Get the free Claim for EZ Wage Tax Credit - tax ny

Show details

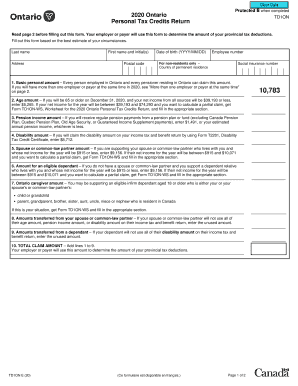

This form is used to claim the EZ Wage Tax Credit for eligible businesses in New York State, detailing the criteria for eligibility, employee counts, and the tax credit calculation.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for ez wage

Edit your claim for ez wage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for ez wage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for ez wage online

To use the services of a skilled PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit claim for ez wage. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for ez wage

How to fill out Claim for EZ Wage Tax Credit

01

Obtain the EZ Wage Tax Credit Claim Form from your state's tax department website.

02

Fill out your personal information including name, address, and Social Security number.

03

Indicate your employer's information, including their name and Employer Identification Number (EIN).

04

Provide details on your wages for the qualifying period, including total wages paid and the number of hours worked.

05

Include any required documentation, such as pay stubs or proof of employment.

06

Complete all necessary sections of the form, ensuring accuracy in calculations.

07

Review your application for completeness and correctness before submitting.

08

Submit the completed form to the appropriate tax authority by the specified deadline.

Who needs Claim for EZ Wage Tax Credit?

01

Individuals who were employed by a qualifying employer during the eligible period and earned wages.

02

Employers seeking to provide benefits to eligible employees under the EZ Wage Tax Credit program.

03

Taxpayers looking to reduce their tax liabilities through qualifying wage credits.

Fill

form

: Try Risk Free

People Also Ask about

How to claim the earned income tax credit?

You must file Form 1040, U.S. Individual Income Tax Return or Form 1040-SR, U.S. Tax Return for Seniors. If you are claiming the credit for a qualifying child, you must also file the Schedule EIC (Form 1040 or 1040-SR), Earned Income Credit with your return.

What is the tax credit for wages?

More In Credits & Deductions The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund.

What is a tax credit and how does it work?

A credit is an amount you subtract from the tax you owe. This can lower your tax payment or increase your refund. Some credits are refundable — they can give you money back even if you don't owe any tax. To claim credits, answer questions in your tax filing software.

What is the $6,000 tax credit?

A bipartisan group of lawmakers has introduced a bill that would give parents up to $6,000 per child in expanded tax credits. It's part of a wider piece of legislation called the Affordable Childcare Act, led by Reps.

Does tax credit mean you get money back?

Tax credits are amounts you subtract from your bottom-line tax due when you file your tax return. Most tax credits can reduce your tax only until it reaches $0. Refundable credits go beyond that to give you any remaining credit as a refund. That's why it's best to file taxes even if you don't have to.

Who is eligible for the $1000 tax credit?

American Opportunity Tax Credit (partially refundable) Up to $1,000 of the American Opportunity Tax Credit is refundable. Your modified adjusted gross income must be $90,000 or less ($180,000 or less for married filing jointly) to claim the credit.

Who is eligible for the income tax credit?

You may be eligible for a California Earned Income Tax Credit (CalEITC) up to $3,644 for tax year 2024 as a working family or individual earning up to $31,950 per year. You must claim the credit on the 2024 FTB 3514 form, California Earned Income Tax Credit, or if you e-file follow your software's instructions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for EZ Wage Tax Credit?

The Claim for EZ Wage Tax Credit is a tax credit program designed to incentivize businesses to hire employees from certain target groups, thereby promoting job creation and reducing unemployment in specific areas.

Who is required to file Claim for EZ Wage Tax Credit?

Employers who hire eligible employees from target groups, such as veterans, ex-felons, and long-term unemployed individuals, are required to file the Claim for EZ Wage Tax Credit to receive the tax benefit.

How to fill out Claim for EZ Wage Tax Credit?

To fill out the Claim for EZ Wage Tax Credit, employers must complete the designated form, providing information about the business, the qualified employees, and the wages paid, and submit it to the appropriate tax authority.

What is the purpose of Claim for EZ Wage Tax Credit?

The purpose of the Claim for EZ Wage Tax Credit is to provide financial incentives to employers for hiring individuals from disadvantaged groups, thereby promoting economic growth and workforce development.

What information must be reported on Claim for EZ Wage Tax Credit?

Employers must report information such as business identification details, names and Social Security numbers of eligible employees, dates of employment, and wages paid on the Claim for EZ Wage Tax Credit.

Fill out your claim for ez wage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Ez Wage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.