Get the free Claim for QETC Capital Tax Credit - tax ny

Show details

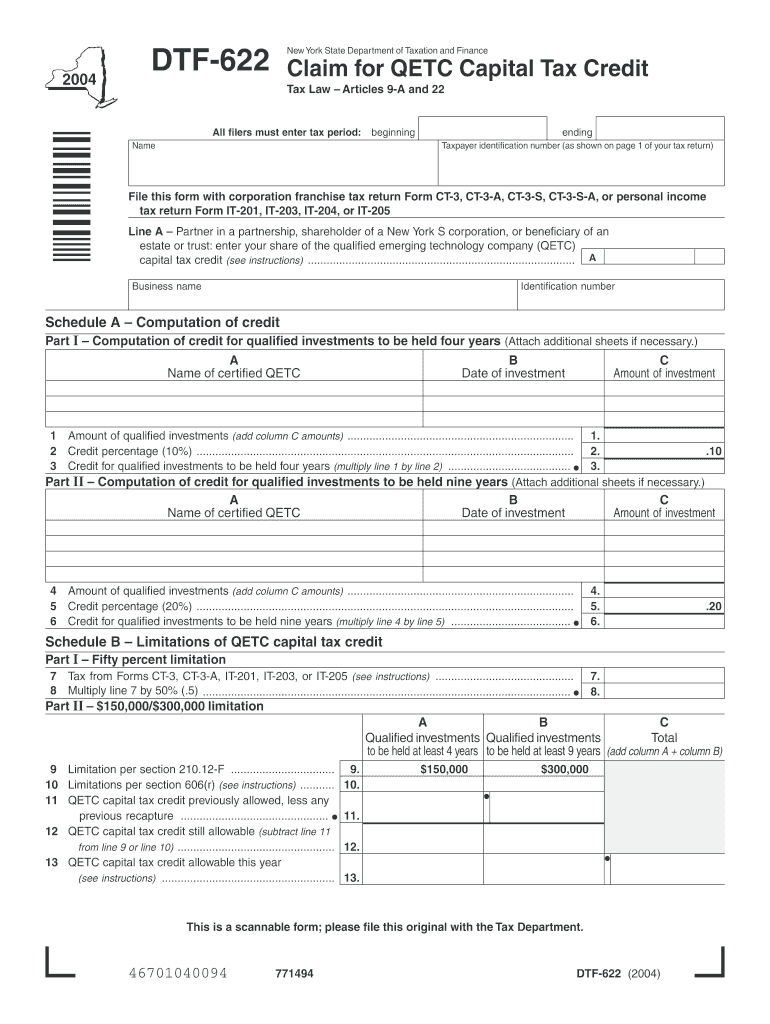

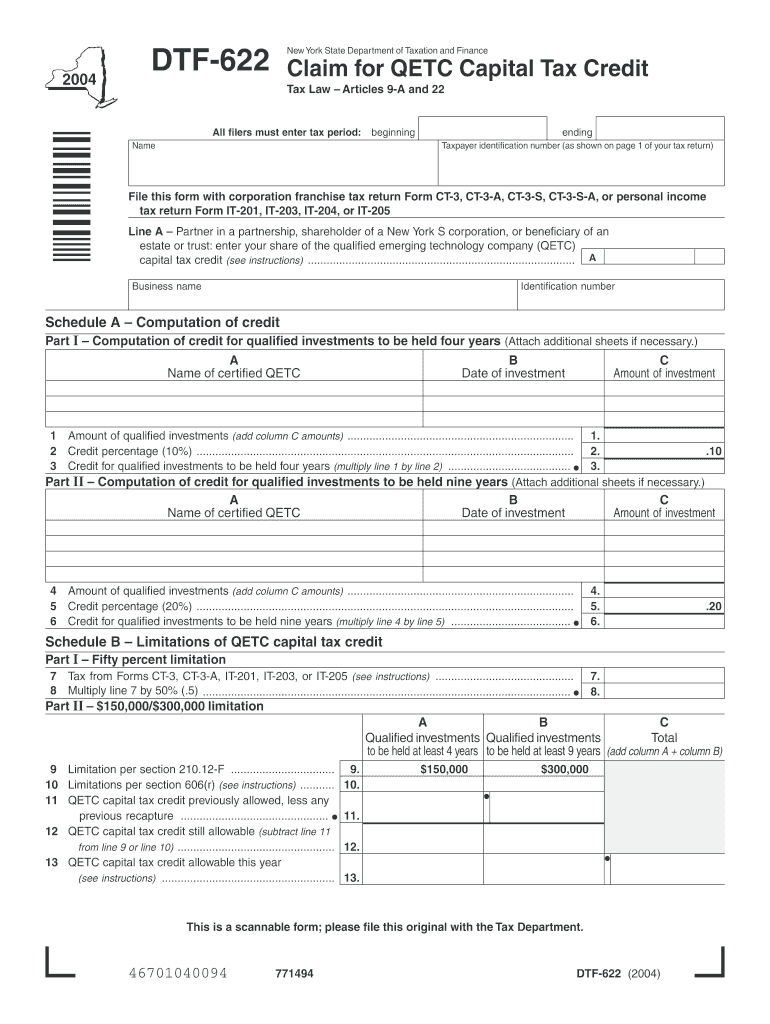

This document is a tax form required for claiming the Qualified Emerging Technology Company (QETC) capital tax credit in New York State, detailing computations and limitations on the credit.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign claim for qetc capital

