Get the free ST-100.4 - tax ny

Show details

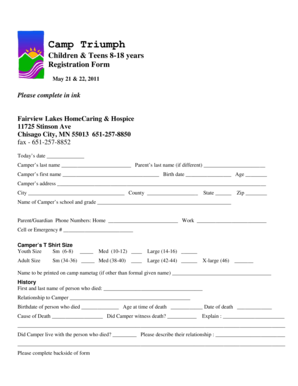

This form is used by vendors located in New York State to report sales tax transactions related to services and goods delivered in New Jersey for a specified quarterly period.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign st-1004 - tax ny

Edit your st-1004 - tax ny form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your st-1004 - tax ny form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing st-1004 - tax ny online

To use our professional PDF editor, follow these steps:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit st-1004 - tax ny. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out st-1004 - tax ny

How to fill out ST-100.4

01

Obtain the ST-100.4 form from the appropriate tax authority website or office.

02

Fill in the name of the business or individual applying.

03

Provide the address of the business or individual.

04

Include the contact information, such as phone number and email.

05

Select the appropriate box indicating the type of exemption being claimed.

06

Provide any necessary details or explanations that support the exemption claim.

07

Review the form to ensure all information is accurate and complete.

08

Sign and date the form where indicated.

09

Submit the form according to the instructions, either online or by mail.

Who needs ST-100.4?

01

Businesses or individuals seeking a specific sales tax exemption.

02

Organizations that qualify for tax exceptions under relevant tax laws.

03

Tax professionals assisting clients with exemption claims.

Fill

form

: Try Risk Free

People Also Ask about

What does Psalm 100 verse 5 mean?

Make a joyful noise unto the LORD, all ye lands. Serve the LORD with gladness: Come before his presence with singing. Know ye that the LORD he is God: It is he that hath made us, and not we ourselves; We are his people, and the sheep of his pasture.

What is the main message of Psalm 100?

Context Summary. Psalm 100:3–5 acknowledges that God deserves our submission, thankfulness, and praise. Not only is He our Creator, He also shows unfailing love and faithfulness. Chapter Summary. The 100th Psalm opens with an invitation to the whole earth to joyfully praise the Lord, serve Him, and worship Him in song.

What is the meaning of Psalm 100 1 5?

Psalm 100 is an exhortation to PRAISE - to lay everything aside that hinders us and make a joyful noise unto the Lord. God doesn't care if we sing or squeak as long as we are opening our mouths and giving him praise with a cheerful and glad heart.

What is Psalm 100 1 5 in English?

4 Enter his gates with thanksgiving; go into his courts with praise. Give thanks to him and praise his name. 5 For the LORD is good. His unfailing love continues forever, and his faithfulness continues to each generation.

What is the meaning of Psalm 100 4?

Worship the LORD with gladness; come before him with joyful songs. Know that the LORD is God. It is he who made us, and we are his; we are his people, the sheep of his pasture. Enter his gates with thanksgiving and his courts with praise; give thanks to him and praise his name.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is ST-100.4?

ST-100.4 is a New York State sales tax form used to report and pay sales and use taxes.

Who is required to file ST-100.4?

Businesses and individuals who are registered to collect sales tax in New York State and have taxable sales must file ST-100.4.

How to fill out ST-100.4?

To fill out ST-100.4, you need to provide your business information, report total sales, calculate sales tax collected, and indicate any exemptions or deductions before submitting the form.

What is the purpose of ST-100.4?

The purpose of ST-100.4 is to ensure that businesses report and remit the correct amount of sales tax collected on their taxable sales.

What information must be reported on ST-100.4?

ST-100.4 requires reporting total sales, taxable sales, exempt sales, the amount of sales tax collected, and any adjustments or credits related to previous filings.

Fill out your st-1004 - tax ny online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

St-1004 - Tax Ny is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.