Get the free Claim for EDZ Wage Tax Credit - tax ny

Show details

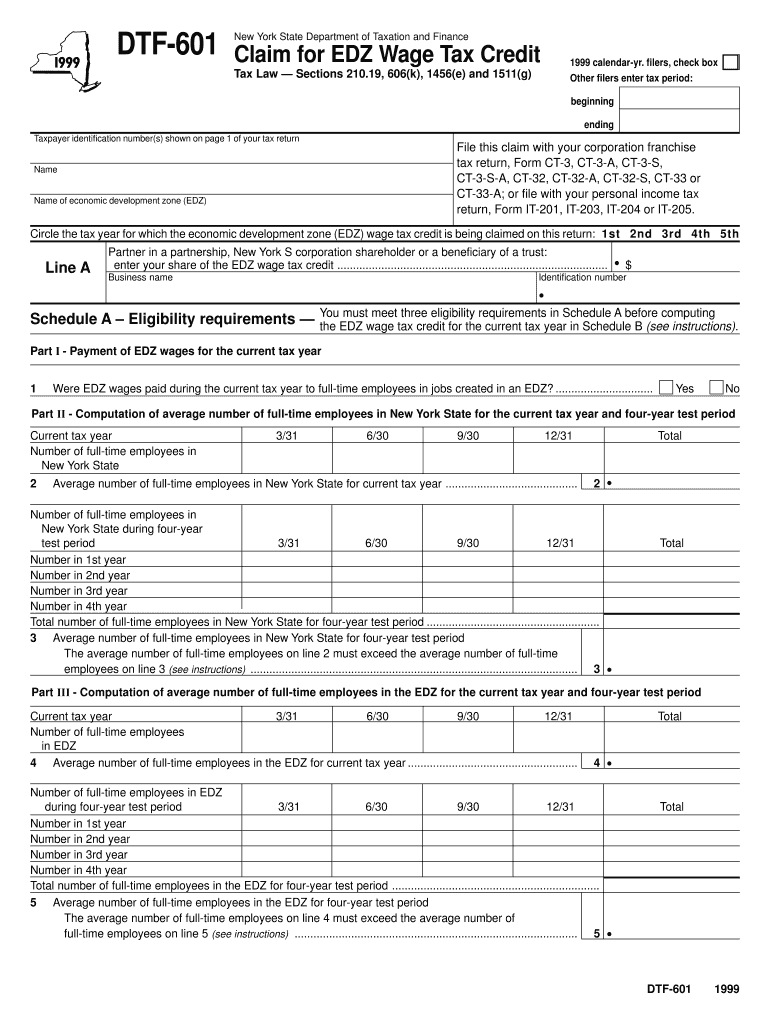

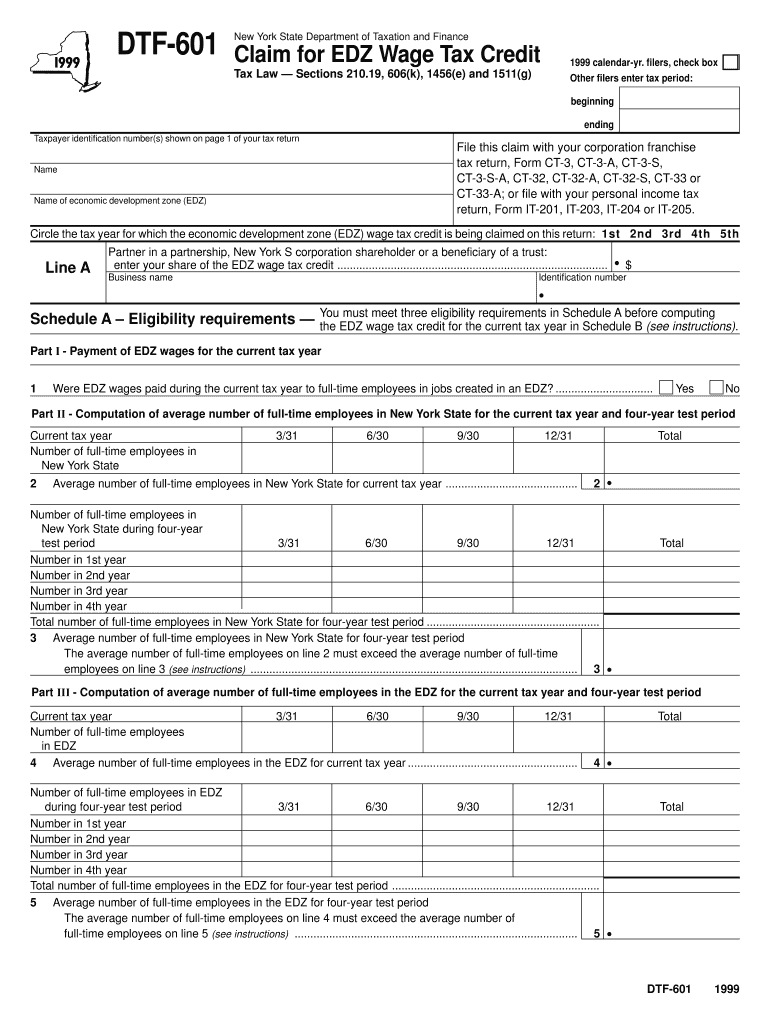

This document serves as a claim for the Economic Development Zone (EDZ) Wage Tax Credit, specifying eligibility requirements and providing computational sections for tax credits related to employment

