Get the free Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel - tax ny

Show details

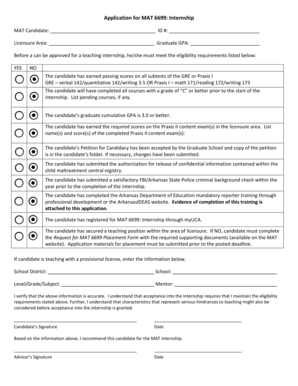

This certificate allows registered aviation fuel businesses or distributors to purchase kero-jet fuel without paying the petroleum business tax in New York State, under specified conditions.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign aviation fuel business exemption

Edit your aviation fuel business exemption form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your aviation fuel business exemption form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing aviation fuel business exemption online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit aviation fuel business exemption. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out aviation fuel business exemption

How to fill out Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel

01

Obtain the Aviation Fuel Business Exemption Certificate form from the relevant aviation authority or website.

02

Fill in the business name and address accurately in the designated fields.

03

Provide the tax identification number (TIN) or employer identification number (EIN) for your business.

04

Specify the type of fuel for which the exemption is requested—Kero-Jet Fuel in this case.

05

Indicate the purpose of using Kero-Jet Fuel in your operations, such as for commercial aviation services.

06

Ensure all required signatures and date are included at the bottom of the certificate.

07

Double-check all information for accuracy before submission to the appropriate authority.

08

Keep a copy of the completed form for your records.

Who needs Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel?

01

Businesses involved in the aviation sector that handle or operate aircraft using Kero-Jet Fuel and wish to claim fuel tax exemptions.

02

Airlines that use Kero-Jet Fuel for domestic or international flights.

03

Charter companies providing aviation services requiring Kero-Jet Fuel.

Fill

form

: Try Risk Free

People Also Ask about

What is the sales tax on jet fuel?

The prepaid sales tax on jet fuel (7/2022-6/2023): $0.1500/gal. Aviation fuels exempt from the Fuel Impact Reduction Fee (FIRF), Perfluoroalkyl and Polyfluoroalkyl Substances Fee (PFAS), and Road Usage Fee (RUF). Aviation fuels subject to 8.1% petroleum products gross earnings tax (PGET).

What is the federal excise tax rate?

Highway-related excise tax revenue totaled $41.5 billion in 2022, 47 percent of all excise tax revenue. Gasoline and diesel taxes, which are 18.4 and 24.4 cents per gallon, respectively, make up over 85 percent of total highway tax revenue, with the remaining from taxes on other fuels, trucks, trailers, and tires.

What is the federal aviation gas tax?

Since the inception of the Airport/Airways Trust Fund, the general aviation community has contributed to the system through a “fuel tax.” Fuel taxes allow aircraft users to pay federal taxes “at the pump” – general aviation pays a 21.9 cents-per-gallon tax on jet fuel and a 19.4 cents-per-gallon tax on aviation

What is the federal excise tax rate on jet fuel?

Aviation fuel excise taxes The federal fuel excise tax rates on aviation fuel are not adjusted for inflation and remain unchanged. Aviation gasoline generally is taxed at 19.4 cents per gallon, which includes the leaking underground storage fund tax (LUST).

Who pays the 720 excise tax?

Excise taxes are independent of income taxes. Often, the retailer, manufacturer or importer must pay the excise tax to the IRS and file the Form 720. Some excise taxes are collected by a third party.

What is the excise tax on a private jet?

This 7.5% tax significantly impacts the overall cost of private jet travel, creating substantial tax implications for jet card users and those utilizing private aviation services.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel?

The Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel is a document that allows eligible businesses to obtain kero-jet fuel without being subject to certain taxes, based on specific exemptions defined by local regulations.

Who is required to file Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel?

Entities that purchase kero-jet fuel for use in eligible operations, such as airlines or other commercial operators, are required to file the Aviation Fuel Business Exemption Certificate to qualify for tax exemptions.

How to fill out Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel?

To fill out the Aviation Fuel Business Exemption Certificate, businesses must provide relevant details including their company name, address, exemption reason, and the specific quantity of kero-jet fuel they intend to purchase, along with any required signatures.

What is the purpose of Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel?

The purpose of the Aviation Fuel Business Exemption Certificate is to facilitate tax-exempt purchases of kero-jet fuel by qualifying businesses, ensuring compliance with tax regulations while supporting the aviation industry.

What information must be reported on Aviation Fuel Business Exemption Certificate for Kero-Jet Fuel?

The information that must be reported on the Aviation Fuel Business Exemption Certificate includes the business's legal name and address, the type of fuel being purchased, exemption reason, the intended use of the fuel, and any other information required by local tax authorities.

Fill out your aviation fuel business exemption online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Aviation Fuel Business Exemption is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.