Get the free Claim for QETC Capital Tax Credit - tax ny

Show details

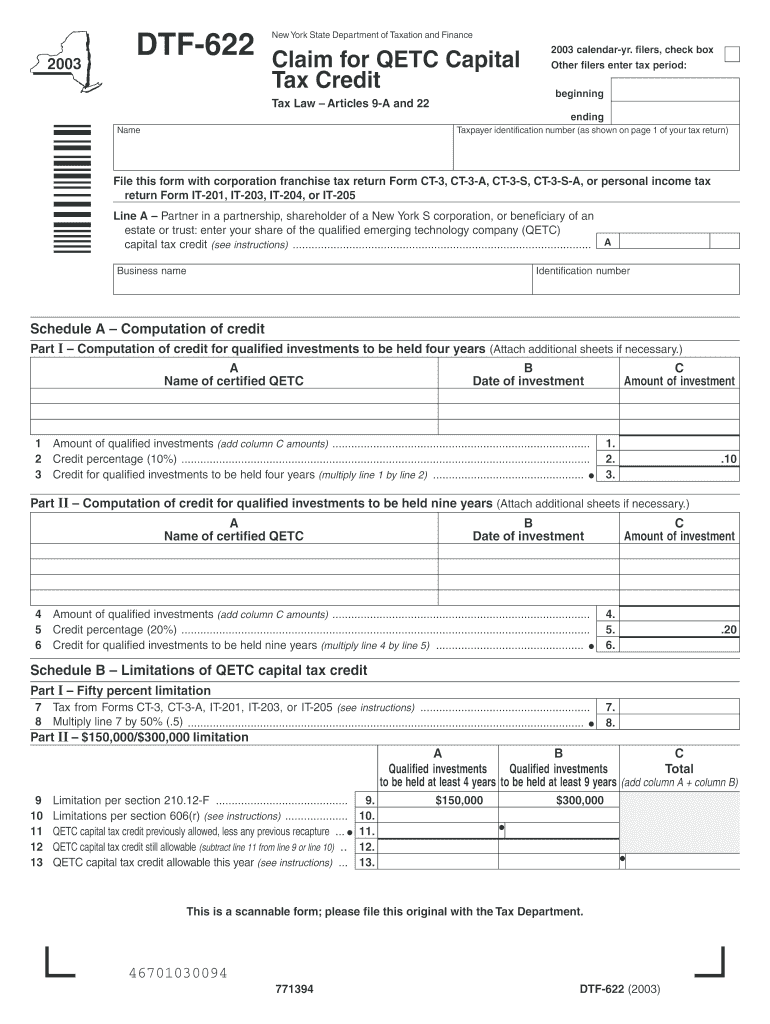

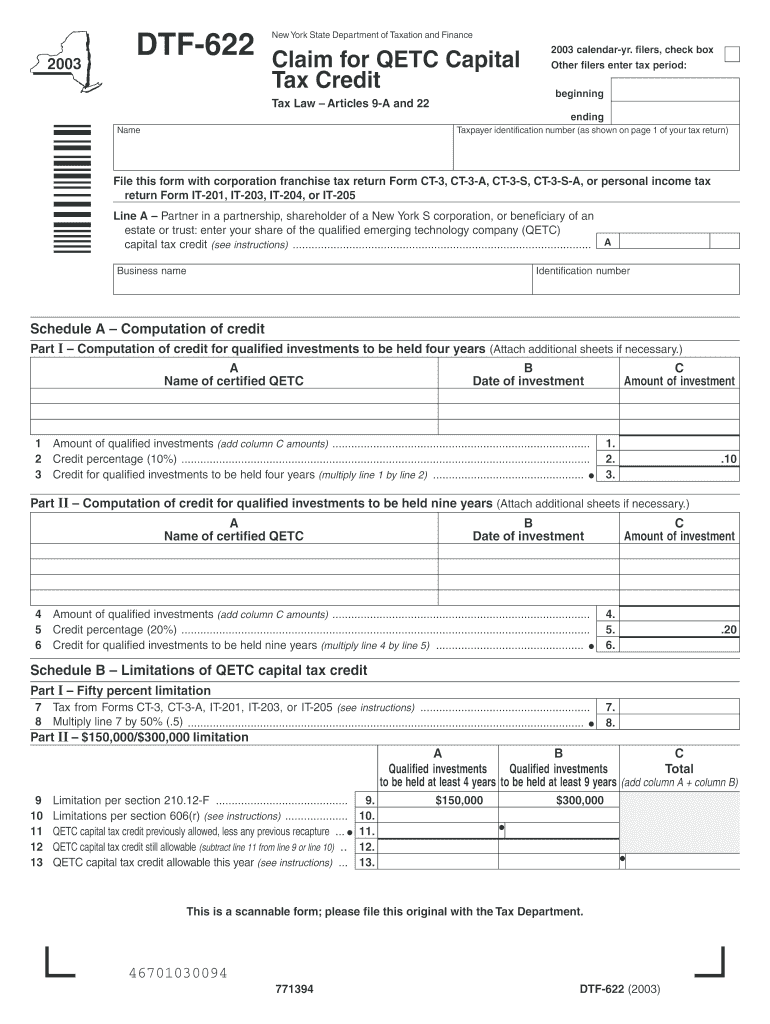

This form is used by taxpayers in New York to claim the Qualified Emerging Technology Company (QETC) capital tax credit according to specific tax laws.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for qetc capital

