Get the free New York State Resident Credit Against Separate Tax on Lump-Sum Distributions - tax ny

Show details

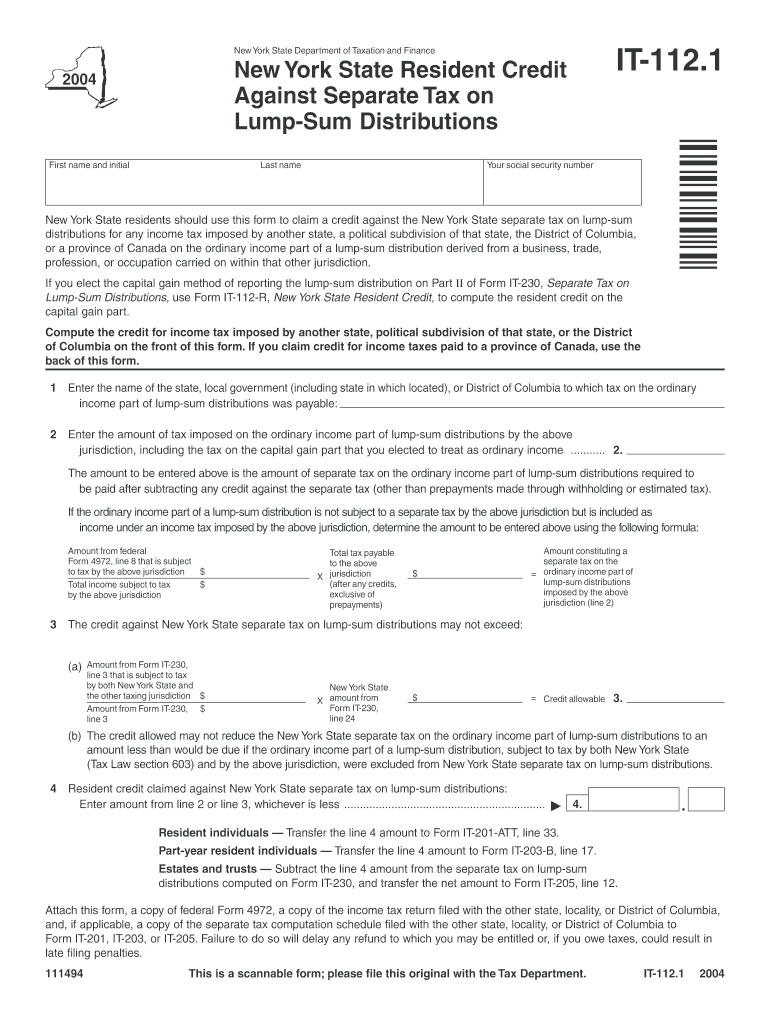

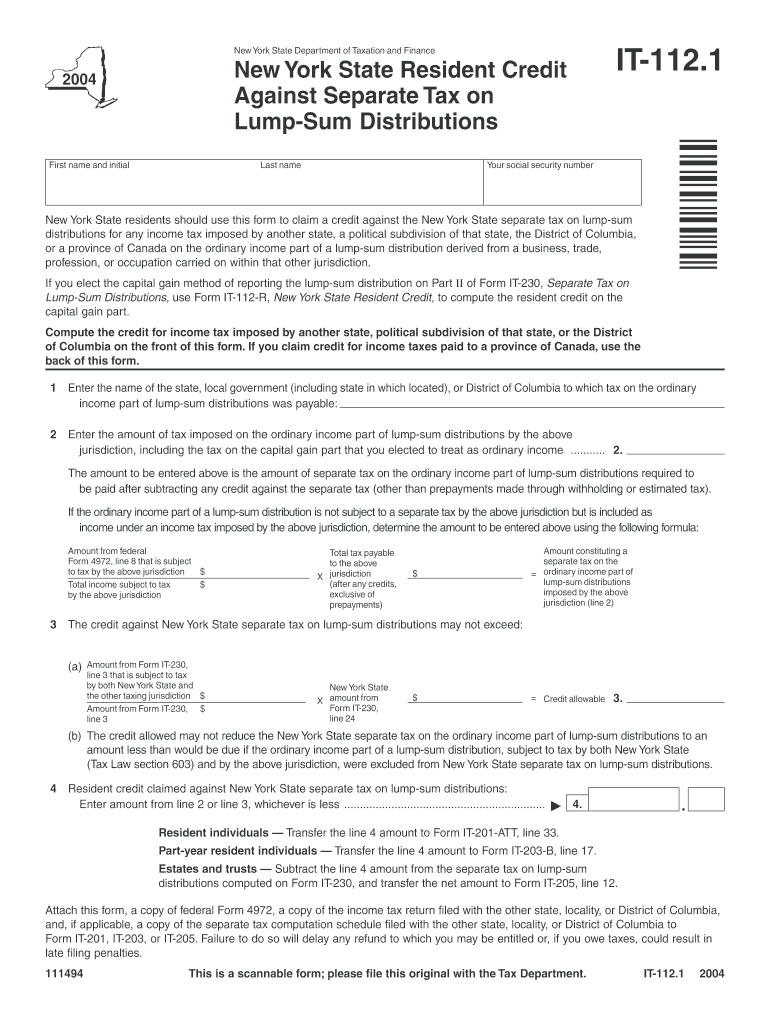

This form is used by New York State residents to claim a credit against the separate tax on lump-sum distributions for any income tax imposed by another state or jurisdiction.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new york state resident

