Get the free IT-203-S-ATT (2000) - tax ny

Show details

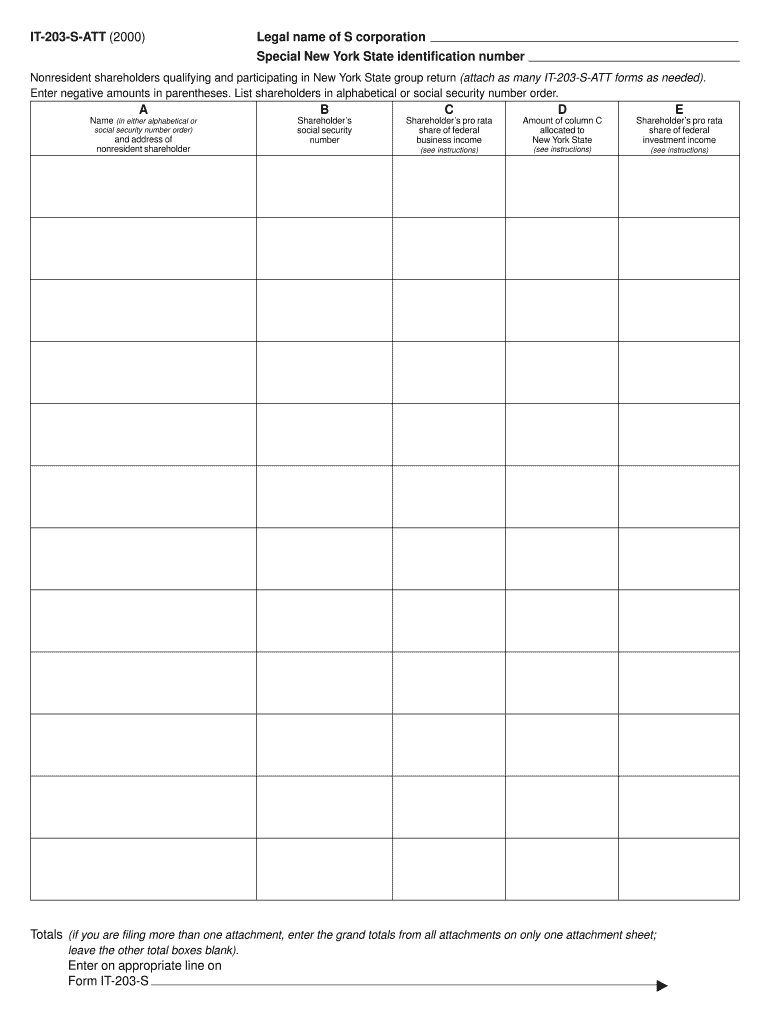

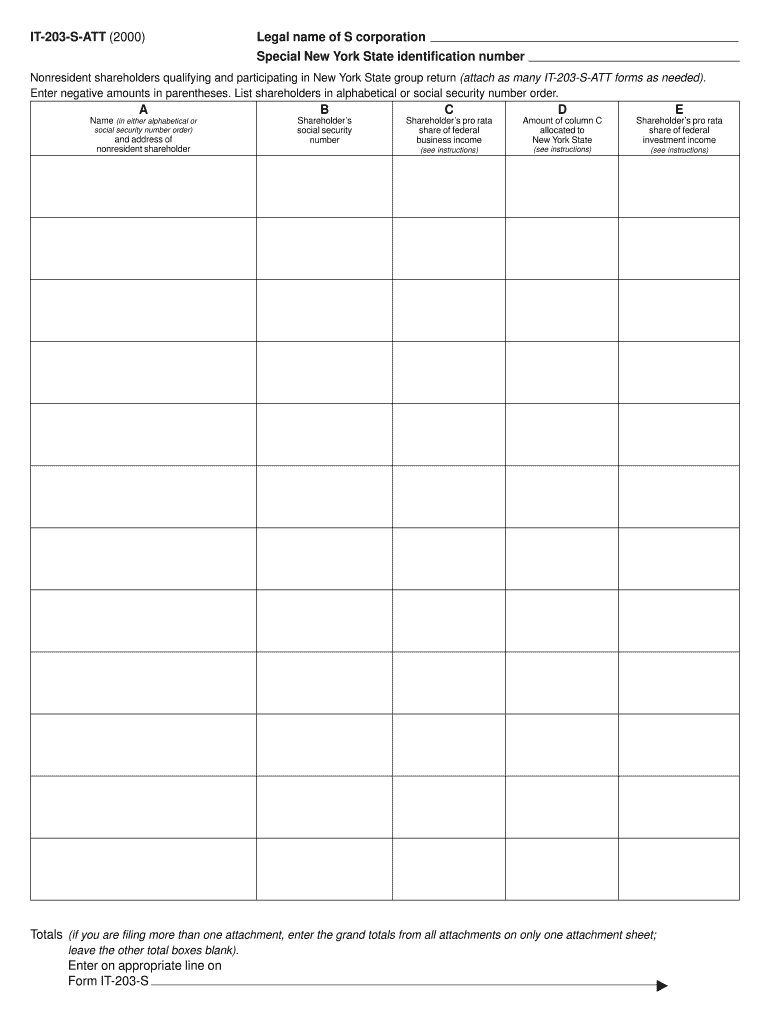

This document is an attachment form for S corporations in New York State, designed to report the shares of business and investment income allocated to nonresident shareholders for tax purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign it-203-s-att 2000 - tax

Edit your it-203-s-att 2000 - tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your it-203-s-att 2000 - tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing it-203-s-att 2000 - tax online

To use the services of a skilled PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit it-203-s-att 2000 - tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out it-203-s-att 2000 - tax

How to fill out IT-203-S-ATT (2000)

01

Obtain the IT-203-S-ATT (2000) form from the New York State Department of Taxation and Finance website or local tax office.

