Get the free ST-101.4 - tax ny

Show details

This form is used by vendors in New York State to report sales and use tax transactions related to New Jersey, including details of gross sales, deductions, and taxes due for a specified reporting

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st-1014 - tax ny

Edit your st-1014 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-1014 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit st-1014 - tax ny online

To use the services of a skilled PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit st-1014 - tax ny. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st-1014 - tax ny

How to fill out ST-101.4

01

Gather all required financial documents and information.

02

Start by entering your personal information in the designated fields, including your name, address, and contact details.

03

Proceed to fill in the relevant financial details, ensuring accuracy in reporting income, expenses, and deductions.

04

Follow the instructions closely for each section, checking the guidelines for any specific eligibility or documentation required.

05

Review your entries for any errors or omissions before submitting.

06

Sign and date the form as required, and keep a copy for your records.

Who needs ST-101.4?

01

Individuals or entities that are required to report specific financial information for regulatory compliance.

02

Tax professionals assisting clients with financial disclosures.

03

Businesses seeking to apply for certain financial benefits or exemptions.

Fill

form

: Try Risk Free

People Also Ask about

What are the 5 things that must be on a food label?

List of ingredients. Date mark. Nutrition information panel (NIP) Country of origin of the food.

What is required to be on food labels?

Under section 403 of the FD&C Act (21 USC § 343), every food label must contain the name of the food, a statement of the net quantity of contents (typically net weight), and the name and address of the manufacturer or distributor.

What is mandatory on a food label?

Mandatory nutrients (total calories, total , saturated , trans , cholesterol, sodium, total carbohydrate, dietary fiber, total sugars, added sugars, protein, vitamin D, calcium, iron, potassium)

What is required by law to be on a food label?

Most food labels must include: a nutrition facts table, which shows: serving size. calories and nutrients. % daily value (% DV) a list of ingredients, including: added sulphites. common allergens. gluten sources (when present as ingredients or components of ingredients)

Does raw food have to have food labels?

Food labeling is required for most prepared foods, such as breads, cereals, canned and frozen foods, snacks, desserts, drinks, etc. Nutrition labeling for raw produce (fruits and vegetables) and fish is voluntary.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

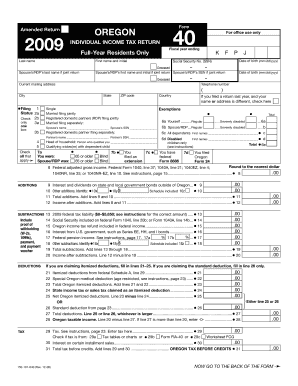

What is ST-101.4?

ST-101.4 is a tax form used in certain jurisdictions to report specific transactions and tax liabilities related to sales tax.

Who is required to file ST-101.4?

Businesses or individuals engaged in taxable sales or services within the jurisdiction that require the reporting of sales tax must file ST-101.4.

How to fill out ST-101.4?

To fill out ST-101.4, one must provide relevant sales information, calculate the total sales tax due, and ensure all sections of the form are completed accurately before submitting it to the tax authority.

What is the purpose of ST-101.4?

The purpose of ST-101.4 is to ensure compliance with sales tax regulations by reporting sales and calculating the taxes owed to the state or local government.

What information must be reported on ST-101.4?

The information that must be reported includes total sales, taxable sales, exempt sales, applicable tax rates, and the total amount of sales tax collected.

Fill out your st-1014 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-1014 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.