statement if necessary.

06

Review your completed form for accuracy and completeness.

07

Sign and date the form before submission.

08

File the amended return with the appropriate tax authority, either by mail or electronically, if applicable.

Who needs IT-203-X-I?

01

Individuals who have filed an IT-203 tax return and need to amend it due to errors or changes in information.

02

Taxpayers who discover discrepancies in their reporting after submitting their original return.

03

Residents who wish to adjust their taxable income, deductions, or credits after the initial filing.

Fill

form

: Try Risk Free

People Also Ask about

What is a 203 nonresident income tax return?

To determine how much tax you owe, use Form IT-203, Nonresident and Part‑Year Resident Income Tax Return. You will calculate a base tax as if you were a full-year resident, then determine the percentage of your income that is subject to New York State tax and the amount of tax apportioned to New York State.

What is a nonresident income tax return?

Generally, you'll need to file a nonresident state return if you made money from sources in a state you don't live in. Some examples are: Wages or income you earned while working in that state. Out-of-state rental income, gambling winnings, or profits from property sales.

What is the tax code 203?

What Is Tax Topic 203? Tax Topic 203, also referred to as Reduced Refund, is an informative page that the IRS will direct you to if they have deducted a portion of your federal income tax refund to satisfy specific financial debts through the Treasury Department's tax refund offset program.

What does it mean to maintain living quarters in NYC?

Determining if you maintain a permanent place of abode in New York City depends on specific factors outlined by the New York State Department of Taxation and Finance. A permanent place of abode is generally defined as a residence you maintain, suitable for year-round use, regardless of ownership.

What is the difference between IT-203 and IT 201?

If one of you was a New York State resident and the other was a nonresident or part-year resident, you must each file a separate New York return. The resident must use Form IT-201. The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203.

What is an IT 203 nonresident income tax return?

NY Form IT-203 is a New York State income tax return for nonresidents and part-year residents. It is used to report income earned in New York State by individuals who are not considered to be full-year residents of the state.

What is 203 income tax?

Section 203 of the Income Tax Act requires employers to deduct TDS from the salaries paid to their employees. The TDS amount is calculated based on the employee's income tax slab rate, and the employer is responsible for deducting and remitting the TDS to the government on behalf of the employee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-203-X-I?

IT-203-X-I is a form used by non-resident individuals and part-year residents in New York State to amend their New York State income tax returns.

Who is required to file IT-203-X-I?

Individuals who need to correct or amend their previously filed New York State non-resident or part-year resident tax returns are required to file IT-203-X-I.

How to fill out IT-203-X-I?

To fill out IT-203-X-I, you need to provide your personal information, the details of your original return, the changes being made, and any additional information requested on the form.

What is the purpose of IT-203-X-I?

The purpose of IT-203-X-I is to allow taxpayers to amend their tax returns to correct errors or make changes that may affect their tax liability.

What information must be reported on IT-203-X-I?

The information that must be reported on IT-203-X-I includes your name, Social Security number, the tax year being amended, the original return information, the changes being made, and any additional supporting documents.

Fill out your it-203-x-i - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-203-X-I - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.