Edit your claim for qetc capital form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for qetc capital form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing claim for qetc capital online

Follow the guidelines below to benefit from a competent PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit claim for qetc capital. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for qetc capital

How to fill out Claim for QETC Capital Tax Credit

01

Gather all necessary documentation related to your qualified equipment and property.

02

Complete the Claim for QETC Capital Tax Credit form honestly and accurately.

03

Provide details about your business and its qualifications for the tax credit.

04

List the qualified expenditures and ensure they meet the requirements specified by the tax credit regulations.

05

Include any required supporting documentation such as invoices, receipts, and other proof of purchase.

06

Review the completed form for any errors or missing information.

07

Submit the form along with any required attachments to the appropriate tax authority by the deadline.

Who needs Claim for QETC Capital Tax Credit?

01

Businesses that have made qualified expenditures on eligible equipment and property.

02

Firms in the qualified emerging technology and telecommunications sector looking to benefit from tax credits.

03

Companies seeking financial assistance to stimulate growth and innovation through capital investments.

Fill

form

: Try Risk Free

People Also Ask about

How do you claim a tax credit?

Some credits are refundable — they can give you money back even if you don't owe any tax. To claim credits, answer questions in your tax filing software. If you file a paper return, you'll need to complete a form and attach it.

Can I write off my college tuition on my taxes?

What is considered a qualified education expense? Although key education expenses like tuition and fees are no longer tax deductible, you might be able to claim a credit by using the American Opportunity Credit or the Lifetime Learning Credit.

How do I redeem my tuition tax credit?

To claim the American opportunity credit complete Form 8863 and submit it with your Form 1040 or 1040-SR. Enter the nonrefundable part of the credit on Schedule 3 (Form 1040 or 1040-SR), line 3. Enter the refundable part of the credit on Form 1040 or 1040-SR, line 29.

How do I claim NYC school tax credits?

This credit must be claimed directly on the New York State personal income tax return. Taxpayers who are not required to file a New York State income tax return must file Form NYC-210 to get the credit. You can get more information and check refund status online and by phone. Learn more about tax credits.

How do you claim a tax credit?

Some credits are refundable — they can give you money back even if you don't owe any tax. To claim credits, answer questions in your tax filing software. If you file a paper return, you'll need to complete a form and attach it.

How do I get my education tax credit?

Be enrolled or taking courses at an eligible educational institution. Be taking higher education courses to get a degree or other recognized education credential or to get or improve job skills. Be enrolled for at least one academic period beginning in the tax year.

How do I claim ERC tax credits?

How Do I Apply for the ERC? Going forward, the only way to apply for the ERC is to file an amended Form 941X (Quarterly Federal Payroll Tax Return) for the quarters during which the company was an eligible employer.

How much do you get back from 1098?

You'll need Form 1098-T to claim the AOTC and the LLC. The AOTC is for students in their first four years of higher education. It allows you to claim up to $2,500 per eligible student. The AOTC is partially refundable, which means even if you owe no tax, you could get up to $1,000 back as a refund.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for QETC Capital Tax Credit?

The Claim for QETC Capital Tax Credit is a petition submitted by eligible businesses to receive tax credits based on qualified expenditures for capital investments in Qualified Emerging Technology Companies (QETCs).

Who is required to file Claim for QETC Capital Tax Credit?

Businesses that have made qualifying capital investments in QETCs and are seeking to benefit from the associated tax credits must file a Claim for QETC Capital Tax Credit.

How to fill out Claim for QETC Capital Tax Credit?

To fill out the Claim for QETC Capital Tax Credit, taxpayers must complete the designated form, providing details of the QETC investment, including expenses, supporting documentation, and any required tax identification information.

What is the purpose of Claim for QETC Capital Tax Credit?

The purpose of the Claim for QETC Capital Tax Credit is to incentivize investment in emerging technology sectors by providing tax relief to businesses that invest in qualified technology companies.

What information must be reported on Claim for QETC Capital Tax Credit?

The information that must be reported on the Claim for QETC Capital Tax Credit includes details of the investment made, the type of capital expenditure, identification of the QETC, and any relevant financial documents to substantiate the claim.

Fill out your claim for qetc capital online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Qetc Capital is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.