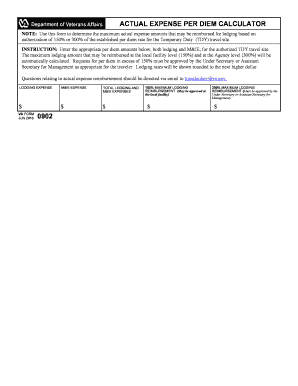

Get the free Claim for Earned Income Credit - tax ny

Show details

This document is used to claim the New York State Earned Income Credit for individuals who qualify, detailing personal information, income, and eligibility requirements.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for earned income

Edit your claim for earned income form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for earned income form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for earned income online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit claim for earned income. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for earned income

How to fill out Claim for Earned Income Credit

01

Gather all required documents, including W-2 forms and any 1099 forms.

02

Obtain the IRS Form 1040 or 1040-SR.

03

Fill out your personal information at the top of the form.

04

Determine your filing status (e.g., single, married filing jointly).

05

Enter your total income and calculate your adjusted gross income (AGI).

06

Locate the section for the Earned Income Credit (EIC) on the form.

07

Complete the EIC worksheet to determine your eligibility and amount.

08

Transfer the calculated EIC amount to the appropriate line on your tax form.

09

Double-check all entries for accuracy and completeness.

10

Submit your completed tax return, including the claim for EIC.

Who needs Claim for Earned Income Credit?

01

Low to moderate-income individuals and families.

02

Working individuals with children who meet certain criteria.

03

People without children who meet income requirements.

04

Taxpayers who are eligible for EIC based on their earned income.

Fill

form

: Try Risk Free

People Also Ask about

Can I claim myself for earned income credit?

California EITC requires filing of your state return (form 540 2EZ or 540) and having earned income reported on a W-2 form (i.e. wages, salaries, and tips) subject to California withholding. Self-employment income cannot be used to qualify for state credit.

How do I figure out my earned income credit?

If your adjusted gross income is greater than your earned income your Earned Income Credit is calculated with your adjusted gross income and compared to the amount you would have received with your earned income. The lower of these two calculated amounts is your Earned Income Credit.

What disqualifies you from earned income credit?

In general, disqualifying income is investment income such as taxable and tax-exempt interest, dividends, child's interest and dividend income reported on the return, child's tax-exempt interest reported on Form 8814, line 1b, net rental and royalty income, net capital gain income, other portfolio income, and net

Can I claim EIC if I have no dependents?

The amount of credit you get when you file your return can depend on whether you have children, dependents, or a disability. However, you may still be able to claim the EITC even if you do not have a qualifying child. If you qualify for the EITC, you may be able to claim credit on returns from prior years.

Can you get earned income credit for yourself?

Yes, your self-employed income is earned income and qualifies you for the Earned Income Credit.

What disqualifies you from earned income credit?

In general, disqualifying income is investment income such as taxable and tax-exempt interest, dividends, child's interest and dividend income reported on the return, child's tax-exempt interest reported on Form 8814, line 1b, net rental and royalty income, net capital gain income, other portfolio income, and net

What qualifies you for the earned income credit?

You have to be 25 or older but under 65 to qualify for the EIC. You also have to have lived in the United States for more than half of the year and can't be a dependent of another person. In 2024, you can earn up to $18,591 ($25,511 if married and filing a joint) with no qualifying children.

Can I claim EIC if I am single?

You have a certain filing status: You must file your tax return using the status of Single, Head of Household, or Qualifying Widow(er) with a Dependent Child to be eligible for the EIC. Generally, the Married Filing Separately status doesn't qualify.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for Earned Income Credit?

The Claim for Earned Income Credit is a tax provision designed to benefit low to moderate-income working individuals and families by reducing the amount of tax owed and potentially providing a refund.

Who is required to file Claim for Earned Income Credit?

Individuals who have earned income and meet certain income and filing status requirements are eligible to file for the Earned Income Credit, particularly those with qualifying children or, in some cases, those without children.

How to fill out Claim for Earned Income Credit?

To fill out the Claim for Earned Income Credit, taxpayers need to complete the IRS Form 1040 or Form 1040A and attach Form EIC, which provides the necessary information about qualifying children and income levels.

What is the purpose of Claim for Earned Income Credit?

The purpose of the Claim for Earned Income Credit is to incentivize and support working individuals and families by providing financial relief through tax credits that can raise their income and reduce poverty.

What information must be reported on Claim for Earned Income Credit?

Taxpayers must report their earned income, adjusted gross income, filing status, and information regarding any qualifying children, including their names, Social Security numbers, and dates of birth.

Fill out your claim for earned income online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Earned Income is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.