NY DTF MT-53 2012 free printable template

Show details

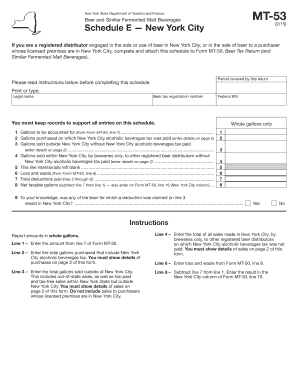

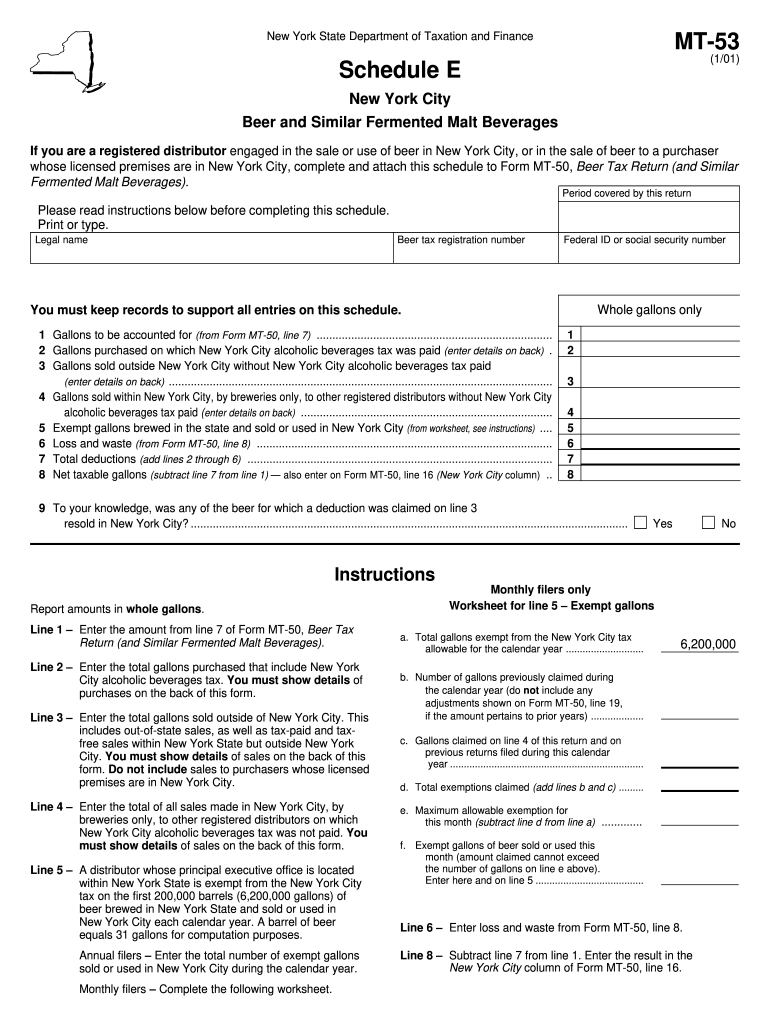

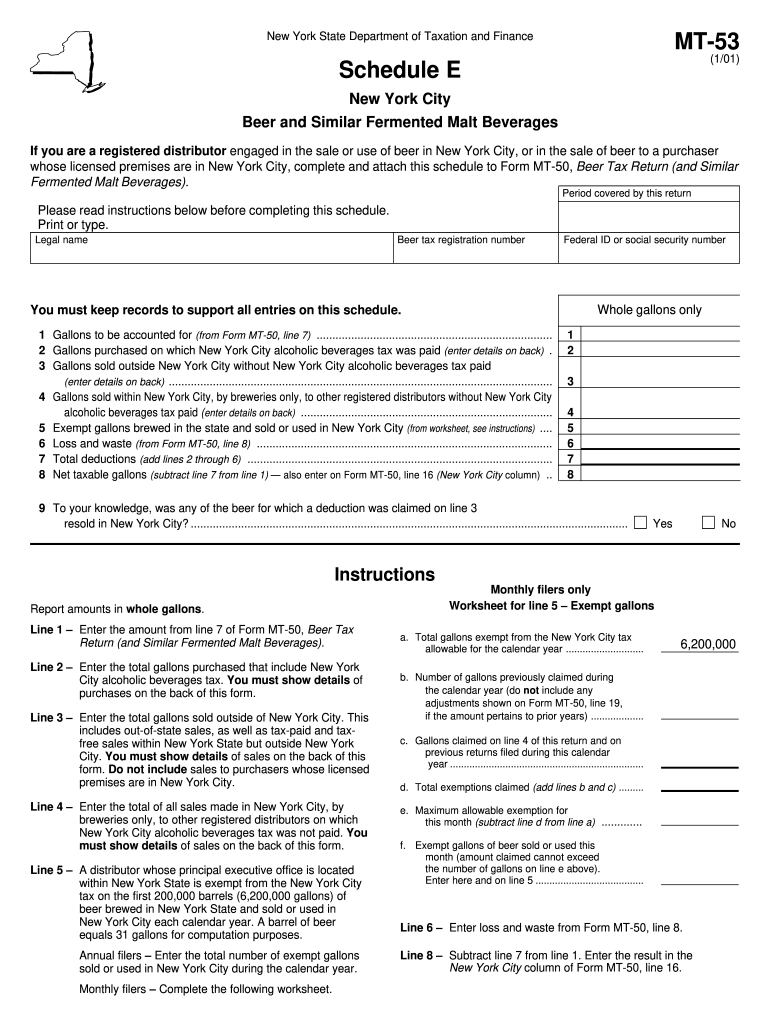

New York State Department of Taxation and Finance MT-53 (1/01) Schedule E New York City Beer and Similar Fermented Malt Beverages If you are a registered distributor engaged in the sale or use of

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NY DTF MT-53

Edit your NY DTF MT-53 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NY DTF MT-53 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NY DTF MT-53 online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit NY DTF MT-53. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NY DTF MT-53 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NY DTF MT-53

How to fill out NY DTF MT-53

01

Obtain the NY DTF MT-53 form from the New York State Department of Taxation and Finance website or your local tax office.

02

Fill in your personal information, including your name, address, and Social Security Number or Employer Identification Number.

03

Indicate the reason for the application by checking the appropriate box.

04

Provide details about the tax period related to the refund request.

05

Include any necessary documentation to support your request, such as previous tax returns or payment records.

06

Review the completed form for accuracy and sign it.

07

Submit the form by mailing it to the address provided in the instructions.

Who needs NY DTF MT-53?

01

Individuals or businesses who are seeking a refund of New York State tax overpayments.

02

Taxpayers who have received a notice from the New York State Department of Taxation and Finance regarding an adjustment or correction.

03

People wishing to claim an exemption from sales tax under certain circumstances.

Fill

form

: Try Risk Free

People Also Ask about

How much is alcohol tax in NYC?

The Taxation of Alcoholic Beverages in New York ProductNew York State Tax RateNew York City Tax RateLiquor, alcohol, distilled or rectified spirits, and wine containing more than 24% alcohol by volume$1.70 per liter$0.264 per literLiquor containing more than 2% but not more than 24% alcohol by volume$0.67 per literNone6 more rows • Oct 23, 2012

Is beer taxable in New York?

You are required to pay excise tax on alcoholic beverages sold or used in New York State during the period covered by the tax return. Under certain circumstances, registered distributors can purchase alcoholic beverages from another registered distributor without payment of the ABT.

What is the excise tax rate in NY?

If products are purchased, an 8.875% combined City and State tax will be charged. The City charges a 10.375% tax and an additional 8% surtax on parking, garaging, or storing motor vehicles in Manhattan.