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for edz wage

Edit your claim for edz wage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for edz wage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claim for edz wage online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit claim for edz wage. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for edz wage

How to fill out Claim for EDZ Wage Tax Credit

01

Gather necessary documentation, including employee records and wage information.

02

Obtain the Claim for EDZ Wage Tax Credit form from the appropriate tax authority website or office.

03

Fill in Part A of the form with your business information, including name, address, and tax identification number.

04

Complete Part B with details of the employees for whom you are claiming the credit, including their names, Social Security numbers, and wages paid.

05

In Part C, calculate the credit amount based on the eligible wages paid to those employees.

06

Review the completed form for accuracy and ensure all required attachments are included.

07

Submit the form by the deadline indicated on the instructions, either electronically or by mail.

Who needs Claim for EDZ Wage Tax Credit?

01

Employers located in an Economic Development Zone (EDZ) who employ eligible workers and wish to claim tax credits for wages paid.

Fill

form

: Try Risk Free

People Also Ask about

How much money do you get for an ERC?

How much money will my small business get from the ERC? YearMaximum refund per employeeHow the ERC is calculated 2020 up to $5,000 per employee 50% of first $10,000 in wages per employee 2021 up to $21,000 per employee 70% of first $10,000 in wages per employee (quarters 1, 2, 3)

Should I claim the foreign tax credit?

You are allowed to deduct all of your foreign taxes but can only take the foreign tax credit in the current year to the extent of your US income tax on foreign income. So if your foreign tax rate is high and your foreign income is low in relation to your US income, the deduction may have the better result.

Who qualifies for the employee retention tax credit?

You may qualify for ERC if your business or organization experienced a significant decline in gross receipts during 2020 or a decline in gross receipts during the first three quarters of 2021.

How to claim WOTC credit?

What is the process for applying for WOTC? Complete the Individual Characteristics Form (ETA 9061) (PDF). Complete the Pre-Screening Notice and Certification Request (IRS Form 8850) (PDF). Both the employer and job seeker must sign the forms under penalty of perjury, confirming the job seeker belongs to a target group.

Can I apply for ERC myself?

Yes, you can apply for the ERC yourself if you're confident in understanding if your business is small or large based on the number of employees, how the 2020 requirements compare to 2021's, how to work out a substantive decline in operations, calculating qualified wages and completing Form 941.

Who is eligible for the employee retention tax credit?

To qualify for ERC, you need to have been subject to a qualifying government order related to COVID-19 that caused a full or partial suspension of your trade or business operations. The government order may be at the local, state or federal level.

Do I qualify for ERC if I got PPP?

Yes. Although, the Employee Retention Credit cannot be claimed on wages paid with the proceeds from a forgiven PPP Loan. With our ERC Calculator, you can quickly see if your business qualifies to receive ERC.

Do I get money back from a tax credit?

Taxes are calculated first, then credits are applied to the taxes you have to pay. Some credits—called refundable credits—will even give you a refund if you don't owe any tax. Other credits are nonrefundable, meaning that if you don't owe any federal taxes, you don't get the credit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for EDZ Wage Tax Credit?

The Claim for EDZ Wage Tax Credit is a request submitted by eligible businesses in an Empowerment Zone to receive a tax credit for wages paid to qualified employees.

Who is required to file Claim for EDZ Wage Tax Credit?

Businesses operating within an Empowerment Zone that qualify for the tax credit based on employee criteria are required to file the Claim for EDZ Wage Tax Credit.

How to fill out Claim for EDZ Wage Tax Credit?

To fill out the Claim for EDZ Wage Tax Credit, businesses must complete the designated form by providing necessary information about the company, qualified employees, and wages paid. Supporting documentation may also be required.

What is the purpose of Claim for EDZ Wage Tax Credit?

The purpose of the Claim for EDZ Wage Tax Credit is to incentivize businesses to hire and retain employees in economically disadvantaged areas, thereby encouraging economic development and job creation.

What information must be reported on Claim for EDZ Wage Tax Credit?

Claim for EDZ Wage Tax Credit must report information such as the business identification, employee details (including qualifying status), wages paid, and any relevant tax identification numbers.

Fill out your claim for edz wage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Edz Wage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.