Edit your new york state resident form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new york state resident form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new york state resident online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit new york state resident. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new york state resident

How to fill out New York State Resident Credit Against Separate Tax on Lump-Sum Distributions

01

Obtain Form IT-201 or IT-150, the required tax forms for New York State residents.

02

Locate the section for 'New York State Resident Credit Against Separate Tax on Lump-Sum Distributions' on the form.

03

Enter the total amount of the lump-sum distribution you received in the appropriate field.

04

Calculate the separate tax amount based on the distribution using the New York State tax tables or instructions provided.

05

Determine your resident credit by following the guidelines provided in the form's instructions.

06

Fill out any additional information requested, such as your personal information, income details, and filing status.

07

Review the form for accuracy and completeness before submitting.

08

Submit the completed form to the New York State Department of Taxation and Finance by the due date.

Who needs New York State Resident Credit Against Separate Tax on Lump-Sum Distributions?

01

New York State residents who have received a lump-sum distribution from a qualified pension, profit-sharing, or stock bonus plan.

02

Taxpayers who wish to claim a credit to offset the separate tax imposed on such distributions.

Fill

form

: Try Risk Free

People Also Ask about

What is a lump-sum distribution credit?

Key Takeaways A lump-sum distribution is an amount of money due that is paid all at once, as opposed to being paid in regular installments.

Which New York state form is used to compute the separate tax on sum distributions?

Submit with Form IT-230 a statement showing the source and amount of each lump-sum distribution you reported on federal Form 4972.

Should I take a lump sum distribution from my pension?

Personally, I would say if you don't have a good plan for retirement yet, keep the pension to form a basis for your retirement. If you are already well on your way to saving for retirement with a solid plan, then the lump sum provides a higher upside.

What is a lump sum distribution credit in Ohio?

Ohio lets you claim a credit if you distributed the entire balance of an employee benefit plan (like a 401(k) or pension) during one year, and are age 65 or older.

What is an example of a lump sum distribution?

A lump-sum distribution is the distribution or payment within a single tax year of a plan participant's entire balance from all of the employer's qualified plans of one kind (for example, pension, profit-sharing, or stock bonus plans).

What is a NY state resident credit?

you are a resident of New York State and another state or Canadian province for income tax purposes, and. the other jurisdiction allows a credit against its tax for the total resident tax paid to New York State.

What is a lump sum credit?

The term “lump-sum credit” means the unrefunded amount consisting of retirement deductions made from a participant's basic pay and amounts deposited by a participant covering earlier service, including any amounts deposited under section 2082(h) of this title .

How do you calculate tax on lump-sum distribution?

Here's how to calculate the taxes: Federal Income Taxes: Determine your tax bracket based on your total income, including the lump sum. Apply this percentage to the lump sum to estimate the federal tax. State Income Taxes: Similar to federal taxes, apply your state's income tax rate to the lump sum.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New York State Resident Credit Against Separate Tax on Lump-Sum Distributions?

The New York State Resident Credit Against Separate Tax on Lump-Sum Distributions is a tax credit that allows residents of New York State to offset the separate tax that applies to lump-sum distributions from pensions, annuities, or retirement plans.

Who is required to file New York State Resident Credit Against Separate Tax on Lump-Sum Distributions?

Residents of New York State who receive lump-sum distributions from their pension, annuity, or other retirement accounts and are subject to the separate tax are required to file for this credit.

How to fill out New York State Resident Credit Against Separate Tax on Lump-Sum Distributions?

To fill out the form, taxpayers need to provide information regarding their lump-sum distribution, the calculations for the separate tax owed, and the amount of credit they are claiming based on their New York State residency.

What is the purpose of New York State Resident Credit Against Separate Tax on Lump-Sum Distributions?

The purpose of the credit is to alleviate the tax burden on New York State residents receiving lump-sum distributions, ensuring that they are not disproportionately taxed compared to other income types.

What information must be reported on New York State Resident Credit Against Separate Tax on Lump-Sum Distributions?

Taxpayers must report their personal information, details of the lump-sum distribution, the amount of tax calculated, and the specific tax year for which the credit is being claimed.

Fill out your new york state resident online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New York State Resident is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.