Get the free Claim for ZEA Wage Tax Credit - tax ny

Show details

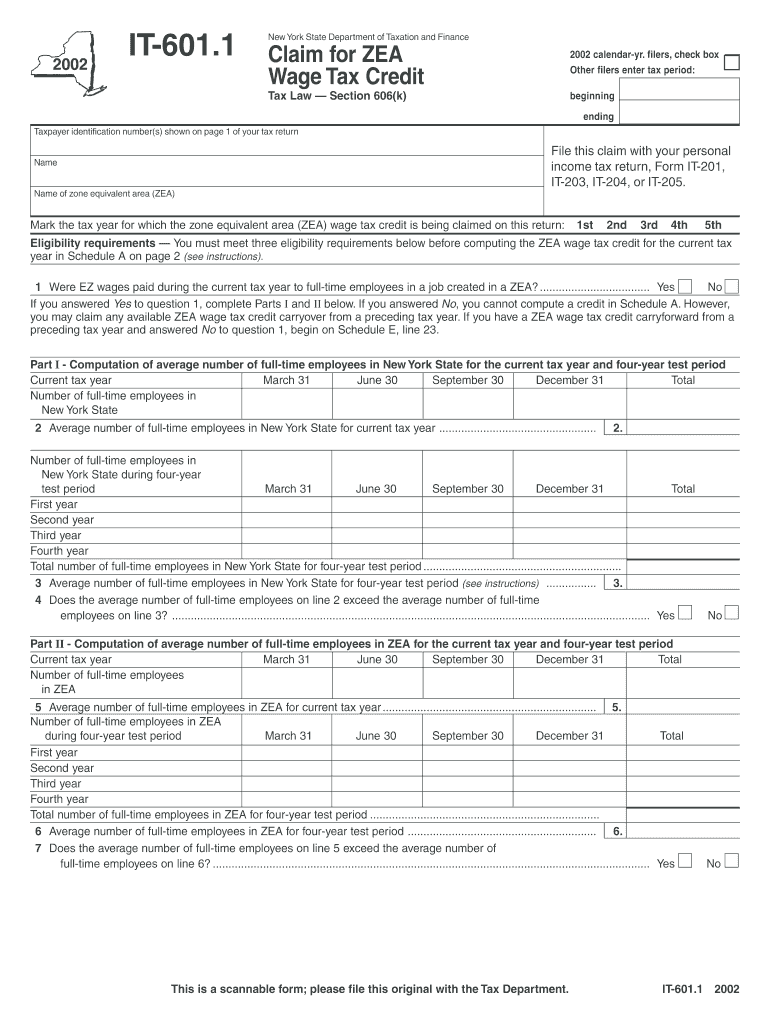

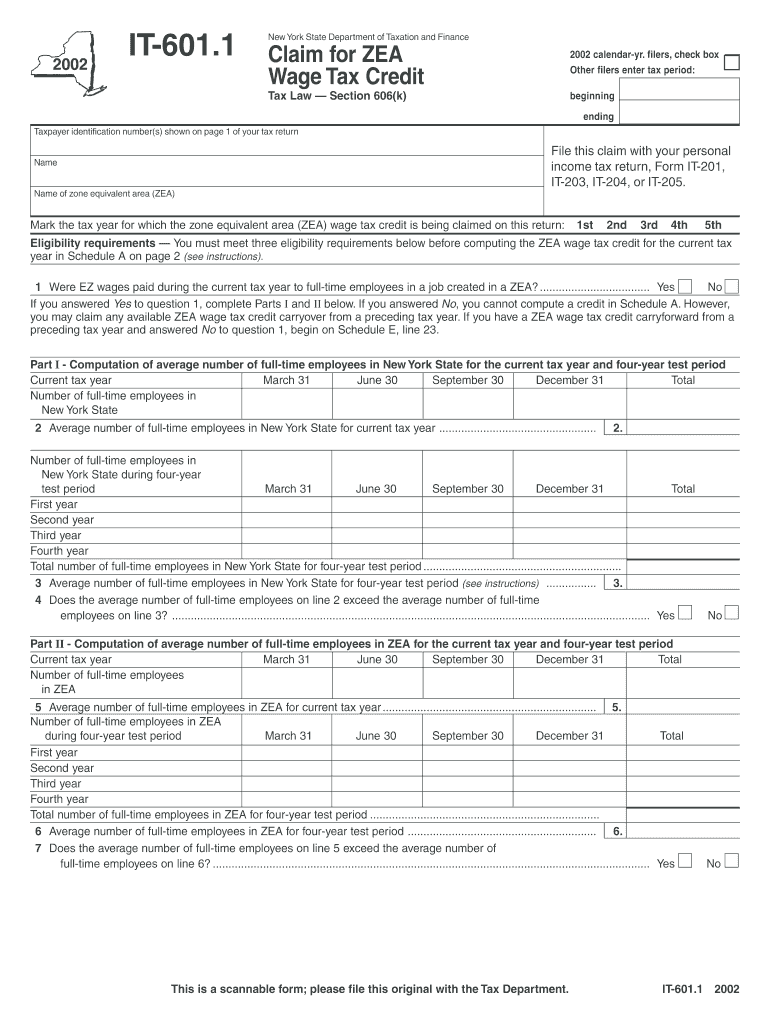

This form is used to claim the Zone Equivalent Area (ZEA) Wage Tax Credit for individuals or entities filing personal income tax returns in New York State.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for zea wage

