Get the free IT-112-R - tax ny

Show details

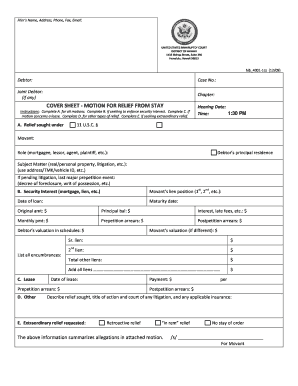

This form is used to claim a resident tax credit or report taxes paid to Canadian provinces for New York State residents.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-112-r - tax ny

Edit your it-112-r - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-112-r - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit it-112-r - tax ny online

To use our professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit it-112-r - tax ny. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-112-r - tax ny

How to fill out IT-112-R

01

Gather all necessary documentation related to your tax year income.

02

Obtain the IT-112-R form from your local tax office or download it from the appropriate governmental website.

03

Fill out your personal information at the top of the form, including name, address, and social security number.

04

Report your total income on the designated lines, ensuring to include all applicable income sources.

05

Deduct any eligible expenses or credits as instructed in the form guidelines.

06

Review your entries for accuracy to avoid any potential errors.

07

Sign and date the form before submission.

08

Submit the completed form by the designated deadline via the method specified (online or by mail).

Who needs IT-112-R?

01

Individuals who have earned income and are required to report their taxes.

02

Taxpayers seeking to claim specific deductions or credits associated with their income.

03

Residents of certain states that mandate the use of form IT-112-R for filing state income tax.

Fill

form

: Try Risk Free

People Also Ask about

Who qualifies for NYS resident credit?

You are entitled to claim this nonrefundable credit for the tax year if: you were a full-year or part-year resident of New York State, or a New York State-resident estate or trust, or a part-year resident trust; and.

What is the CT state income tax?

Connecticut introduced its first state income tax—a flat rate of 4.5%—on August 22, 1991, to help offset a $963 million budget deficit. Today, the state uses a progressive state income tax system with seven tax rates—ranging from 2% to 6.99%—for the 2024 tax year (the taxes you'll file in 2025).

Who qualifies for NYS resident credit?

You are entitled to claim this nonrefundable credit for the tax year if: you were a full-year or part-year resident of New York State, or a New York State-resident estate or trust, or a part-year resident trust; and.

What is NY IT 112 R?

If you paid tax to both a state and one or more local governments within that state, you must use one Form IT-112-R to claim the resident credit for both taxes.

Who pays NY City resident taxes?

As a resident, you pay state tax (and city tax if a New York City or Yonkers resident) on all your income no matter where it is earned. As a nonresident, you only pay tax on New York source income, which includes earnings from work performed in New York State, and income from real property located in the state.

Do I have to file a New York State tax return as a non-resident?

What are the filing requirements for New York as a Part-Year or Nonresident? ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction.

What is 112 R CT?

Who should file Form IT-112-R? Your client should file this form to claim a credit against their New York State tax if they resided in New York for all or part of the year, and they had income sourced to and taxed by: Another state. A local government within another state.

What is the nonresident filing threshold for CT?

The gross income (federal adjusted gross income with any additions to income from Form CT-1040NR/PY, Schedule 1, Line 33, Interest on state and local government obligations other than Connecticut) is $16,000. Therefore, the nonresident must file a Connecticut nonresident income tax return.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-112-R?

IT-112-R is a tax form used in certain jurisdictions for reporting specific tax credits or deductions related to individual income tax.

Who is required to file IT-112-R?

Individuals who are eligible for specific tax credits or deductions as outlined by the jurisdiction's tax authority are required to file IT-112-R.

How to fill out IT-112-R?

To fill out IT-112-R, gather the necessary documentation, complete each section of the form with accurate personal and financial information, and ensure that you calculate any credits or deductions correctly before submitting it to the tax authority.

What is the purpose of IT-112-R?

The purpose of IT-112-R is to enable taxpayers to claim specific tax credits or deductions, which can reduce their overall tax liability.

What information must be reported on IT-112-R?

IT-112-R must report personal information such as the taxpayer's name, address, Social Security number, and details regarding eligible credits or deductions, including income information and any relevant supporting documentation.

Fill out your it-112-r - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-112-R - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.