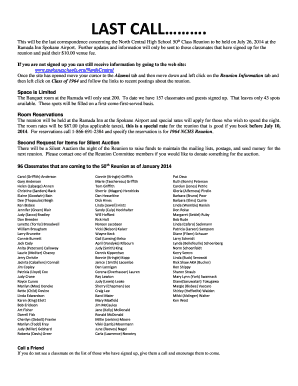

Get the free New York State Pari-Mutuel Betting Tax Return - Schedule III - tax ny

Show details

This schedule is used to report and claim simulcast credits for off-track betting regions, detailing on-track and off-track simulcast handles to determine eligible credits for tax purposes.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign new york state pari-mutuel

Edit your new york state pari-mutuel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your new york state pari-mutuel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing new york state pari-mutuel online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit new york state pari-mutuel. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out new york state pari-mutuel

How to fill out New York State Pari-Mutuel Betting Tax Return - Schedule III

01

Obtain the New York State Pari-Mutuel Betting Tax Return - Schedule III form.

02

Fill in the taxpayer's name and address at the top of the form.

03

Enter the reporting period for which you are filing the return.

04

List the total amount of gross receipts from all betting activities during the period.

05

Calculate the amount of deductions allowed and enter it in the appropriate section.

06

Subtract the deductions from the gross receipts to determine the taxable amount.

07

Calculate the tax owed based on the applicable tax rate, and enter the amount.

08

Complete any additional required sections, such as signatures or declarations.

09

Review the form for accuracy and completeness.

10

Submit the completed form to the appropriate tax authority by the due date.

Who needs New York State Pari-Mutuel Betting Tax Return - Schedule III?

01

Individuals or businesses engaged in pari-mutuel betting in New York State.

02

Any operator of a betting facility subject to state tax regulations.

03

Taxpayers required to report and pay taxes on wagering activities in New York.

Fill

form

: Try Risk Free

People Also Ask about

What is pari mutuel betting?

Parimutuel betting, or pool betting, is a betting system in which all bets of a particular type are placed together in a pool; taxes and the house-take, or vigorish, are deducted, and payoff odds are calculated by sharing the pool among all winning bets.

What is pari mutuel betting in golf?

Parimutuel betting is frequently used for club events where members (and others) can bet on teams and players. This type of betting is frequently used for Member-Guest Invitationals but can also be used for other tournaments. Bets can be easily entered before the event while live odds are computed.

What is the main advantage of pari mutuel betting over other kinds of bets?

Unlike fixed odds, parimutuel betting pools all wagers together, with payouts determined after betting closes. This system means the odds continue shifting until just before the race starts. Bettors don't know their exact payout until the race is about to begin, making this a more dynamic betting option.

What does +500 mean in golf odds?

Odds of +500 in golf betting indicate how much of a profit you can make on a $100 bet. For example: If Xander Schauffele has odds of +500 to win the PGA Championship, Schauffele needs to win the tournament for the bet to hit. If the bet hits with a stake of $100, the payout is $600 (including stake).

What is an example of pari mutuel betting?

For example, a wheel bet of "3-all" in a given race picks the #3 horse to win, and any other horse in the field to finish second (each permutation being a single bet - thus, in this example, if there are 5 horses in the field, a "3-all wheel" would 4 bets).

What's the best way to bet on golf?

Dollar Per Hole This is basically the simplest way to bet on the course? You just bet a dollar denomination on each hole, like $5 per hole, and each time a player or team (2 v. 2) wins a hole, they win a bet. Make things extra interesting by allowing the player or team that is behind to double the bet at any time.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is New York State Pari-Mutuel Betting Tax Return - Schedule III?

The New York State Pari-Mutuel Betting Tax Return - Schedule III is a form used by New York to report and pay tax on pari-mutuel wagering activities related to horse racing and other eligible events.

Who is required to file New York State Pari-Mutuel Betting Tax Return - Schedule III?

Individuals or entities that operate licensed racetracks or engage in pari-mutuel betting activities in New York State are required to file this tax return.

How to fill out New York State Pari-Mutuel Betting Tax Return - Schedule III?

To fill out the return, one must provide detailed information about the wagering activities, calculate the total taxes owed, and include any relevant supporting documentation as specified by the form's instructions.

What is the purpose of New York State Pari-Mutuel Betting Tax Return - Schedule III?

The purpose of this return is to ensure compliance with state tax laws regarding pari-mutuel betting, to report earnings from such activities, and to facilitate the collection of taxes due on these earnings.

What information must be reported on New York State Pari-Mutuel Betting Tax Return - Schedule III?

The return requires information such as total amounts wagered, total payouts, taxable income, and any deductions or exemptions applicable, as well as the signature and date from the payer.

Fill out your new york state pari-mutuel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

New York State Pari-Mutuel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.