What is the tax on wine in New York State?

State Excise Tax Rates on Wine StateWine ($/Gal.)Sales Tax AppliesNHnaNJ$0.88yesNM$1.70yesNY$0.30yes47 more rows

Is beer taxed in NYC?

You are required to pay excise tax on alcoholic beverages sold or used in New York State during the period covered by the tax return. Under certain circumstances, registered distributors can purchase alcoholic beverages from another registered distributor without payment of the ABT. See Interdistributor exemption.

What is the New York state tax on liquor?

New York Consumer Tax Laws Sales TaxPurchases above $110 subject to 4% State Sales Tax, 4.5% New York City sales taxUse Tax8.875%Liquor TaxBeer 14¢/gal. state, plus NYC 12¢; Still and sparkling wine 30¢/gal. (natural); Spirits <24% $1.70 per liter state, plus 26¢; Spirits >24% 67¢ per liter3 more rows

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit NY DTF MT-53 from Google Drive?

It is possible to significantly enhance your document management and form preparation by combining pdfFiller with Google Docs. This will allow you to generate papers, amend them, and sign them straight from your Google Drive. Use the add-on to convert your NY DTF MT-53 into a dynamic fillable form that can be managed and signed using any internet-connected device.

How do I complete NY DTF MT-53 online?

pdfFiller has made it simple to fill out and eSign NY DTF MT-53. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

How do I fill out NY DTF MT-53 using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign NY DTF MT-53 and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is NY DTF MT-53?

NY DTF MT-53 is a form used by the New York State Department of Taxation and Finance to report the sale of motor fuel and petroleum products in lieu of an excise tax.

Who is required to file NY DTF MT-53?

Individuals or businesses that sell or distribute motor fuel and petroleum products in New York are required to file NY DTF MT-53.

How to fill out NY DTF MT-53?

To fill out NY DTF MT-53, you need to provide details such as the seller's information, buyer's information, product type, quantities sold, and other relevant sales details as outlined in the form instructions.

What is the purpose of NY DTF MT-53?

The purpose of NY DTF MT-53 is to ensure compliance with state tax regulations and to report sales of motor fuel for proper tax assessment.

What information must be reported on NY DTF MT-53?

Information that must be reported includes the seller's and buyer's contact information, product description, quantity sold, sale date, and any applicable exemptions or deductions.

Fill out your NY DTF MT-53 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NY DTF MT-53 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.