Get the free Annual Schedule Q - tax ny

Show details

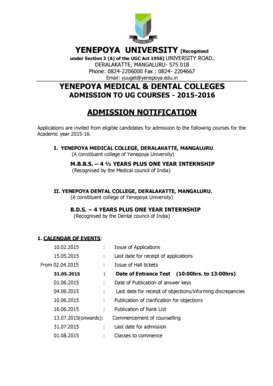

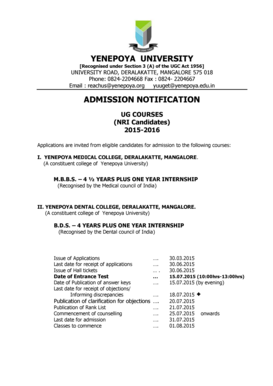

This document is used to report sales of tangible personal property and services that are eligible for exemption from New York State sales and use tax to Qualified Empire Zone Enterprises (QEZE).

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign annual schedule q

Edit your annual schedule q form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your annual schedule q form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit annual schedule q online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit annual schedule q. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out annual schedule q

How to fill out Annual Schedule Q

01

Gather all relevant information and documents related to your financial activities for the year.

02

Complete the personal information section, including your name, address, and taxpayer identification number.

03

Fill out the income section, reporting all sources of income received during the year.

04

Include deductions and credits to which you are entitled, making sure to attach any necessary documentation.

05

Accurately calculate your total income, deductions, and resulting tax liability.

06

Review the form for completeness and accuracy before submission.

07

Submit the completed Annual Schedule Q along with your tax return by the specified deadline.

Who needs Annual Schedule Q?

01

Individuals who are required to report their income and deductions for tax purposes.

02

Taxpayers seeking to claim tax credits or deductions related to specific activities.

03

Those mandated by tax law to file an Annual Schedule Q based on their income level or type.

Fill

form

: Try Risk Free

People Also Ask about

What is a schedule Q?

REMICs typically file a federal tax return using Form 1066 and send a Schedule Q to each investor and the IRS to report their share of the profit. Companies use Schedule Q with Forms 5300, 5307, or 5310 to file for a "determination letter" for their employee benefit plans to qualify for special tax treatment.

What is the form 5471 Schedule Q?

Form 5471 Schedule Q is used by U.S. taxpayers to report income earned by controlled foreign corporations (CFCs). This form helps the IRS understand how income is distributed among different CFC income groups. It's important because it ensures compliance with U.S. tax laws and helps prevent tax avoidance.

What is the form Schedule Q?

What is Schedule Q (Form 1042)? Schedule Q (Form 1042), Tax Liability of Qualified Derivatives Dealer (QDD), is used by withholding agents that are QDDs to report their tax liability on Section 871(m) transactions and dividend-equivalent payments.

Who must file schedule Q form 5471?

You may need to file Form 5471 if you are a U.S. person who: Owns at least 10% of the shares of a foreign corporation. Is an officer or director of a foreign corporation where a U.S. person has acquired a substantial ownership interest. Owns more than 50% of the shares of a foreign corporation.

Who is required to file form 5471?

Form 5471 is required for U.S. persons with ownership interests in foreign corporations, capturing details on the corporation's financials, income, and ownership structure.

Who must file Schedule F?

Sole proprietor farming businesses use IRS Schedule F, Profit or Loss from Farming to report income and expenses of the farming business. Schedule F can be used by partnerships, Corporations, Trusts and Estates to report farming activities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Annual Schedule Q?

Annual Schedule Q is a tax form used to report certain tax-related information related to qualified pension plans and similar arrangements. It provides details on contributions, distributions, and other plan-related financial transactions.

Who is required to file Annual Schedule Q?

Employers who maintain qualified retirement plans, such as pension plans or profit-sharing plans, are required to file Annual Schedule Q. This includes any plan that has undergone certain distributions or modifications during the tax year.

How to fill out Annual Schedule Q?

To fill out Annual Schedule Q, taxpayers should gather relevant financial data from their pension plan’s records. They need to complete the form by entering information about contributions, distributions, and any funding adjustments, ensuring accuracy in reporting amounts for the specified tax year.

What is the purpose of Annual Schedule Q?

The purpose of Annual Schedule Q is to provide the Internal Revenue Service (IRS) with a comprehensive overview of the financial activities of retirement plans, ensuring compliance with tax regulations and facilitating oversight of plan operations and funding.

What information must be reported on Annual Schedule Q?

Annual Schedule Q must report information such as total contributions made to the plan, distributions paid to participants, details of plan assets, and any changes in funding levels. Accurate reporting of these figures is crucial for regulatory compliance.

Fill out your annual schedule q online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Annual Schedule Q is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.