Get the free Schoharie County Sales and Use Tax Rate Increase - tax ny

Show details

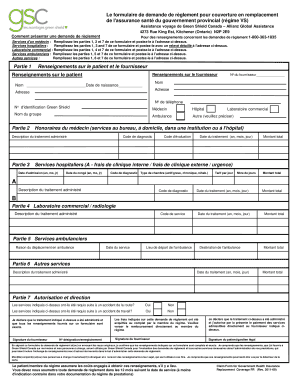

This document informs individuals and businesses about the increase in sales and use tax rates in Schoharie County, effective from June 1, 2004, detailing compliance requirements and transitional

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign schoharie county sales and

Edit your schoharie county sales and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your schoharie county sales and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing schoharie county sales and online

Follow the guidelines below to use a professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit schoharie county sales and. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out schoharie county sales and

How to fill out Schoharie County Sales and Use Tax Rate Increase

01

Obtain the Schoharie County Sales and Use Tax Rate Increase form from the county's official website or office.

02

Review the instructions provided on the form for specific requirements.

03

Fill in the necessary personal and business information as requested.

04

Calculate the applicable sales and use tax rates based on current regulations.

05

Provide detailed documentation supporting the need for the tax increase, if required.

06

Review all completed information for accuracy before submission.

07

Submit the form by the designated deadline to the appropriate county department.

Who needs Schoharie County Sales and Use Tax Rate Increase?

01

Local businesses that require an understanding of the new tax rate for compliance.

02

Consumers who need to be informed about potential changes in sales tax on goods and services.

03

Tax professionals assisting clients with tax preparation in Schoharie County.

04

Local government entities that are involved in setting and implementing the tax policy.

Fill

form

: Try Risk Free

People Also Ask about

What are the tax rates going up to in 2026?

For individuals The TCJA reduced the top marginal income tax rate from 39.6% to 37% and updated the income tax thresholds across several income tax brackets. In 2026, the top rate is set to revert to 39.6%.

What is the sales tax rate in NY 2025?

Sales tax: 8.53 percent (average combined state and local) A 4 -percent state sales tax is levied across New York, in addition to local state sales tax as high as 4.875 percent in local state sales tax. The state's average combined sales tax rate is 8.53 percent, ing to the Tax Foundation.

What state has 7% sales tax?

State-by-state sales tax breakdown State guidesState base rateTotal range Rhode Island 7% 7% South Carolina 6% 6%–9% South Dakota 4.50% 4.5%–6.5% Tennessee 7% 7%–10%47 more rows

What is the New York sales tax rate?

Purchases above $110 are subject to a 4.5% NYC sales tax and a 4% NY State sales tax. The City Sales Tax rate is 4.5%, NY State Sales and use tax is 4% and the Metropolitan Commuter Transportation District surcharge of 0.375% for a total sales and use tax of 8.875 percent.

What will tax rates be in 2025?

In both 2024 and 2025, the federal income tax rates for each of the seven brackets in the U.S. are the same: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent and 37 percent.

What is the sales tax in NY for 2025?

The minimum combined 2025 sales tax rate for New York, New York is 8.0%.

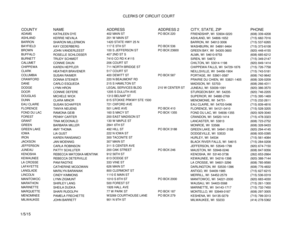

What is the tax rate in Schoharie NY?

The minimum combined 2025 sales tax rate for Schoharie County, New York is 8.0%. This is the total of state, county, and city sales tax rates. The New York sales tax rate is currently 4.0%. The Schoharie County sales tax rate is 4.0%.

What county in New York state has the highest sales tax?

New York County Sales Tax Rates in 2020 Tompkins County 8.00% Ulster County 8.00% Warren County 7.00% Washington County 7.00% Wayne County 8.00% Westchester County 8.88% Wyoming County 8.00% Yates County 8.00%

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Schoharie County Sales and Use Tax Rate Increase?

The Schoharie County Sales and Use Tax Rate Increase refers to a change in the sales and use tax rate applied to taxable goods and services within Schoharie County, typically implemented to fund local projects or services.

Who is required to file Schoharie County Sales and Use Tax Rate Increase?

Businesses and individuals that sell goods or services subject to sales tax in Schoharie County are required to file for the Sales and Use Tax Rate Increase.

How to fill out Schoharie County Sales and Use Tax Rate Increase?

To fill out the Schoharie County Sales and Use Tax Rate Increase form, provide accurate sales data, calculate the tax due based on the new rate, and submit the form along with payment by the designated deadline.

What is the purpose of Schoharie County Sales and Use Tax Rate Increase?

The purpose of the Schoharie County Sales and Use Tax Rate Increase is to generate additional revenue for the county, which can be used to improve public services, infrastructure, and community programs.

What information must be reported on Schoharie County Sales and Use Tax Rate Increase?

Information that must be reported includes total taxable sales, the calculation of the sales tax based on the new rate, exemptions applied, and any credits eligible, along with the total tax due.

Fill out your schoharie county sales and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Schoharie County Sales And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.