02

Provide your name, Social Security number, and address in the designated fields.

03

Indicate your filing status, such as single, married filing jointly, or head of household.

04

Fill in the income section, reporting all sources of income as required.

05

Complete any necessary adjustments to your income according to the instructions provided.

06

Claim deductions applicable to your situation, ensuring you adhere to the limits and criteria outlined.

07

Review any tax credits you may qualify for and fill out those sections accurately.

08

Double-check all entries for accuracy and completeness to avoid errors.

09

Sign and date the form at the bottom.

10

Submit the completed IT-203-S-ATT (2000) form to the appropriate tax authority by the due date.

Who needs IT-203-S-ATT (2000)?

01

Individuals who are part-year residents or non-residents of New York State seeking to report their New York source income.

02

Taxpayers who have filed their federal tax return and need to report income and deductions specific to New York State.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax code 203?

What Is Tax Topic 203? Tax Topic 203, also referred to as Reduced Refund, is an informative page that the IRS will direct you to if they have deducted a portion of your federal income tax refund to satisfy specific financial debts through the Treasury Department's tax refund offset program.

What does form It-201 mean?

The State Tax Form 201, also known as IT-201, is the standard income tax return form for New York State residents. This form is used to report income, calculate tax liability, and claim credits or deductions. Think of it as the New York equivalent of the federal Form 1040.

What is 203 income tax?

Section 203 of the Income Tax Act requires employers to deduct TDS from the salaries paid to their employees. The TDS amount is calculated based on the employee's income tax slab rate, and the employer is responsible for deducting and remitting the TDS to the government on behalf of the employee.

Who must file a NY nonresident tax return?

What are the filing requirements for New York as a Part-Year or Nonresident? ing to Form IT-203-I, you must file a New York part-year or nonresident return if: You have any income from a New York source and your New York AGI exceeds your New York State standard deduction.

What is the tax code 203?

What Is Tax Topic 203? Tax Topic 203, also referred to as Reduced Refund, is an informative page that the IRS will direct you to if they have deducted a portion of your federal income tax refund to satisfy specific financial debts through the Treasury Department's tax refund offset program.

Who qualifies for the New York City school tax credit?

The New York City School Tax credit is available to New York City residents or part-year residents who cannot be claimed as a dependent on another taxpayer's federal income tax return. The credit amounts vary. This credit must be claimed directly on the New York State personal income tax return.

What is an IT-203 nonresident income tax return?

NY Form IT-203 is a New York State income tax return for nonresidents and part-year residents. It is used to report income earned in New York State by individuals who are not considered to be full-year residents of the state.

What is the difference between it-203 and it 201?

The nonresident or part-year resident, if required to file a New York State return, must use Form IT-203. However, if you both choose to file a joint New York State return, use Form IT-201; both spouses' income will be taxed as full-year residents of New York State.

What is NY tax form 203?

The form ensures that New York State receives its fair share of taxes on income that was earned while the taxpayer resided in the state, even if the income is received after moving out. The regulation governing the multiyear allocation of equity compensation is detailed in the New York State Tax Law, Section 601(e).

What is a nonresident income tax return?

Generally, you'll need to file a nonresident state return if you made money from sources in a state you don't live in. Some examples are: Wages or income you earned while working in that state. Out-of-state rental income, gambling winnings, or profits from property sales.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is IT-203-S-ATT (2000)?

IT-203-S-ATT (2000) is a New York State tax form used by non-resident individuals to report income received from New York State sources and to calculate New York State tax obligations.

Who is required to file IT-203-S-ATT (2000)?

Non-resident individuals who have income derived from New York State sources and who meet certain income thresholds are required to file IT-203-S-ATT (2000).

How to fill out IT-203-S-ATT (2000)?

To fill out IT-203-S-ATT (2000), individuals need to gather income information, complete the sections on income earned in New York, deductions, and provide relevant supporting documentation before submitting the form to the New York State tax authority.

What is the purpose of IT-203-S-ATT (2000)?

The purpose of IT-203-S-ATT (2000) is to enable non-resident individuals to report their New York State source income and calculate the correct amount of New York State tax owed.

What information must be reported on IT-203-S-ATT (2000)?

Information that must be reported on IT-203-S-ATT (2000) includes total income from New York sources, adjustments to income, applicable deductions, credits, and any taxes already paid to New York State.

Fill out your it-203-s-att 2000 - tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

It-203-S-Att 2000 - Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.