Get the free CT-40 Claim for Alternative Fuels Credit - tax ny

Show details

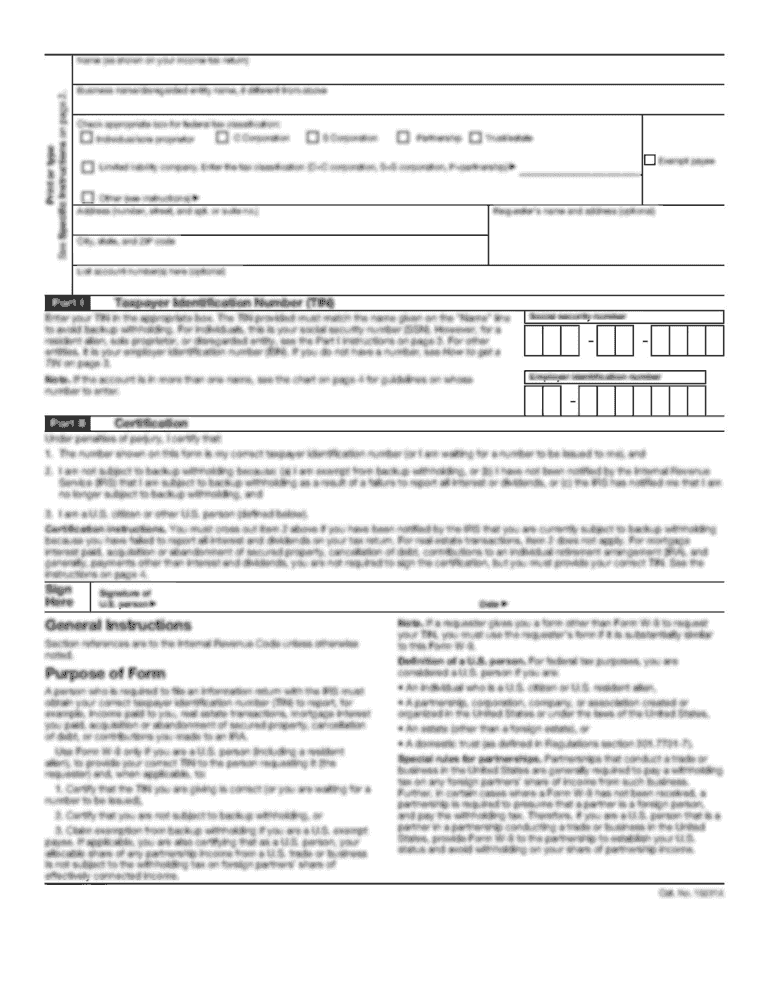

A form for taxpayers in New York State to claim tax credits for alternative fuels, clean-fuel vehicles, and related property, detailing how to compute and report any credits applicable for the tax

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign ct-40 claim for alternative

Edit your ct-40 claim for alternative form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your ct-40 claim for alternative form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing ct-40 claim for alternative online

To use our professional PDF editor, follow these steps:

1

Sign into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit ct-40 claim for alternative. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out ct-40 claim for alternative

How to fill out CT-40 Claim for Alternative Fuels Credit

01

Obtain Form CT-40 from the official tax website or relevant authorities.

02

Enter your personal information at the top of the form, including your name, address, and taxpayer identification number.

03

Specify the tax year for which you are claiming the Alternative Fuels Credit.

04

List the types and amounts of alternative fuels used during the tax year in the designated section.

05

Calculate the total credit by referring to the guidelines for the specific alternative fuels used.

06

Complete any additional supporting documentation required.

07

Review the form for accuracy and ensure all sections are filled out.

08

Sign and date the form before submission.

09

Submit the completed CT-40 form electronically or by mail to the appropriate tax authority.

Who needs CT-40 Claim for Alternative Fuels Credit?

01

Individuals and businesses that use alternative fuels in their vehicles or operations.

02

Taxpayers seeking to claim tax credits for fuel types such as biodiesel, ethanol, or compressed natural gas.

03

Owners of alternative fuel vehicles looking to benefit from tax incentives.

Fill

form

: Try Risk Free

People Also Ask about

What is an alternative fuel tax credit?

Consumers who purchase qualified residential fueling equipment between January 1, 2023, and December 31, 2032, may receive a tax credit of up to $1,000.

What qualifies as an alternative fuel vehicle?

The term typically refers to internal combustion engine vehicles or fuel cell vehicles that utilize synthetic renewable fuels such as biofuels (ethanol fuel, biodiesel and biogasoline), hydrogen fuel or so-called "Electrofuel".

Is alternative fuel vehicle fee tax deductible?

For consumers who purchase and an electric vehicle charger for their principal residence, the tax credit equals 30% of the cost, up to a maximum credit of $1,000 per charging port.

Is vehicle fuel tax deductible?

If you're claiming actual expenses, things like gas, oil, repairs, insurance, registration fees, lease payments, depreciation, bridge and tunnel tolls, and parking can all be deducted." Just make sure to keep a detailed log and all receipts, he advises, and keep track of your yearly mileage and then deduct the

What fuel qualifies for the fuel tax credit?

Types of fuels and uses The credit is available only for nontaxable uses of gasoline, aviation gasoline, undyed diesel and undyed kerosene. Nontaxable uses are purposes where fuel isn't used for regular driving purposes, such as: On a farm for farming purposes.

What is the Alternative Fuels Incentive Act?

A bipartisan bill — Renewable Natural Gas Incentive Act of 2025 — to provide federal tax credits for renewable natural gas (RNG) used for motor vehicle fuel was recently introduced by Sens.

What is the alternative fuel vehicle AFV conversion tax credit?

Alternative Fuel Vehicle (AFV) Conversion and Infrastructure Tax Credit. Businesses and individuals are eligible for an income tax credit of 50% of the equipment and labor costs for the conversion of qualified AFVs, up to $19,000 per vehicle.

Is the alternative fuel vehicle fee tax deductible?

For property you buy and place in service at your main home from January 1, 2023, to December 31, 2033, the credit equals 30% of the cost of the property up to a maximum credit of $1,000 per item (each charging port, fuel dispenser, or storage property).

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is CT-40 Claim for Alternative Fuels Credit?

The CT-40 Claim for Alternative Fuels Credit is a form used to claim a credit for the use of alternative fuels in the state of Connecticut. This credit is designed to incentivize the use of cleaner fuel alternatives to reduce environmental impact.

Who is required to file CT-40 Claim for Alternative Fuels Credit?

Any individual or business entity that has used alternative fuels for transportation or other purposes and wishes to claim the corresponding tax credit is required to file the CT-40 Claim for Alternative Fuels Credit.

How to fill out CT-40 Claim for Alternative Fuels Credit?

To fill out the CT-40 Claim for Alternative Fuels Credit, applicants must complete the form by providing required details about the alternative fuels used, including the type of fuel, quantity consumed, and relevant supporting documentation to substantiate the claim.

What is the purpose of CT-40 Claim for Alternative Fuels Credit?

The purpose of the CT-40 Claim for Alternative Fuels Credit is to promote the use of alternative fuels in Connecticut, reduce greenhouse gas emissions, and support environmentally friendly transportation solutions.

What information must be reported on CT-40 Claim for Alternative Fuels Credit?

Information required on the CT-40 Claim for Alternative Fuels Credit includes the claimant's identification details, the type of alternative fuels used, the total amount of fuel consumed, and documentation linking the claim to tax liabilities.

Fill out your ct-40 claim for alternative online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ct-40 Claim For Alternative is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.