Edit your claim for qetc capital form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your claim for qetc capital form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit claim for qetc capital online

Follow the steps down below to take advantage of the professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit claim for qetc capital. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out claim for qetc capital

How to fill out Claim for QETC Capital Tax Credit

01

Obtain the Claim for QETC Capital Tax Credit form from your local tax office or download it from the official tax website.

02

Fill in the taxpayer information section with your name, address, and tax identification number.

03

Provide detailed information about qualifying expenses including the type and amount of capital investment.

04

Attach any required documentation, such as receipts, invoices, and proof of payment for the qualifying expenses.

05

Review all information for accuracy and completeness to avoid delays.

06

Sign and date the form.

07

Submit the completed form along with supporting documents to the appropriate tax authority by the specified deadline.

Who needs Claim for QETC Capital Tax Credit?

01

Businesses that have made capital investments in qualified emerging technology companies seeking tax credits.

02

Companies that meet the eligibility criteria set by the state for claiming the QETC Capital Tax Credit.

Fill

form

: Try Risk Free

People Also Ask about

How do I redeem my tuition tax credit?

To claim the American opportunity credit complete Form 8863 and submit it with your Form 1040 or 1040-SR. Enter the nonrefundable part of the credit on Schedule 3 (Form 1040 or 1040-SR), line 3. Enter the refundable part of the credit on Form 1040 or 1040-SR, line 29.

How do I claim NYC school tax credits?

This credit must be claimed directly on the New York State personal income tax return. Taxpayers who are not required to file a New York State income tax return must file Form NYC-210 to get the credit. You can get more information and check refund status online and by phone. Learn more about tax credits.

How do I claim school credit on my taxes?

To claim your education tax credit, use the following steps. Get Form 1098-T. In January your school will send you Form 1098-T, which outlines your qualified tuition and education expenses. Deduct student loan interest. Complete Form 8863.

How do you claim a tax credit?

Some credits are refundable — they can give you money back even if you don't owe any tax. To claim credits, answer questions in your tax filing software. If you file a paper return, you'll need to complete a form and attach it.

How do I redeem my tuition tax credit?

To claim the American opportunity credit complete Form 8863 and submit it with your Form 1040 or 1040-SR. Enter the nonrefundable part of the credit on Schedule 3 (Form 1040 or 1040-SR), line 3. Enter the refundable part of the credit on Form 1040 or 1040-SR, line 29.

How do you qualify for school tax credit?

To be eligible for AOTC, the student must: Be pursuing a degree or other recognized education credential, Be enrolled at least half time for at least one academic period* beginning in the tax year, Not have finished the first four years of higher education at the beginning of the tax year,

How do I claim ERC tax credits?

How Do I Apply for the ERC? Going forward, the only way to apply for the ERC is to file an amended Form 941X (Quarterly Federal Payroll Tax Return) for the quarters during which the company was an eligible employer.

Is New York school tax deductible?

The School Tax Relief (STAR) and Enhanced School Tax Relief (E-STAR) benefits offer property tax relief to eligible New York homeowners. STAR and E-STAR can be issued as a credit by the State of New York, or, in some cases, as a tax exemption by the City of New York.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Claim for QETC Capital Tax Credit?

The Claim for QETC Capital Tax Credit is a tax form that allows qualified emerging technology companies to obtain tax credits for eligible capital investments.

Who is required to file Claim for QETC Capital Tax Credit?

Qualified emerging technology companies that meet specific eligibility criteria set by the tax authority are required to file the Claim for QETC Capital Tax Credit.

How to fill out Claim for QETC Capital Tax Credit?

To fill out the Claim for QETC Capital Tax Credit, businesses must provide detailed information about their qualifying activities, eligible expenses, and required documentation as instructed in the form.

What is the purpose of Claim for QETC Capital Tax Credit?

The purpose of the Claim for QETC Capital Tax Credit is to encourage investment in emerging technology sectors by reducing the tax burden on qualifying companies.

What information must be reported on Claim for QETC Capital Tax Credit?

The information that must be reported includes the business's identification, details of eligible expenditures, and any necessary supporting documentation to substantiate the claim.

Fill out your claim for qetc capital online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Claim For Qetc Capital is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.