Edit your claim for zea wage form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for zea wage form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claim for zea wage online

To use our professional PDF editor, follow these steps:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit claim for zea wage. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for zea wage

How to fill out Claim for ZEA Wage Tax Credit

01

Gather all necessary documentation, including employment records and tax information.

02

Obtain the Claim for ZEA Wage Tax Credit form from the relevant tax authority website.

03

Fill in your personal information, including name, address, and taxpayer identification number.

04

Provide details about your business, including the business name and entity type.

05

Enter the number of employees you are claiming the credit for and their corresponding wages.

06

Calculate the wage tax credit based on the guidelines provided for the specific tax year.

07

Double-check all entries for accuracy and completeness.

08

Sign and date the form to certify that all information is true and correct.

09

Submit the completed form to the appropriate tax authority before the deadline.

Who needs Claim for ZEA Wage Tax Credit?

01

Employers who have paid wages to employees and qualify for the ZEA Wage Tax Credit based on the specified eligibility criteria.

02

Businesses experiencing downturns that can benefit from wage tax relief.

03

Eligible small to medium-sized enterprises looking to reduce payroll tax burdens.

Fill

form

: Try Risk Free

People Also Ask about

What is the tax credit for wages?

More In Credits & Deductions The Earned Income Tax Credit (EITC) helps low- to moderate-income workers and families get a tax break. If you qualify, you can use the credit to reduce the taxes you owe – and maybe increase your refund.

Should I claim the foreign tax credit?

You are allowed to deduct all of your foreign taxes but can only take the foreign tax credit in the current year to the extent of your US income tax on foreign income. So if your foreign tax rate is high and your foreign income is low in relation to your US income, the deduction may have the better result.

Is the foreign tax credit worth it?

Pros of a Foreign Tax Credit One of the most significant advantages of the foreign tax credit is that it provides a dollar-for-dollar reduction in your U.S. tax liability. If you've paid foreign taxes on your income, you can directly offset your U.S. tax bill with these credits, reducing your overall tax burden.

Do I have to claim foreign tax credit on my taxes?

To avoid double taxation on Americans living abroad, the IRS gives them a choice: Deduct their foreign taxes on Schedule A, like other common deductions. Use Form 1116 to claim the Foreign Tax Credit (FTC) and subtract the taxes they paid to another country from whatever they owe the IRS.

Should I take the foreign tax credit or foreign income exclusion?

You can get FTCs for any tax amount. But if the effective tax rate in the other country is less than the US, you will end up paying the difference (which would usually make the FEIE a better option). Most countries do not have an effective tax rate lower then the US though.

Why am I getting a NYC school tax credit?

New York City school tax credit (rate reduction amount) You are entitled to this refundable credit if you: were a full-year or part-year New York City resident, cannot be claimed as a dependent on another taxpayer's federal income tax return, and. had New York City taxable income of $500,000 or less.

Are tax credits a good idea?

This can lower your tax payment or increase your refund. Some credits are refundable — they can give you money back even if you don't owe any tax. To claim credits, answer questions in your tax filing software. If you file a paper return, you'll need to complete a form and attach it.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for ZEA Wage Tax Credit?

The Claim for ZEA Wage Tax Credit is a form used by eligible employers to request a tax credit for certain wages paid to employees, aimed at encouraging job creation and retention.

Who is required to file Claim for ZEA Wage Tax Credit?

Employers who meet specific eligibility criteria, such as those who have paid qualifying wages to employees and are seeking to benefit from the tax credit, are required to file this claim.

How to fill out Claim for ZEA Wage Tax Credit?

To fill out the Claim for ZEA Wage Tax Credit, employers must complete the required sections of the form, providing details about their business, employees, and the qualifying wages paid, and submit it to the appropriate tax authority.

What is the purpose of Claim for ZEA Wage Tax Credit?

The purpose of the Claim for ZEA Wage Tax Credit is to incentivize employers to hire and retain employees, thereby promoting economic growth and reducing unemployment.

What information must be reported on Claim for ZEA Wage Tax Credit?

The information that must be reported includes the employer's identification details, the number of eligible employees, the total qualifying wages paid, and any other required documentation as specified by the tax authority.

Fill out your claim for zea wage online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Zea Wage is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.